This Content Is Only For Subscribers

The Sub-Prime Mortgage Crisis Explained: Causes, Impact, and Lessons Learned

How Did the Sub-Prime Crisis Start?

The Housing Bubble

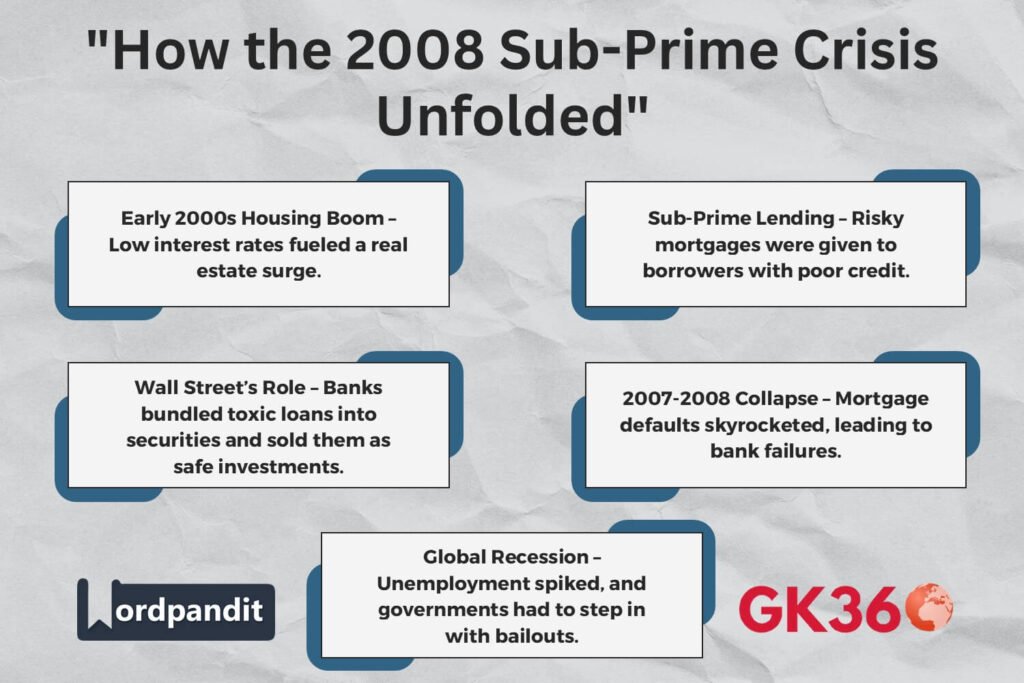

In the early 2000s, the U.S. housing market was booming. Low interest rates and government policies encouraging homeownership led to skyrocketing demand. Prices surged as people believed real estate values would always rise.

Table of Contents

- How Did the Sub-Prime Crisis Start?

- The Financial Collapse of 2008

- Government Bailouts and Economic Fallout

- Lessons Learned from the Sub-Prime Crisis

- FAQs: Your Questions Answered

- Conclusion: Can It Happen Again?

Risky Sub-Prime Mortgages

Banks started issuing loans to borrowers with poor credit histories—so-called “sub-prime” borrowers. These loans often had:

- Adjustable interest rates that started low but skyrocketed later.

- Little or no down payment requirements.

- “No-doc” loans, where lenders didn’t verify income or employment.

Wall Street’s Role

Investment banks bundled these risky loans into Mortgage-Backed Securities (MBS) and Collateralized Debt Obligations (CDOs), which were sold to investors as “safe” investments. Rating agencies gave these securities top ratings, even though they contained toxic loans.

The Financial Collapse of 2008

Key Events Leading to the Crisis

- 2007: Sub-prime mortgage defaults surged, triggering losses in the banking sector.

- March 2008: Bear Stearns, a major investment bank, collapsed and was sold to JPMorgan Chase.

- September 15, 2008: Lehman Brothers filed for bankruptcy, causing panic in global markets.

- September 16, 2008: AIG, the world’s largest insurer, needed an $85 billion government bailout.

- Banks froze lending, causing an economic standstill.

The Domino Effect on Global Markets

The crisis spread worldwide, leading to:

- Bank failures across the U.S. and Europe.

- Stock market crashes, wiping out trillions in wealth.

- Recessions in multiple countries.

- Mass layoffs and business closures.

Government Bailouts and Economic Fallout

TARP and Quantitative Easing

To prevent a total collapse, the U.S. government launched the Troubled Asset Relief Program (TARP), a $700 billion bailout for banks. The Federal Reserve also introduced quantitative easing, injecting liquidity into the economy.

Recession and Unemployment

The crisis triggered the Great Recession, leading to:

- U.S. unemployment peaking at 10%.

- Millions of home foreclosures.

- Public trust in banks and financial institutions plummeting.

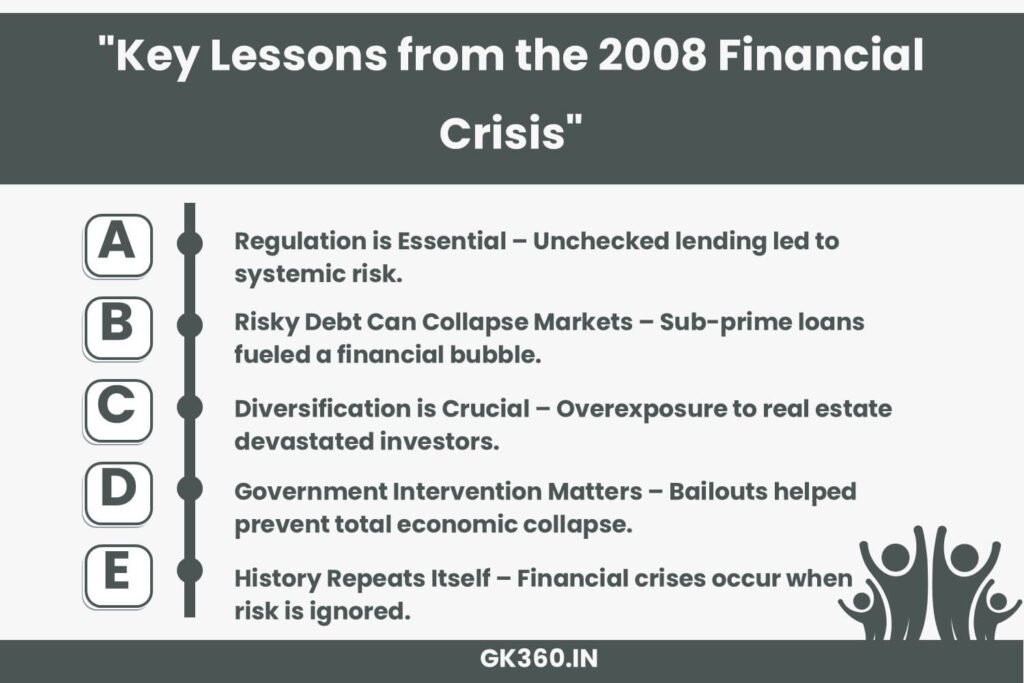

Lessons Learned from the Sub-Prime Crisis

- If it sounds too good to be true, it probably is. Housing prices don’t always go up.

- Regulation matters. Unchecked lending and financial engineering created systemic risks.

- Risk needs to be managed properly. Banks must maintain responsible lending standards.

- Diversification is key. Overexposure to one asset class can lead to financial disaster.

FAQs: Your Questions Answered

1. What caused the 2008 financial crisis?

The crisis was caused by a combination of risky lending, lack of financial regulation, and excessive speculation in the housing market.

2. How did sub-prime mortgages contribute to the crisis?

Banks issued loans to borrowers who couldn’t afford them, leading to mass defaults when interest rates rose.

3. Could a similar financial crisis happen again?

While regulations have tightened, financial bubbles and risky lending practices still exist, making another crisis possible.

Conclusion: Can It Happen Again?

The 2008 financial crisis serves as a cautionary tale of greed, poor regulation, and market speculation gone wrong. While measures have been taken to prevent another collapse, history has shown that financial crises tend to repeat in different forms.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Root Cause | Excessive sub-prime lending and financial speculation. |

| Key Events | Housing bubble burst, bank failures, global market collapse. |

| Government Response | $700 billion TARP bailout and Federal Reserve’s quantitative easing. |

| Economic Impact | U.S. unemployment peaked at 10%, millions of homes foreclosed. |

| Regulatory Changes | Dodd-Frank Act introduced stricter financial regulations. |

| Lessons for the Future | Avoid over-leveraging, improve risk management, and strengthen oversight. |

Related terms

- 2008 Financial Crisis

- Sub-Prime Mortgage Crisis

- Causes of the 2008 Crash

- Wall Street and the Financial Collapse

- Housing Market Bubble 2008

- Lessons from the Sub-Prime Crisis

- Effects of the Great Recession

- Financial Regulation Post-2008

- Bank Failures in 2008

- How to Prevent Another Financial Crisis