Zomato Joins BSE Sensex, Replacing JSW Steel: A Shift Towards Tech-Driven Markets

Introduction

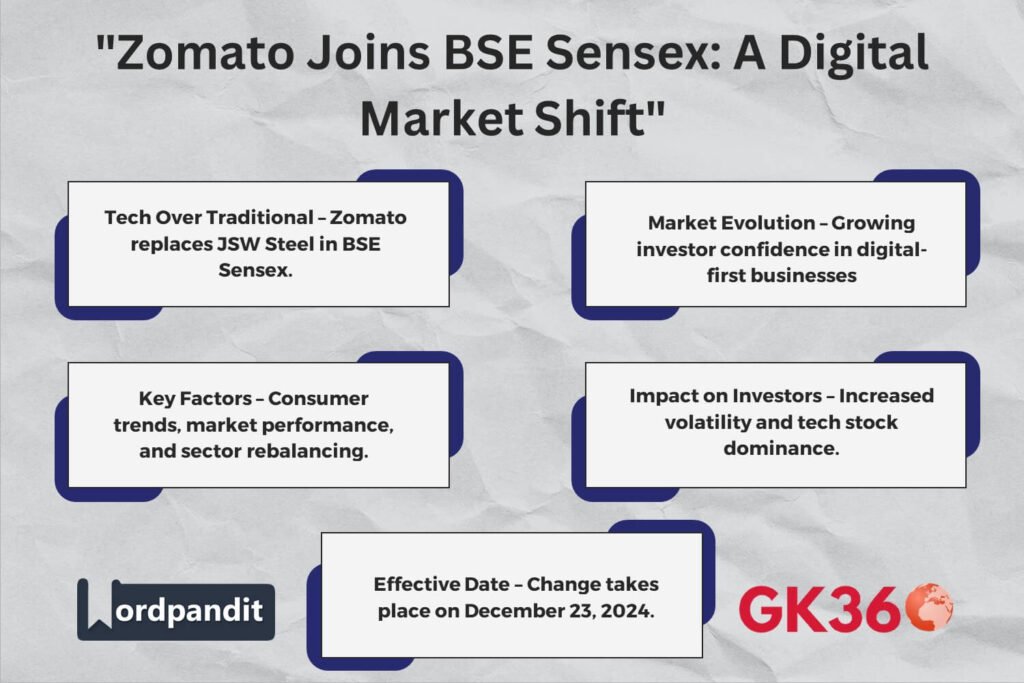

In a landmark reshuffle in India’s stock market, Zomato, the leading food delivery and restaurant aggregator platform, is set to replace JSW Steel on the Bombay Stock Exchange (BSE) Sensex, effective December 23, 2024. This transition highlights the evolving stock market landscape, where technology-driven companies are gaining prominence over traditional industrial giants.

Table of Contents

- What is BSE Sensex?

- Why is Zomato Replacing JSW Steel?

- The Rise of Tech-Driven Stocks

- Market Impact & Investor Sentiments

- Challenges & Opportunities for Zomato

- Future of Traditional Industries Like Steel

- FAQs

- Conclusion

1. What is BSE Sensex?

The BSE Sensex, also known as the S&P BSE Sensex, is a benchmark index that tracks the performance of the top 30 companies listed on the Bombay Stock Exchange. These companies are chosen based on market capitalization, financial stability, and sector representation. Inclusion in this prestigious index signals credibility and significant influence in the stock market.

2. Why is Zomato Replacing JSW Steel?

Zomato’s rapid growth and increasing market capitalization have positioned it as a key player in India’s digital economy. The decision to replace JSW Steel, a cornerstone of India’s traditional industrial sector, signifies a broader shift in investment trends. Key factors behind this change include:

- Technological Growth: Increased investor confidence in digital platforms.

- Consumer Trends: Growing reliance on food delivery and online services.

- Market Performance: Zomato’s strong post-IPO performance and expansion.

- Sectoral Rebalancing: Greater representation of emerging industries in stock indices.

3. The Rise of Tech-Driven Stocks

Over the past decade, India’s stock market has seen an influx of new-age technology firms. Companies like Paytm, Nykaa, and PolicyBazaar have demonstrated the potential of digital businesses. Zomato’s inclusion in the Sensex reflects:

- A shift towards technology-driven consumer businesses.

- Increased investor appetite for high-growth, scalable business models.

- The impact of smartphone penetration and digital payments on market trends.

4. Market Impact & Investor Sentiments

The replacement of JSW Steel with Zomato has significant implications:

For Investors:

- Investors may witness increased volatility, as tech stocks tend to be more sensitive to market conditions compared to traditional industrial stocks.

For Mutual Funds & ETFs:

- Portfolio adjustments will be required, leading to buying pressure on Zomato shares.

For Traditional Sectors:

- The steel and manufacturing industries might experience reduced investor focus as tech dominates the market narrative.

5. Challenges & Opportunities for Zomato

Challenges:

- Profitability Concerns: Despite strong revenue growth, achieving sustainable profits remains a key hurdle.

- Regulatory Scrutiny: Data privacy, taxation policies, and compliance issues could pose risks.

- Competition: Rival companies like Swiggy continue to challenge Zomato’s market leadership.

Opportunities:

- Diversification: Expanding into grocery delivery, cloud kitchens, and sustainability initiatives.

- Investor Trust: Sensex inclusion boosts credibility and institutional investor interest.

- Tech Innovation: Advancements in AI-driven delivery, logistics, and user engagement.

6. Future of Traditional Industries Like Steel

JSW Steel’s exclusion from the Sensex does not diminish its significance. Traditional industries continue to play a crucial role in India’s economy, but they must:

- Adopt digital transformation to remain competitive.

- Explore sustainability initiatives and green steel production.

- Leverage government policies favoring infrastructure growth.

7. FAQs

Q1: Why is JSW Steel being removed from Sensex?

A: The replacement is based on market capitalization trends and the growing influence of tech-driven companies.

Q2: What does Zomato’s inclusion mean for investors?

A: It reflects shifting market trends toward digital-first businesses and may lead to increased market volatility.

Q3: How often does the BSE Sensex reshuffle its stocks?

A: The Sensex undergoes periodic reviews to ensure representation of the most influential companies.

Q4: Is Zomato profitable, and how does this affect its market position?

A: Zomato is still in the process of achieving profitability, but its revenue growth and market expansion keep investor confidence strong.

Q5: Will more tech startups join the Sensex in the future?

A: As India’s digital economy expands, more technology-driven companies are likely to enter the Sensex.

8. Conclusion

The inclusion of Zomato in the BSE Sensex marks a significant milestone, symbolizing India’s transition towards a technology-driven stock market. While traditional industries like steel remain essential, investor confidence is shifting toward businesses that align with evolving consumer behaviors and digital trends.

As the market continues to evolve, adaptability and innovation will be key determinants of long-term success.

Stay updated with the latest stock market insights on [Your Website]. Share your thoughts: Do you think Zomato’s inclusion in the Sensex is justified?

Key Takeaways Table

| Aspect | Details |

|---|---|

| Sensex Reshuffle Date | December 23, 2024 |

| New Entrant | Zomato – Leading food delivery & digital service platform |

| Replaced Company | JSW Steel – Major player in India’s steel industry |

| Market Trend | Growing investor preference for tech-driven stocks |

| Impact on Investors | Increased portfolio adjustments & tech market volatility |

| Challenges for Zomato | Profitability concerns, regulatory scrutiny, and competition |

| Future of Traditional Industries | Need for digital transformation & sustainability efforts |

Related terms

- Zomato BSE Sensex Inclusion

- JSW Steel Exit from Sensex

- BSE Sensex Market Reshuffle 2024

- Tech Stocks vs Traditional Stocks

- India Stock Market Trends

- Zomato Market Performance

- Digital Economy and Stock Market

- Tech-Driven Investments in India

- Zomato vs JSW Steel in Sensex

- Investor Sentiment on Tech Stocks