Sanjay Shukla Appointed as Managing Director of National Housing Bank (NHB)

Introduction

Leadership transitions in major financial institutions like the National Housing Bank (NHB) are pivotal for shaping the future of housing finance in India. Sanjay Shukla’s appointment as the Managing Director (MD) of NHB marks a significant milestone, bringing his extensive experience and innovative approach to the forefront. This guide explores his career achievements, the role of NHB, and the broader implications of his appointment.

Table of Contents

- Key Highlights of Sanjay Shukla’s Appointment

- Professional Background

- About National Housing Bank (NHB)

- Understanding the Significance of NHB

- Practical Implications and Preparation Tips

- FAQ

- Conclusion: Embrace the Future of Housing Finance

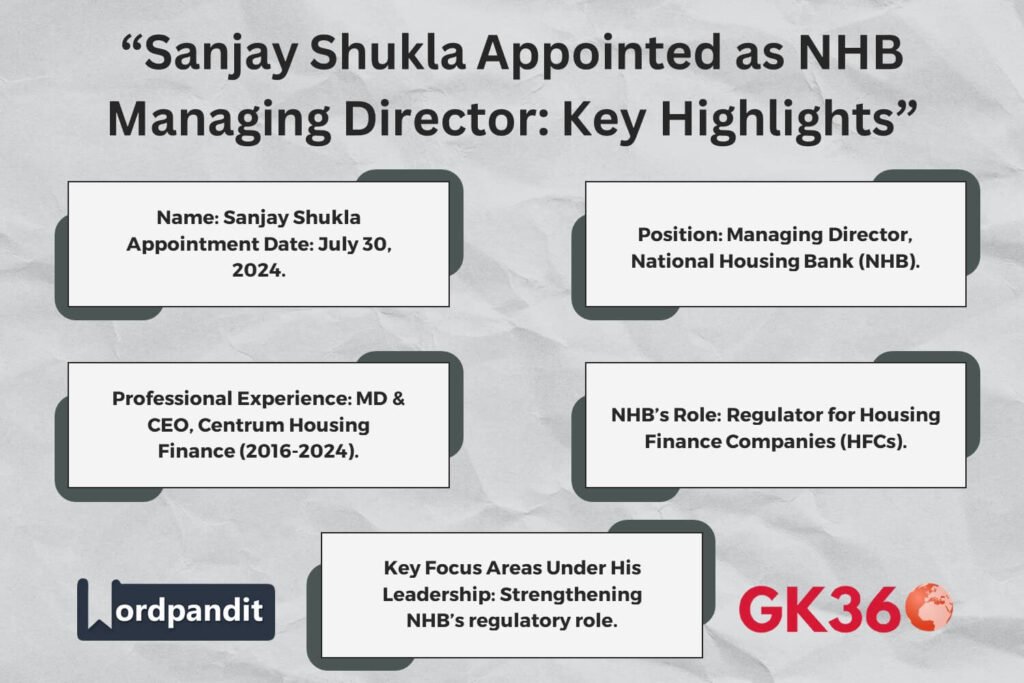

Key Highlights of Sanjay Shukla’s Appointment

- Official Appointment Date: July 30, 2024

- New Role: Managing Director of National Housing Bank (NHB)

- Predecessor: Appointed following the completion of the previous tenure.

Professional Background

Career Beginnings

- 1991: Started as an officer at LIC Housing Finance Limited.

Previous Positions

- Centrum Housing Finance Limited (CHFL): Founding MD and CEO (October 2016).

- Cent Bank Home Finance Ltd (CBHFL): MD and CEO, improving asset quality.

- ING Vysya Bank: Business Head, expanding consumer loan segments.

- Tata Capital: First Business Head for retail housing finance.

- Citibank: Vice President and Area Director, leading mortgage distribution in Tier-II and Tier-III cities.

About National Housing Bank (NHB)

Overview

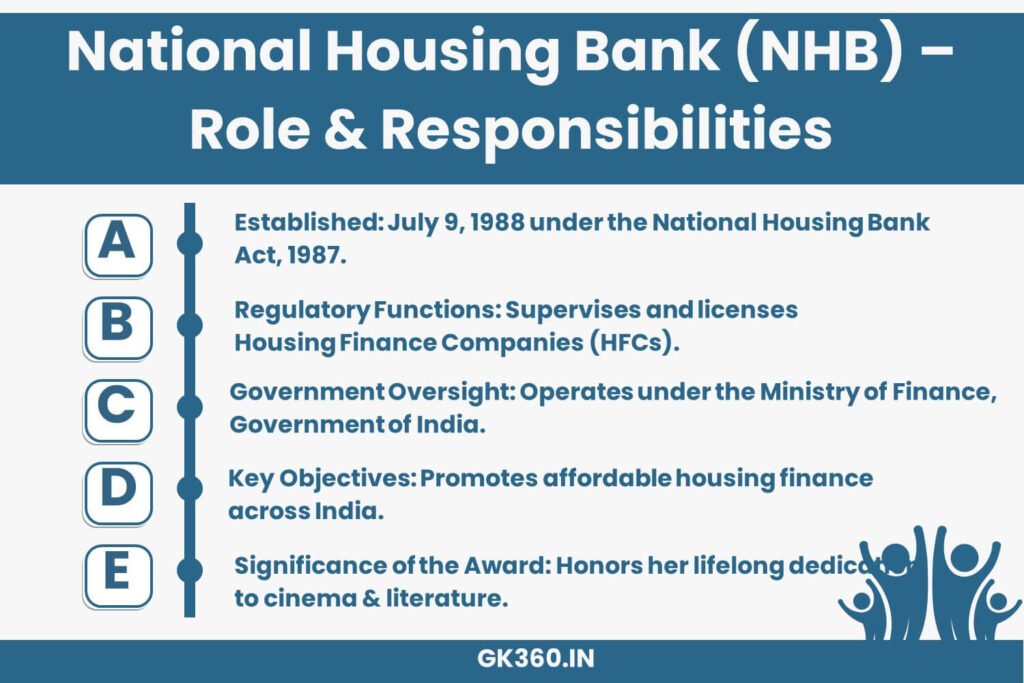

- Founded: July 9, 1988, under the National Housing Bank Act, 1987.

- Headquarters: New Delhi, India.

Role and Jurisdiction

- Apex Regulatory Body: Regulates and licenses housing finance companies (HFCs).

- Operates Under: Ministry of Finance, Government of India.

Understanding the Significance of NHB

Functions of NHB

- Regulation: Ensures the stability and development of housing finance companies.

- Licensing: Grants licenses to housing finance institutions.

- Policy Formulation: Develops policies to promote affordable housing finance.

Impact on Housing Finance

- Development Initiatives: Improves accessibility of housing finance.

- Financial Stability: Ensures stability of housing finance companies.

Practical Implications and Preparation Tips

For Competitive Exam Aspirants

- Stay Updated: Keep track of leadership changes in major financial institutions.

- Understand Core Functions: Know the roles of NHB in housing finance.

- Analyze Leadership Contributions: Study how Sanjay Shukla’s expertise influences the sector.

- Practice Questions: Solve banking and finance-related exam questions.

- Mock Tests: Focus on financial institutions and regulatory frameworks.

Encouragement for Self-Exploration

- Explore Further: Learn about NHB and other regulatory bodies.

- Join Forums: Engage in banking and finance discussions.

- Read Books & Articles: Expand knowledge on housing finance and financial policies.

FAQ

What is the theme for International Customs Day 2025?

The theme is “Customs Delivering on its Commitment to Efficiency, Security, and Prosperity.”

Why is January 26 celebrated as International Customs Day?

It marks the date of the first session of the Customs Cooperation Council in 1953.

How does the WCO support customs administrations?

The WCO offers guidance, training, and tools to enhance customs operations globally.

What challenges do customs systems face today?

Key challenges include adopting new technologies, combating smuggling, and balancing security with trade facilitation.

What is the role of customs in economic growth?

Customs systems reduce trade barriers, enhance connectivity, and promote sustainable development.

Conclusion: Embrace the Future of Housing Finance

Understanding the roles and contributions of leaders like Sanjay Shukla is crucial for staying informed and preparing effectively for competitive exams. His appointment as MD of NHB is a significant milestone that strengthens housing finance policies in India.

Key Takeaways

- Sanjay Shukla’s Appointment:

- Assumed role on July 30, 2024.

- Extensive background in housing finance and banking.

- NHB Overview:

- Apex regulatory body for housing finance.

- Operates under the Ministry of Finance, Government of India.

Further Learning and Exploration

- Study NHB’s Structure and Functions: Understand NHB’s impact on housing finance.

- Review Sanjay Shukla’s Career: Analyze his contributions to housing finance and banking.

- Stay Informed: Keep up with the latest developments in housing finance and regulatory policies.

Key Takeaways Table

| Aspect | Details |

|---|---|

| New NHB MD | Sanjay Shukla |

| Appointment Date | July 30, 2024 |

| Professional Experience | MD & CEO of Centrum Housing Finance, CBHFL, Senior Roles at ING Vysya, Tata Capital, Citibank |

| NHB’s Role | Regulator for Housing Finance Companies (HFCs), Promotes Affordable Housing |

| Government Oversight | Ministry of Finance, Government of India |

| Key Priorities | Strengthening housing finance regulations, boosting sectoral stability, increasing affordable housing accessibility |

| Strategic Impact | Enhances financial stability in the housing finance sector |

Related terms

- Sanjay Shukla NHB Managing Director

- New MD of National Housing Bank 2024

- Sanjay Shukla Housing Finance Leadership

- NHB Regulatory Role in India

- Affordable Housing Finance in India 2025

- Government Housing Finance Policies India

- Role of NHB in Banking & Finance

- National Housing Bank Leadership Change

- India’s Housing Finance Growth Strategies

- Housing Sector Reforms Under NHB MD Sanjay Shukla