Switzerland’s Major Reforms in 2025: Legal, Economic, and Social Transformations

Introduction

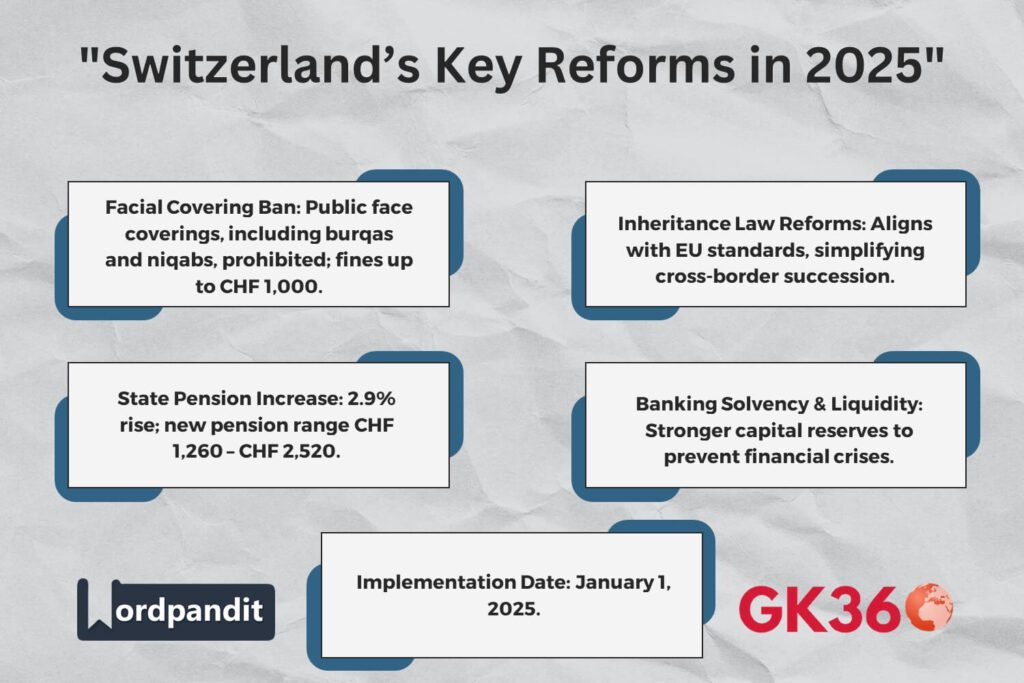

Switzerland is set to implement several transformative changes in its legal, economic, and social policies starting January 1, 2025. These reforms address a wide array of issues, from facial coverings in public spaces to inheritance laws, pension increases, and banking regulations. Each change reflects Switzerland’s ongoing efforts to align more closely with European standards and address challenges arising from financial crises and demographic shifts.

Table of Contents

- Ban on Facial Coverings in Public Spaces

- Reforms to Inheritance Laws

- Increase in State Pensions and Benefits

- Strengthening Bank Solvency and Liquidity

- Broader Impacts of the Reforms

- FAQs

- Conclusion

Ban on Facial Coverings in Public Spaces

A significant shift in public policy, Switzerland will enforce a nationwide ban on facial coverings, including burqas, niqabs, and other veils, in public spaces. This move aligns Switzerland with France and Austria, which have similar restrictions.

Key Provisions:

- Applicability: The ban prohibits face coverings in public areas, with violators facing fines of up to CHF 1,000 ($1,143).

- Exemptions: Coverings worn for health, security, or weather-related reasons are permitted. Artistic performances and advertisements are also exempt.

Objective:

The ban aims to enhance transparency and integration while addressing concerns about cultural assimilation and security. However, it has sparked debates on freedom of expression and religious rights.

Reforms to Inheritance Laws

Switzerland has overhauled its inheritance laws to resolve frequent jurisdictional conflicts with EU and European Free Trade Association (EFTA) nations. These changes harmonize Swiss inheritance regulations with the European Succession Regulation.

Key Aspects:

- Jurisdictional Clarity: The reforms simplify inheritance planning for Swiss nationals residing abroad.

- Legal Certainty: Clear jurisdictional guidelines ensure smoother resolution of cross-border inheritance disputes.

Benefits:

- Greater legal predictability for Swiss nationals abroad.

- Easier inheritance planning, reducing bureaucratic hurdles.

These reforms have been positively received, particularly by the Organization of the Swiss Abroad (OSA).

Increase in State Pensions and Benefits

To counteract rising living costs, Switzerland is introducing a 2.9% increase in state pensions.

Pension Adjustments:

- Minimum Pension: Increases from CHF 1,225 to CHF 1,260 ($1,382 to $1,422).

- Maximum Pension: Rises from CHF 2,450 to CHF 2,520 ($2,764 to $2,843).

- Broader Impact: The increase will extend to supplementary benefits and occupational pensions.

Review Mechanism:

Pensions will undergo biennial reviews to remain aligned with inflation and cost-of-living adjustments.

Strengthening Bank Solvency and Liquidity

Switzerland is implementing final-stage reforms to banking regulations in response to the financial crises of 2007-2009 and the collapses of UBS (2018) and Credit Suisse (2023).

Key Measures:

- Capital Reserves: Banks must build capital reserves during economic stability to absorb future financial shocks.

- Objective: Minimize the likelihood of taxpayer-funded bailouts and fortify financial resilience.

Long-Term Benefits:

- Greater banking stability.

- Enhanced financial trust in Swiss institutions.

Broader Impacts of the Reforms

Switzerland’s 2025 reforms demonstrate a proactive governance approach:

- Facial Covering Ban: Strengthens public integration and security.

- Inheritance Law Reforms: Provide clarity for Swiss expatriates.

- Pension Increases: Support financial stability for retirees.

- Banking Reforms: Ensure long-term economic resilience.

These changes reinforce Switzerland’s alignment with international standards while ensuring stability and predictability for its citizens.

FAQs

1. What is the purpose of Switzerland’s ban on facial coverings?

The ban aims to enhance transparency and integration while addressing security and cultural concerns.

2. How do the inheritance law reforms benefit Swiss expatriates?

The reforms simplify inheritance planning and reduce jurisdictional conflicts for Swiss nationals residing abroad.

3. What is the impact of the pension increase?

Pension adjustments ensure financial security for retirees, with biennial reviews to keep up with inflation.

4. How will the banking reforms strengthen Switzerland’s economy?

The reforms enhance financial stability, reducing dependence on taxpayer-funded bailouts and fortifying bank solvency.

5. When will these changes take effect?

All reforms will come into effect on January 1, 2025.

Conclusion

Switzerland’s 2025 reforms mark a significant step in modernizing policies across legal, economic, and social sectors. These changes enhance public security, legal clarity, financial stability, and social welfare. As the nation moves forward, these reforms offer stability and alignment with global standards, ensuring long-term benefits for citizens and expatriates alike.

Key Takeaways

| Key Reform | Description | Impact |

|---|---|---|

| Facial Covering Ban | Prohibition of face coverings (e.g., burqas, niqabs) in public spaces. | Enhances public security and integration, but sparks debate on freedom of expression and religious rights. |

| Inheritance Law Reforms | Aligns Swiss inheritance law with EU and EFTA standards, simplifying cross-border inheritance matters. | Provides legal certainty and ease for Swiss nationals residing abroad, reducing jurisdictional conflicts. |

| Pension Increase | A 2.9% rise in state pensions, effective from January 2025. | Supports financial security for retirees, ensuring that pensions keep pace with inflation and living costs. |

| Banking Reforms | Stronger capital reserve requirements for banks to ensure financial stability. | Improves bank solvency, reducing the risk of taxpayer-funded bailouts in the event of financial crises. |

SEO-Driven Tags

- Switzerland reforms 2025

- Switzerland facial covering ban

- inheritance law reforms Switzerland

- increase in state pensions Switzerland

- banking regulations Switzerland 2025

- Swiss pension reform 2025

- Swiss banking solvency reforms

- public security reforms Switzerland

- Switzerland pension increase 2025

- facial coverings public spaces Switzerland

- Swiss inheritance law EU alignment

- 2025 Swiss economic reforms