Sanjay Malhotra Appointed as 26th RBI Governor: A New Era for India’s Central Bank

Introduction

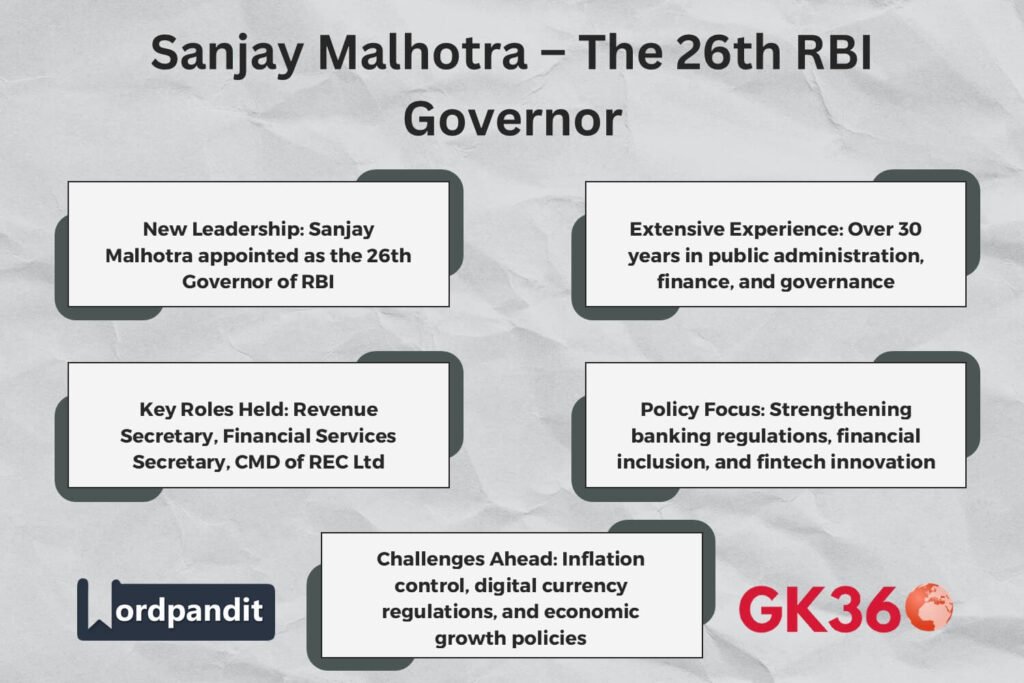

Sanjay Malhotra, an accomplished civil servant and former Revenue Secretary, has been appointed as the 26th Governor of the Reserve Bank of India (RBI). His appointment marks a new chapter in the leadership of India’s central bank, following the tenure of Shaktikanta Das, who played a pivotal role in stabilizing India’s financial sector. With his extensive experience across finance, taxation, power, and IT, Malhotra is expected to steer RBI’s policies toward sustained economic growth and financial stability.

Table of Contents

Who is Sanjay Malhotra?

Sanjay Malhotra, an officer of the 1990 IAS batch from the Rajasthan cadre, brings over three decades of diverse administrative experience. His appointment as the RBI Governor underscores the government’s commitment to experienced leadership in managing India’s monetary policies, inflation control, and financial regulations.

Educational and Professional Background

Academic Achievements

- B.Tech in Computer Science – Indian Institute of Technology (IIT), Kanpur

- Master’s in Public Policy – Princeton University, USA

Key Government Roles

- Revenue Secretary (December 2022 – Present)

Spearheaded key tax policy reforms to strengthen India’s fiscal health.

Oversaw the expansion and compliance of Goods and Services Tax (GST). - Secretary, Department of Financial Services

Led reforms in banking and financial institutions to improve credit accessibility.

Strengthened governance and operational efficiency in public sector banks. - Chairman & Managing Director (CMD), REC Ltd.

Drove initiatives to improve energy distribution and infrastructure financing.

Played a key role in India’s renewable energy expansion and power sector modernization.

Major Contributions in Public Administration

Taxation and Fiscal Policy Reforms

- Enhanced tax collection efficiency and streamlined GST implementation.

- Strengthened compliance mechanisms to boost government revenues.

- Served as ex-officio Secretary to the GST Council, shaping critical fiscal policies.

Banking and Financial Sector Reforms

- Focused on NPA (Non-Performing Asset) resolution strategies to stabilize the banking sector.

- Advocated for digital banking reforms and fintech integration.

- Facilitated credit flow to key industries for economic expansion.

Leadership in the Power Sector

- Pioneered energy security policies to ensure a stable power supply.

- Led financing initiatives for green energy projects, boosting sustainability efforts.

- Strengthened the financial health of power distribution companies (DISCOMs).

Challenges and Opportunities as RBI Governor

As Malhotra assumes leadership at RBI, he faces multiple challenges:

- Inflation Control – Implementing policies to stabilize price levels.

- Banking Sector Regulation – Ensuring financial institutions comply with global best practices.

- Monetary Policy Reforms – Strengthening RBI’s monetary policy framework.

- Digital Currency & Fintech – Regulating cryptocurrencies and fostering digital banking.

Legacy of Predecessor Shaktikanta Das

- Shaktikanta Das served as the RBI Governor from December 2018 to 2024 and was instrumental in:

- Steering the Indian economy through COVID-19 with effective fiscal interventions.

- Strengthening RBI’s credibility through clear and proactive communication.

- Maintaining economic stability despite global financial uncertainties.

- Shaktikanta Das served as the RBI Governor from December 2018 to 2024 and was instrumental in:

Das’s tenure set high benchmarks, and Malhotra’s leadership will be crucial in continuing RBI’s proactive economic strategies.

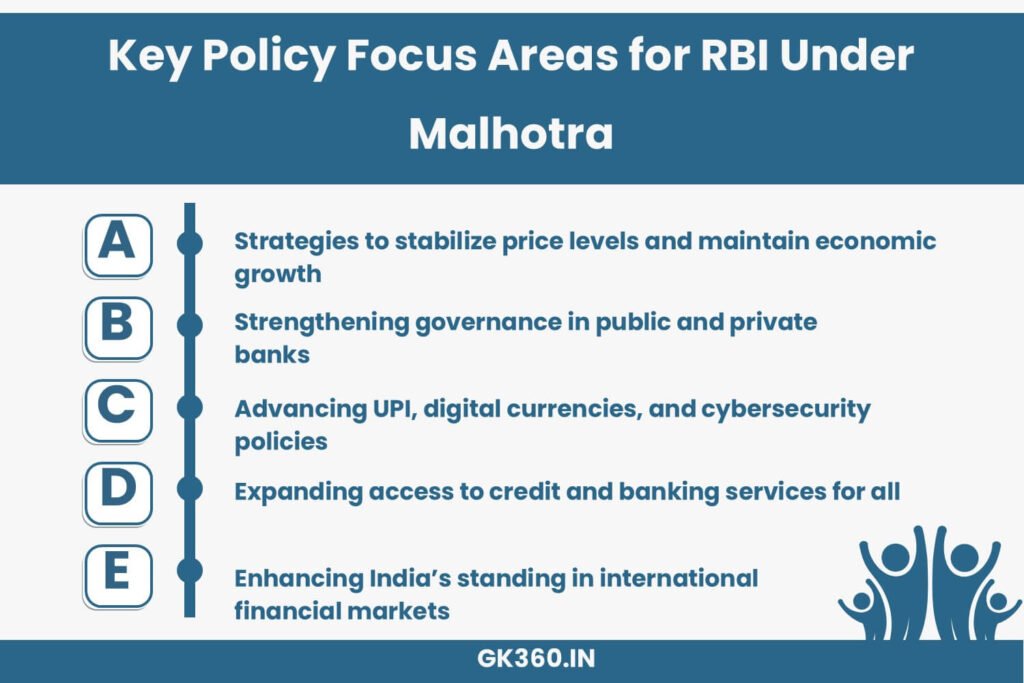

Future Policy Outlook for RBI Under Malhotra

Under Malhotra’s leadership, RBI’s policies are expected to focus on:

- Strengthening monetary policy frameworks to balance growth and inflation.

- Enhancing regulatory oversight on NBFCs and fintech companies.

- Encouraging financial inclusion through digital payment innovations.

- Boosting India’s global financial standing by modernizing banking laws.

FAQs About Sanjay Malhotra’s Appointment as RBI Governor

Who is Sanjay Malhotra?

Sanjay Malhotra is a seasoned Indian Administrative Service (IAS) officer from the 1990 Rajasthan cadre. He has held key positions such as Revenue Secretary and Financial Services Secretary before being appointed as the 26th Governor of the Reserve Bank of India (RBI).

What is Sanjay Malhotra’s educational background?

He holds a B.Tech in Computer Science from the Indian Institute of Technology (IIT) Kanpur and a Master’s in Public Policy from Princeton University, USA.

Who did Sanjay Malhotra replace as RBI Governor?

He replaced Shaktikanta Das, who served as the 25th RBI Governor from December 2018 to 2024 and was known for his crucial role in steering India’s economy during the COVID-19 crisis.

What are the major challenges Sanjay Malhotra faces as RBI Governor?

- Inflation Control: Implementing policies to maintain stable price levels.

- Banking Regulations: Ensuring financial institutions comply with global best practices.

- Digital Currency & Fintech: Regulating cryptocurrencies and fostering digital banking.

- Economic Stability: Balancing economic growth while managing fiscal policies.

What policies can be expected under Sanjay Malhotra’s leadership?

- Strengthening monetary policy frameworks to balance growth and inflation.

- Enhancing NBFC & fintech regulations to ensure financial security.

- Encouraging digital banking innovations to promote financial inclusion.

- Modernizing banking laws to align with global economic standards.

Conclusion

Sanjay Malhotra’s appointment as RBI Governor marks the beginning of a new era in India’s financial governance. With his deep expertise in taxation, banking, and policy-making, he is well-equipped to navigate economic challenges and drive sustainable financial reforms. As India continues to assert itself as a global economic powerhouse, Malhotra’s leadership will be pivotal in shaping the future of India’s monetary and fiscal policies.

Key Takeaways Table

| Aspect | Details |

|---|---|

| New RBI Governor | Sanjay Malhotra appointed as the 26th Governor of the Reserve Bank of India (RBI). |

| Professional Background | Former Revenue Secretary, Financial Services Secretary, and CMD of REC Ltd. |

| Key Challenges | Inflation control, digital banking regulations, and financial stability. |

| Major Policy Focus | Strengthening banking governance, fintech growth, and financial inclusion. |

| Predecessor’s Legacy | Shaktikanta Das stabilized the financial sector, guided India through COVID-19, and enhanced RBI’s credibility. |

| Economic Outlook | RBI expected to balance growth, inflation, and regulatory oversight. |

| Significance | Malhotra’s leadership will shape India’s financial landscape and economic policies for the coming years. |

Related terms

- Sanjay Malhotra RBI Governor

- 26th RBI Governor India

- RBI Leadership 2024

- Monetary Policy India

- Banking Reforms India

- Inflation Control RBI

- Fintech Regulation India

- Digital Currency RBI

- Indian Economy 2024

- Financial Inclusion India