Unified Pension Scheme (UPS) 2025: A Secure Retirement Plan for Government Employees

Introduction

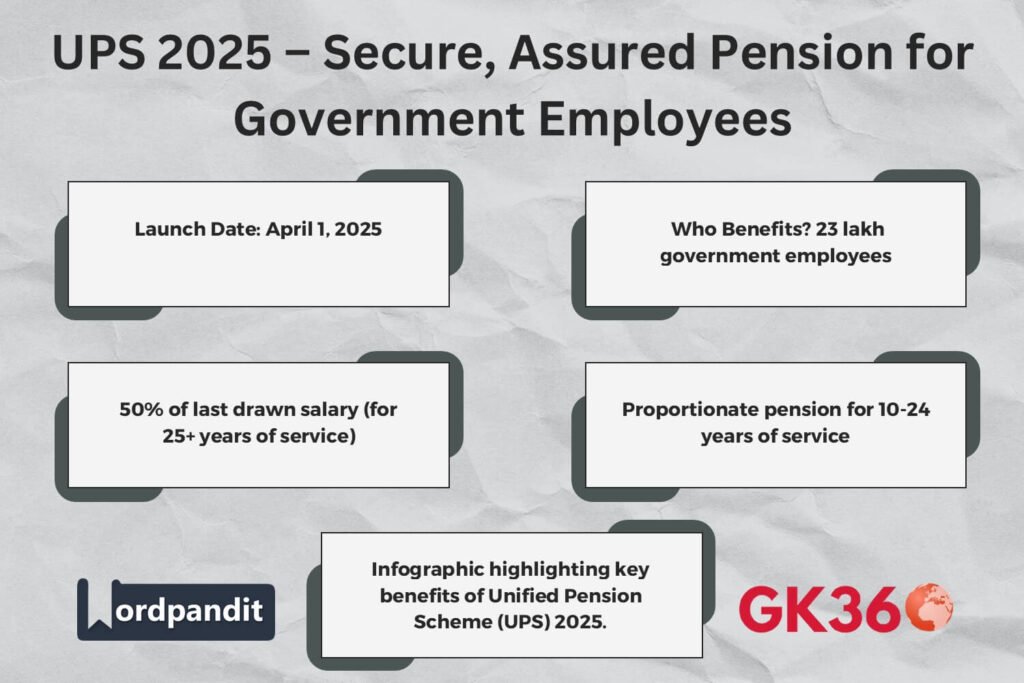

The Indian government has introduced the Unified Pension Scheme (UPS), a significant reform aimed at enhancing retirement benefits for government employees. Set to be implemented from April 1, 2025, UPS serves as an alternative to the National Pension System (NPS), offering assured pension benefits, inflation protection, and greater financial security. This move is expected to impact 23 lakh government employees, addressing concerns regarding market-linked uncertainties under NPS.

Table of Contents

- Background: The Need for Pension Reform

- Key Features of the Unified Pension Scheme

- Eligibility Criteria & Implementation Timeline

- Transition from NPS to UPS: What Government Employees Should Know

- Pros and Cons: How UPS Stands Against NPS

- FAQs: Unified Pension Scheme 2025 Explained

- Conclusion: A New Era for Government Employee Retirement

Background: The Need for Pension Reform

Challenges with the National Pension System (NPS)

- Introduced in 2004, NPS provided market-linked returns with contributions from both employees and the government.

- Concerns emerged about pension stability, especially during economic downturns.

- The need for a more predictable and secure pension led to the formation of a government committee in 2023 to assess alternatives.

The result was the Unified Pension Scheme (UPS), designed to provide a guaranteed and inflation-protected pension to government employees.

Key Features of the Unified Pension Scheme

✔ Assured Pension

- Employees completing 25 years of service will receive 50% of their last 12 months’ average basic pay as pension.

- Those with 10-24 years of service will get a proportionate pension based on service duration.

✔ Family Pension

- In case of an employee’s demise, their family will receive 60% of the entitled pension, ensuring continued financial support.

✔ Minimum Pension Guarantee

- A minimum pension of Rs. 10,000 per month is assured for those with at least 10 years of service at retirement.

✔ Inflation Protection

- Pension benefits will be indexed to inflation, ensuring that retirees maintain purchasing power.

- Dearness Relief (DR) will be provided based on the All India Consumer Price Index for Industrial Workers (AICPI-IW).

✔ Lump Sum Payment

- Retirees will receive a one-time payment calculated as 1/10th of their monthly emoluments for every completed six months of service.

Eligibility Criteria & Implementation Timeline

- Applicable to all government employees retiring on or after April 1, 2025.

- Retrospective benefits for retirees between April 1, 2024 – March 31, 2025.

- Arrears will be paid to eligible retirees as per new UPS provisions.

Transition from NPS to UPS: What Government Employees Should Know

- Employees currently under NPS will have the option to switch to UPS.

- The transition period starts from FY 2025-26.

- Employees can compare the benefits of NPS vs UPS before making a decision.

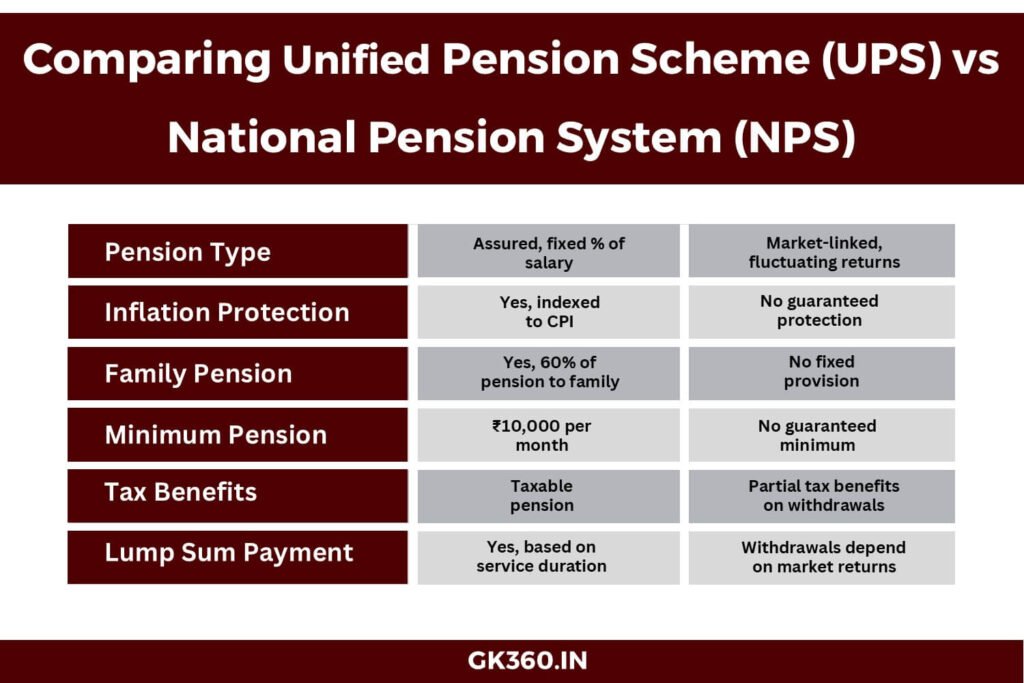

Pros and Cons: How UPS Stands Against NPS

| Feature | Unified Pension Scheme (UPS) | National Pension System (NPS) |

|---|---|---|

| Pension Type | Assured pension (fixed percentage of salary) | Market-linked returns |

| Inflation Protection | Yes, indexed to inflation | No guaranteed protection |

| Family Pension | Yes, 60% of pension to family | No fixed provision |

| Minimum Pension | Rs. 10,000 per month | No guaranteed minimum |

| Flexibility | Employees can switch from NPS | Mandatory contribution-based growth |

FAQs: Unified Pension Scheme 2025 Explained

- What is the main difference between UPS and NPS?

UPS provides an assured and inflation-protected pension, while NPS is market-linked and does not guarantee a fixed amount. - Who is eligible for the Unified Pension Scheme?

All government employees retiring on or after April 1, 2025, are eligible, with benefits extending to some retirees from April 2024 – March 2025. - Will UPS provide better financial security than NPS?

Yes, UPS offers a stable income, while NPS pensions fluctuate based on market performance. - Can retired government employees also benefit from UPS?

Yes, those retiring between April 1, 2024 – March 31, 2025, will receive retrospective benefits. - Is the pension taxable under UPS?

Yes, the pension received under UPS is taxable as per prevailing laws.

Conclusion: A New Era for Government Employee Retirement

The Unified Pension Scheme (UPS) 2025 is a landmark reform ensuring a secure, predictable, and inflation-protected retirement for 23 lakh government employees. Unlike NPS, which depends on market fluctuations, UPS guarantees financial stability, offering retirees peace of mind.

For government employees, the choice between UPS and NPS will shape their financial future. With the launch of UPS in April 2025, employees must evaluate their options carefully.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Scheme Name | Unified Pension Scheme (UPS) 2025 |

| Launch Date | April 1, 2025 |

| Eligibility | Government employees retiring on or after April 2025 |

| Assured Pension | 50% of last drawn salary for 25+ years of service |

| Minimum Pension | ₹10,000 per month (for 10+ years of service) |

| Family Pension | 60% of entitled pension to dependents |

| Inflation Protection | Linked to AICPI-IW Consumer Price Index |

| Lump Sum Payment | 1/10th of monthly emoluments per 6 months served |

| Transition from NPS | Employees may switch from NPS to UPS |

Related terms

- Unified Pension Scheme 2025 India

- UPS vs NPS government pension comparison

- Government employee pension scheme 2025

- New pension scheme for Indian government employees

- India’s retirement benefits for public sector workers

- Minimum pension for government employees 2025

- UPS 2025 launch date and eligibility

- Inflation-protected pension scheme India

- Difference between NPS and UPS pension schemes

- Unified Pension Scheme benefits for retirees