Warren Buffett Retires: Greg Abel Named CEO of Berkshire Hathaway – Leadership Transition 2025

Introduction

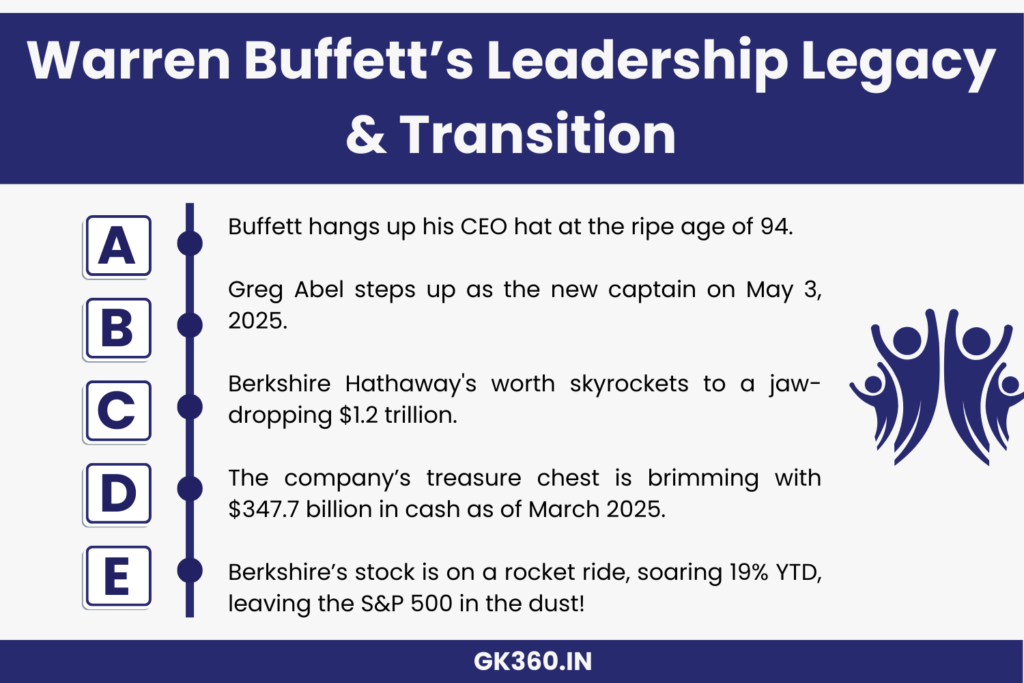

In a historic announcement at the Berkshire Hathaway annual shareholder meeting in Omaha, Nebraska, on May 3, 2025, legendary investor Warren Buffett confirmed he will step down as CEO of Berkshire Hathaway by the end of 2025. At 94 years old, Buffett’s decision marks the end of an extraordinary era spanning six decades, during which he transformed a struggling textile company into a $1.2 trillion global conglomerate.

Buffett named Greg Abel, 62-year-old Vice Chairman for non-insurance operations, as his successor—setting the stage for a pivotal leadership transition in one of the world’s most influential companies. This move signals a commitment to continuity, stability, and strategic growth for Berkshire Hathaway’s future.

With investors, analysts, and markets reacting to this leadership shift, the appointment of Abel raises critical questions about the company’s direction beyond Buffett’s legendary stewardship.

Table of Contents

- Why Warren Buffett is Stepping Down

- Who is Greg Abel?

- The Leadership Transition Plan

- Impact on Berkshire Hathaway’s Future

- Market Reaction and Stock Performance

- Buffett’s Legacy at Berkshire Hathaway

- Investor Perspectives

- FAQs

- Conclusion: The Future of Berkshire Hathaway

Why Warren Buffett is Stepping Down

After nearly 60 years at the helm, Warren Buffett’s decision to retire reflects long-term succession planning and the natural evolution of leadership. At 94, Buffett remains mentally sharp but acknowledges the need for continuity beyond his lifetime.

During the Omaha meeting, Buffett reassured shareholders:

“Greg Abel has the trust of our board, our managers, and me. Berkshire’s culture and principles are in steady hands.”

The retirement will take effect at the end of 2025, giving time for a smooth handover while maintaining investor confidence.

Who is Greg Abel?

Greg Abel, a Canadian executive born in 1962, joined Berkshire Hathaway in 2000 through its acquisition of MidAmerican Energy. Over the years, he climbed the ranks, eventually becoming Vice Chairman for non-insurance operations in 2018.

Key highlights of Abel’s career:

- Successfully led Berkshire Hathaway Energy to expand renewable energy investments

- Managed key non-insurance businesses like BNSF Railway and NetJets

- Known for his hands-on leadership style and focus on operational excellence

Buffett previously hinted at Abel as his successor, noting his “ability to maintain Berkshire’s decentralized management approach.”

The Leadership Transition Plan

The transition plan, announced May 3, 2025, outlines:

- ✔️ Effective retirement by December 31, 2025

- ✔️ Greg Abel assuming CEO role starting January 1, 2026

- ✔️ No major structural changes to Berkshire’s decentralized operating model

Buffett will remain involved as Chairman of the Board, offering guidance during Abel’s initial tenure.

Board members and key executives publicly backed the transition, with Vice Chairman Charlie Munger (now 101 years old) calling Abel “the logical choice to uphold Berkshire’s values.”

Impact on Berkshire Hathaway’s Future

Abel’s appointment aims to preserve Berkshire Hathaway’s culture of autonomy, discipline, and long-term investing. However, analysts point out potential shifts:

- Greater focus on energy and infrastructure investments, reflecting Abel’s background

- Continued technology holdings like Apple (Berkshire’s largest stock holding)

- Possible increased operational oversight compared to Buffett’s more laissez-faire style

With $347.7 billion in cash reserves as of March 2025, Berkshire is well-positioned for strategic acquisitions under new leadership.

Investor sentiment remains cautiously optimistic, though some question whether Abel will be able to replicate Buffett’s intuitive investment decisions.

Market Reaction and Stock Performance

The announcement of Warren Buffett’s retirement and Greg Abel’s appointment triggered an immediate response from global markets. Following the news at the Omaha shareholder meeting:

- Berkshire Hathaway’s stock price rose by 1.7% intraday, signaling investor confidence in a well-telegraphed succession plan

- Year-to-date, Berkshire shares have outperformed the S&P 500 by 22 percentage points, with Berkshire’s stock up 19% in 2025 while the S&P 500 declined 3%

Analysts attributed the market’s calm reaction to Buffett’s earlier statements about Abel being “the guy” to follow him, reducing uncertainty. Still, some institutional investors are closely monitoring whether Abel will maintain the company’s value investing principles or tilt toward more aggressive growth strategies.

Buffett’s Legacy at Berkshire Hathaway

Warren Buffett’s retirement closes an unprecedented chapter in global business history. Since taking control of Berkshire Hathaway in 1965, Buffett transformed it:

- ✔️ From a struggling textile company to a $1.2 trillion conglomerate

- ✔️ Into an enterprise owning major businesses like Geico, BNSF Railway, See’s Candies, Dairy Queen, and others

- ✔️ A portfolio with significant stakes in Apple, American Express, Bank of America, Coca-Cola

Buffett’s value investing philosophy, summarized in his approach to buying “wonderful companies at fair prices,” has influenced generations of investors. His annual letters to shareholders became required reading for anyone in finance or business leadership.

In his farewell message, Buffett emphasized:

“Berkshire’s secret sauce isn’t me—it’s our culture, our people, and our managers. That doesn’t retire.”

Investor Perspectives

Investor reactions have been largely positive but mixed with caution:

- ✅ Long-term shareholders praised the seamless transition and Abel’s deep operational knowledge

- ✅ Younger investors voiced interest in whether Berkshire will embrace more technology and sustainability investments

- ✅ Skeptics questioned if Abel could replicate Buffett’s instinctive dealmaking, noting that future acquisitions might be more committee-driven

Larry Cunningham, a Berkshire scholar, summarized investor sentiment:

“Greg Abel will be judged not for being another Buffett, but for staying true to Berkshire’s unique model while evolving for a changing world.”

FAQs About Berkshire Hathaway’s Leadership Transition

- Why did Warren Buffett choose Greg Abel as his successor?

Buffett cited Abel’s deep understanding of Berkshire’s decentralized culture, his proven leadership of non-insurance businesses, and strong board confidence. - When will Greg Abel officially become CEO?

Abel will assume the CEO role on January 1, 2026, following Buffett’s retirement at the end of 2025. - What companies are part of Berkshire Hathaway’s portfolio?

Key holdings include Geico, BNSF Railway, Apple, American Express, Bank of America, Dairy Queen, and dozens of others. - How large is Berkshire Hathaway’s cash reserve?

As of March 2025, Berkshire holds $347.7 billion in cash, offering flexibility for acquisitions. - Will Berkshire Hathaway’s investment strategy change under Greg Abel?

While the core principles are expected to remain intact, analysts believe Abel may pursue more investments aligned with infrastructure, energy, and sustainability.

Conclusion: The Future of Berkshire Hathaway

Warren Buffett’s retirement signals the end of one of the greatest eras in business leadership. Yet, by choosing Greg Abel—a leader rooted in Berkshire’s culture and operational excellence—Buffett ensures continuity while opening the door for evolution.

As Berkshire Hathaway embarks on its next chapter, investors and markets alike will closely watch how Abel balances tradition and innovation in a rapidly changing global economy.

👉 Stay updated on Berkshire Hathaway’s leadership journey and market insights by following our latest coverage on [Your Website/Platform Name].

Key Takeaways Table

| Aspect | Details |

|---|---|

| Announcement Date | May 3, 2025 |

| Effective Retirement | End of 2025 |

| Successor | Greg Abel, Vice Chairman for non-insurance operations |

| Buffett’s Leadership Tenure | 60 years (since 1965) |

| Company Valuation | $1.2 trillion |

| Cash Reserves | $347.7 billion as of March 2025 |

| Stock Performance | 19% increase YTD, beating S&P 500 decline |

| Leadership Objectives | Smooth transition, cultural preservation, future growth |

Follow GDPIWAT.com for GDPI Prep.