EPFO Implements Centralized Pension Payments System (CPPS) Across India

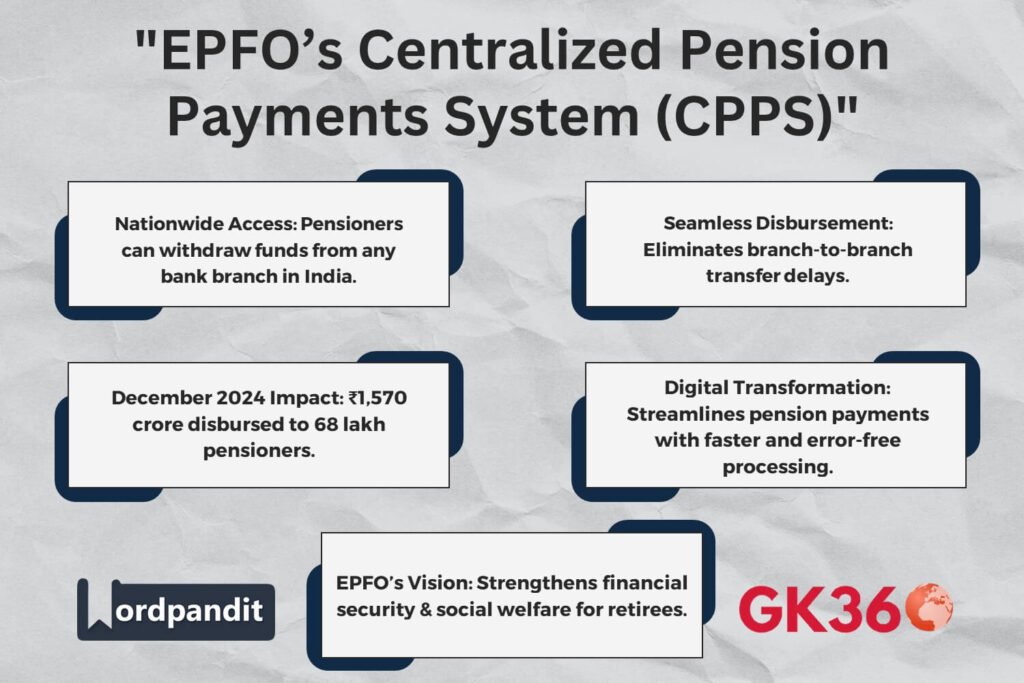

The Employees’ Provident Fund Organisation (EPFO) has achieved a significant milestone in pension disbursement by implementing its Centralized Pension Payments System (CPPS) across all regional offices in India. This system modernizes pension services for over 68 lakh pensioners, enabling them to access their pensions from any bank branch nationwide.

Table of Contents

- Key Features of the Centralized Pension Payments System (CPPS)

- Historical Context

- Financial Impact

- Future Implications

- FAQs

- Conclusion

Key Features of the Centralized Pension Payments System (CPPS)

- Nationwide Accessibility: Pensioners can withdraw their pensions from any bank branch in India. Eliminates the need for branch-to-branch transfers. Ensures greater flexibility and convenience.

- Streamlined Disbursement Process: Modernized and centralized pension disbursement system. Faster processing times and reduced complexities. Eliminates inefficiencies of decentralized pension systems.

Historical Context

Previously, the pension disbursement process was decentralized, with each regional EPFO office having separate agreements with banks. Pensioners faced delays and inconveniences when relocating or switching bank branches. The CPPS was introduced to unify and simplify pension disbursement, allowing seamless access to funds nationwide.

Financial Impact

- December 2024 Disbursement: ₹1,570 crore successfully distributed to 68 lakh pensioners.

- The CPPS handles large-scale financial operations efficiently.

- Enhances timely, accurate, and transparent pension transactions.

Future Implications

- Enhances quality of life for pensioners by ensuring timely and secure payments.

- Reduces administrative overhead for the EPFO.

- Aligns with India’s digital transformation initiatives in public services.

- Can serve as a blueprint for future government-led financial reforms.

FAQs

- What is the Centralized Pension Payments System (CPPS)? CPPS is a modernized pension disbursement system that allows nationwide access to pension funds, eliminating the need for bank branch-specific transactions.

- How many pensioners benefit from the CPPS? The CPPS benefits over 68 lakh pensioners across 122 EPFO regional offices in India.

- What financial impact has CPPS had so far? In December 2024 alone, the system successfully disbursed ₹1,570 crore to pensioners.

- How does CPPS improve pension accessibility? Pensioners can now withdraw their pensions from any bank branch, ensuring greater flexibility and eliminating account transfer delays.

- What are the future prospects of CPPS? The system is expected to pave the way for further digital advancements in pension management and financial inclusion.

Conclusion

The EPFO’s implementation of CPPS is a transformative step in modernizing pension disbursement in India. By ensuring nationwide accessibility, streamlined processes, and financial inclusion, the CPPS sets a new benchmark for public service delivery. This initiative reinforces the EPFO’s role as a pillar of social security, ensuring a better quality of life for millions of pensioners across India.

Key Takeaways Table

| Aspect | Details |

|---|---|

| System Name | Centralized Pension Payments System (CPPS) |

| Implemented By | Employees’ Provident Fund Organisation (EPFO) |

| Nationwide Accessibility | Pensioners can withdraw from any bank branch. |

| December 2024 Disbursement | ₹1,570 crore distributed to 68 lakh pensioners. |

| Key Benefits | Faster processing, digital efficiency, reduced administrative delays. |

| Future Prospects | Strengthens India’s digital financial infrastructure for pensioners. |

Relative Terms

- EPFO Centralized Pension Payments System

- CPPS Pension Disbursement India

- EPFO Digital Pension Payment 2025

- Nationwide Pension Access EPFO

- EPFO Pensioners Digital Initiative

- Pension Withdrawal Any Bank India

- Social Security Reforms India 2025

- Digital Financial Inclusion EPFO

- Employees Provident Fund Pension System

- Government Pension Reforms India