X Money by Elon Musk: A Visa-Backed Digital Wallet Set to Revolutionize Payments

Introduction

Elon Musk’s X (formerly Twitter) is gearing up to launch X Money, a Visa-backed digital wallet designed to revolutionize online payments. This move marks a major milestone in Musk’s vision of transforming X into a super app, much like China’s WeChat, where users can socialize, shop, and make seamless transactions—all within one platform.

With features like instant funding via Visa Direct, real-time peer-to-peer payments, and direct bank transfers, X Money is set to challenge Apple Pay, PayPal, and other major payment platforms.

Table of Contents

- What is X Money?

- Key Features of X Money

- Regulatory Compliance & State Licenses

- Visa’s Role in Powering X Money

- How X Money Compares to Competitors

- Future Expansion Plans

- Final Thoughts: Can X Money Disrupt Digital Payments?

- FAQs

What is X Money?

X Money is a digital payment solution that integrates directly into the X platform, allowing users to send, receive, and manage funds seamlessly. Built with Visa Direct, X Money aims to eliminate traditional banking delays while making transactions as simple as sending a message.

This feature aligns with Musk’s long-term vision of turning X into an “everything app”, where social networking, e-commerce, and financial services coexist within a single ecosystem.

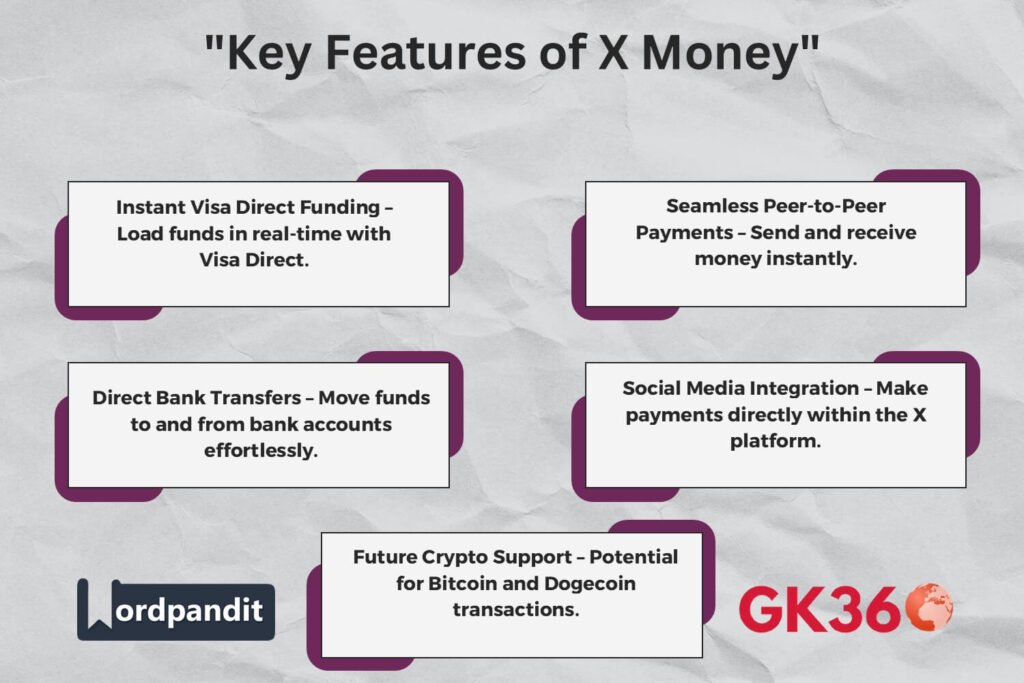

Key Features of X Money

1. Instant Funding via Visa Direct

One of X Money’s biggest advantages is real-time funding. Unlike traditional wallets that rely on slow bank transfers, X Money users can instantly load funds using Visa Direct, making transactions faster and more efficient.

2. Peer-to-Peer Transactions

X Money will offer instant P2P (peer-to-peer) payments, allowing users to:

- ✅ Split bills effortlessly.

- ✅ Send money to friends and family with zero friction.

- ✅ Make business transactions directly on X.

By securely linking debit cards to X Money, users can make instant, hassle-free payments without needing external apps.

3. Real-Time Bank Transfers

Unlike many digital wallets that require third-party services, X Money allows direct bank transfers. Users can move their funds from X Money to their bank accounts instantly, offering financial flexibility.

Regulatory Compliance & State Licenses

To ensure smooth operations in the U.S., X has secured money transmitter licenses in 41 states. These licenses enable secure and legal transactions, although availability may vary by state due to regulatory constraints.

Musk’s team is actively working on expanding full compliance across all 50 states.

Visa’s Role in Powering X Money

Visa’s collaboration with X strengthens the credibility of X Money. As a trusted financial services provider, Visa ensures:

- ✔ Secure payment processing across the platform.

- ✔ Global acceptance, allowing X Money users to transact internationally.

- ✔ Seamless integration with existing Visa-powered merchants.

With this partnership, X Money gains instant credibility in the fintech space, giving it a competitive edge over emerging payment platforms.

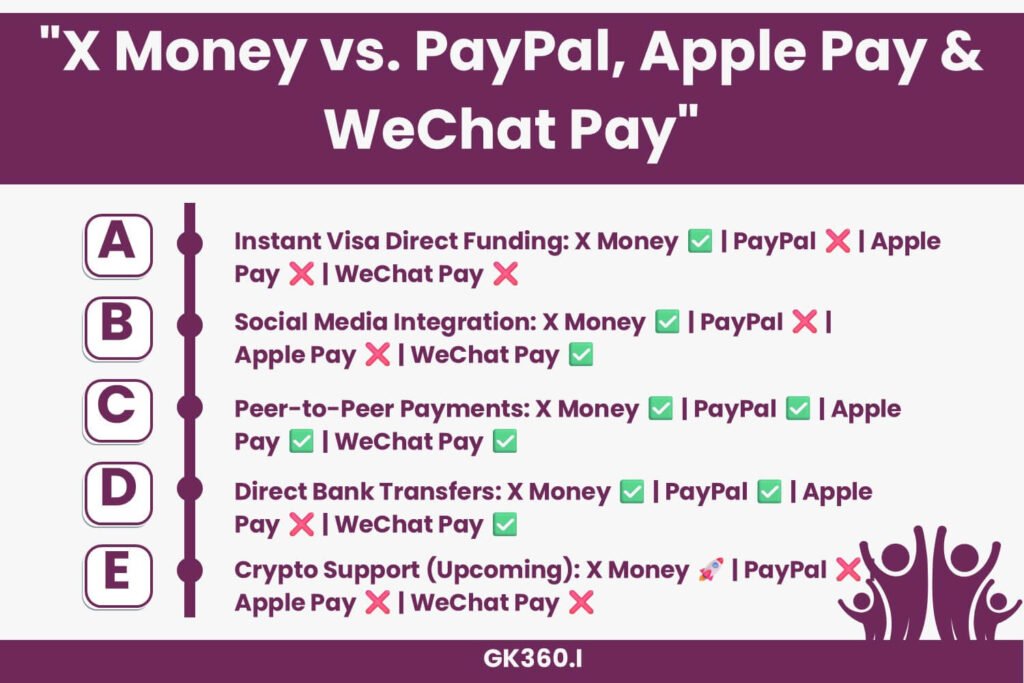

How X Money Compares to Competitors

| Feature | X Money | PayPal | Apple Pay | WeChat Pay |

|---|---|---|---|---|

| Instant Visa Direct Funding | ✅ Yes | ❌ No | ❌ No | ❌ No |

| Seamless Social Media Integration | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| Peer-to-Peer Payments | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| Direct Bank Transfers | ✅ Yes | ✅ Yes | ❌ No | ✅ Yes |

| Potential Crypto Support | 🚀 Coming Soon | ❌ No | ❌ No | ❌ No |

X Money stands out by seamlessly integrating payments with social networking, making it a one-stop solution for digital transactions.

Future Expansion Plans

1. Cryptocurrency Integration

Given Musk’s strong support for Bitcoin and Dogecoin, there’s speculation that X Money could support cryptocurrency payments in the future. This would allow users to buy, sell, and trade crypto directly within the X app.

2. Merchant Payments & Business Adoption

X Money could evolve into a merchant payment solution, enabling businesses to:

- 💰 Accept payments via X Money instead of relying on PayPal or Stripe.

- 🛍️ Process in-app transactions without third-party fees.

- 📈 Monetize services directly on X.

3. Subscription-Based Monetization

With premium subscriptions like X Premium (formerly Twitter Blue), X Money could become a built-in payment method for content creators, allowing:

- ✔ Direct earnings through in-app monetization.

- ✔ Seamless subscription payments for premium content.

Final Thoughts: Can X Money Disrupt Digital Payments?

X Money is not just another digital wallet—it’s a step toward a fully integrated financial ecosystem within X. By combining instant payments, peer-to-peer transactions, and bank transfers with Visa-backed security, X Money has the potential to reshape the digital payment landscape.

As it expands globally and potentially integrates cryptocurrency, X Money could emerge as a serious competitor to PayPal, Apple Pay, and WeChat Pay.

🚀 With Musk at the helm, the future of X Money is limitless.

FAQs

1️⃣ What is X Money and how does it work?

X Money is a Visa-backed digital wallet integrated within the X platform, allowing users to send, receive, and manage funds seamlessly.

2️⃣ Is X Money available worldwide?

Currently, X Money is launching in the U.S. with regulatory approvals in 41 states, with plans for global expansion.

3️⃣ How does X Money compare to PayPal and Apple Pay?

Unlike PayPal and Apple Pay, X Money is fully integrated into X, making transactions instant and seamless within the platform.

4️⃣ Can businesses accept payments via X Money?

Yes! X Money is expected to support merchant transactions, allowing businesses to accept payments directly on X.

5️⃣ Will X Money support cryptocurrency payments?

Musk has hinted at future crypto integration, meaning Bitcoin, Dogecoin, and other digital assets could be supported.

Key Takeaways Table

| Aspect | Details |

|---|---|

| What is X Money? | A Visa-backed digital wallet integrated into the X platform for seamless transactions. |

| Key Features | Instant Visa Direct funding, P2P payments, real-time bank transfers, and social media integration. |

| Regulatory Compliance | Licensed in 41 U.S. states with plans for nationwide expansion. |

| Visa’s Role | Provides secure payment processing and global transaction capabilities. |

| Competitive Edge | Unlike Apple Pay & PayPal, X Money offers instant funding and seamless integration with X. |

| Future Expansion | Potential cryptocurrency integration, merchant payments, and subscription-based monetization. |

| Disruptive Potential | X Money aims to reshape the fintech industry, competing directly with PayPal and Apple Pay. |

Related terms

- X Money Digital Wallet

- Elon Musk Payment System

- Visa-Backed X Money

- X Money vs PayPal

- Instant Visa Direct Funding

- Peer-to-Peer Transactions on X

- X Money Crypto Integration

- Elon Musk Fintech Disruption

- Future of Digital Payments

- Social Media-Based Payments

🚀 Stay Tuned! As X Money gears up for launch, expect major updates that could disrupt the digital finance industry. Stay connected on X for the latest developments in fintech, crypto, and social media payments.