RBI Introduces Guidelines for Government Debt Relief Scheme

Introduction

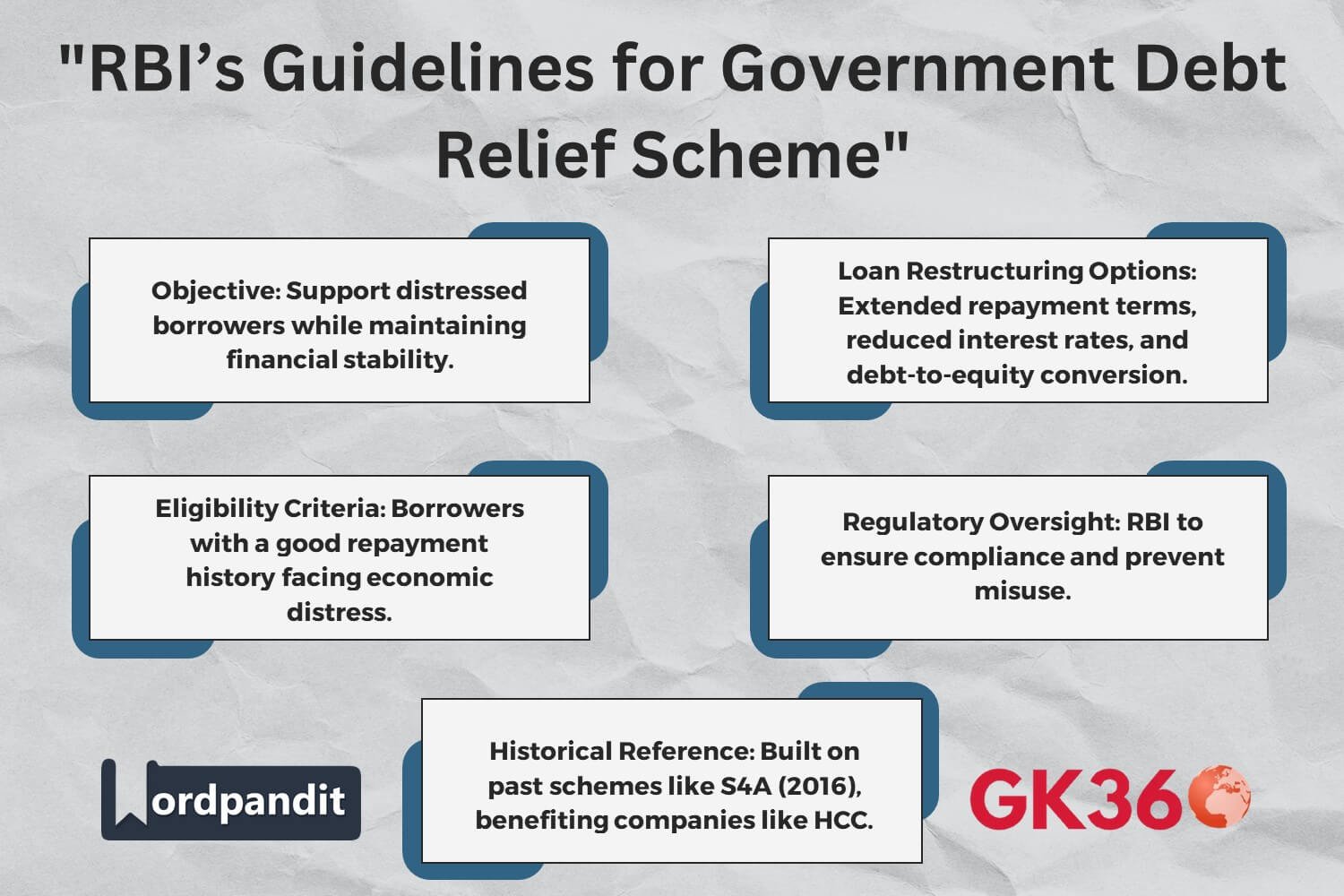

The Reserve Bank of India (RBI) has introduced comprehensive guidelines for lenders participating in the Government Debt Relief Scheme. This initiative aims to provide structured assistance to borrowers facing financial distress, aligning with the RBI’s broader objective of financial stability and economic recovery.

Table of Contents

- Overview of the Guidelines

- Key Components of the Scheme

- Regulatory Oversight

- Historical Context

- Implications for Stakeholders

- Summary of the Guidelines

- FAQs

- Conclusion

Overview of the Guidelines

The RBI’s framework provides a roadmap for lenders to offer debt relief while ensuring financial stability. The initiative enables loan restructuring to support borrowers without compromising the integrity of the financial system.

Key Components of the Scheme

Eligibility Criteria

- Targets borrowers with a strong repayment history facing financial distress due to economic disruptions, natural calamities, or global economic changes.

- Ensures relief is extended fairly and transparently to genuinely distressed borrowers.

Restructuring Framework

- Extending Repayment Periods – Borrowers receive additional time to repay loans, easing financial strain.

- Reducing Interest Rates – Lower interest rates make loans more affordable.

- Converting Debt into Equity – Allows partial debt conversion into equity, reducing repayment burdens while maintaining lender stakes.

All restructuring measures adhere to RBI-specified conditions to ensure systemic stability.

Regulatory Oversight

- The RBI will monitor implementation to ensure compliance.

- Oversight prevents misuse of the scheme while safeguarding financial system stability.

Historical Context

- Builds upon past initiatives like the Scheme for Sustainable Structuring of Stressed Assets (S4A) (2016).

- Hindustan Construction Company (HCC) was the first to benefit from S4A, setting a precedent for effective restructuring.

Implications for Stakeholders

For Lenders

- Offers a structured mechanism for addressing distressed assets.

- Reduces risks of Non-Performing Assets (NPAs).

- Ensures financial relief to borrowers while maintaining lender stability.

For Borrowers

- Provides a lifeline to struggling businesses and individuals.

- Helps regain financial stability without risk of insolvency.

- Encourages economic recovery and confidence in the financial system.

Summary of the Guidelines

| Purpose | RBI issues detailed guidelines for lenders under the Government Debt Relief Scheme. |

| Loan Restructuring Options | Extended repayment terms, reduced interest rates, or partial debt-to-equity conversion. |

| Target Beneficiaries | Borrowers affected by unforeseen financial challenges with a responsible repayment history. |

| Regulatory Oversight | RBI to ensure compliance and safeguard financial stability. |

| Historical Precedent | Draws from the S4A framework (2016), benefiting companies like Hindustan Construction Company. |

FAQs

- What is the purpose of the Government Debt Relief Scheme? The scheme aims to support distressed borrowers while ensuring financial stability.

- Who is eligible for loan restructuring? Borrowers with good repayment histories facing distress due to economic disruptions, natural calamities, or global financial changes.

- What restructuring options are available? Options include extended loan tenures, reduced interest rates, and debt-to-equity conversion.

- How does the RBI ensure compliance? The RBI monitors lender participation to prevent misuse and maintain financial integrity.

- How does this scheme compare to past initiatives? It builds on previous restructuring efforts, such as S4A (2016), offering an enhanced framework for debt relief.

Conclusion

The RBI’s Government Debt Relief Scheme balances borrower support and lender risk mitigation. By offering structured loan restructuring, the initiative fosters financial resilience and long-term economic stability. Coupled with regulatory oversight, it strengthens India’s financial ecosystem, paving the way for sustainable economic recovery.

Key Takeaways Table

| Scheme Name | Government Debt Relief Scheme. |

| Announced By | Reserve Bank of India (RBI). |

| Loan Restructuring Options | Extended tenures, reduced interest rates, debt-to-equity conversion. |

| Eligibility Criteria | Borrowers with strong repayment history facing financial distress. |

| Regulatory Oversight | RBI ensures compliance and prevents misuse. |

| Historical Reference | Modeled after past frameworks like S4A (2016). |

| Economic Impact | Supports distressed borrowers, stabilizes lending institutions, and strengthens financial resilience. |

Relative Terms

- RBI Debt Relief Guidelines 2024

- Government Loan Restructuring Scheme India

- RBI Loan Restructuring Framework

- Financial Stability Measures India

- Non-Performing Assets (NPA) Reduction RBI

- Debt Relief for Borrowers in India

- S4A Loan Restructuring History

- Economic Recovery Policies India 2024

- RBI Borrower Support Program

- Reserve Bank of India Debt Policy