RBI Reports 97.92% Return of ₹2,000 Banknotes by July 31, 2024

Introduction

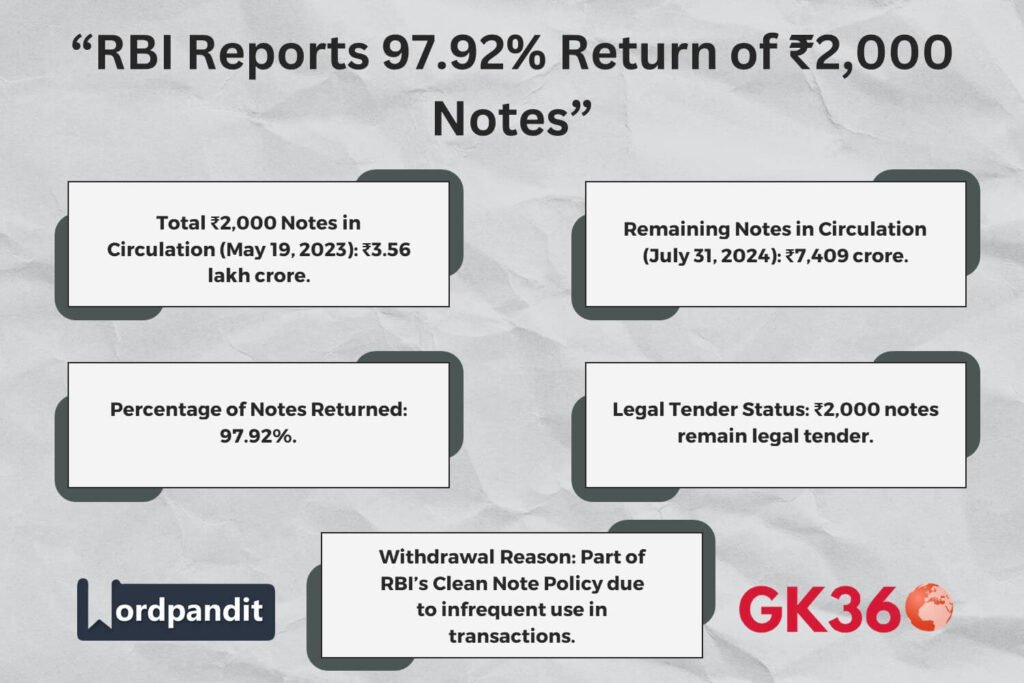

The Reserve Bank of India (RBI) has announced that as of July 31, 2024, 97.92% of ₹2,000 banknotes in circulation have been returned. This move aligns with the RBI’s broader monetary strategy, ensuring efficient currency circulation and adherence to its Clean Note Policy.

Table of Contents

Key Highlights

- Circulation Reduction: The total value of ₹2,000 notes in circulation dropped from ₹3.56 lakh crore (May 19, 2023) to ₹7,409 crore (July 31, 2024).

- Legal Tender Status: Despite the withdrawal, ₹2,000 banknotes remain legal tender.

- Reason for Withdrawal: The primary reason for withdrawing these notes was their infrequent use in transactions.

- Sufficiency of Other Denominations: The RBI has ensured that there are adequate other denominations available to meet public currency demands.

- Clean Note Policy: This move is part of the RBI’s “Clean Note Policy,” aimed at maintaining the quality of currency notes in circulation.

Deposit and Exchange Facility

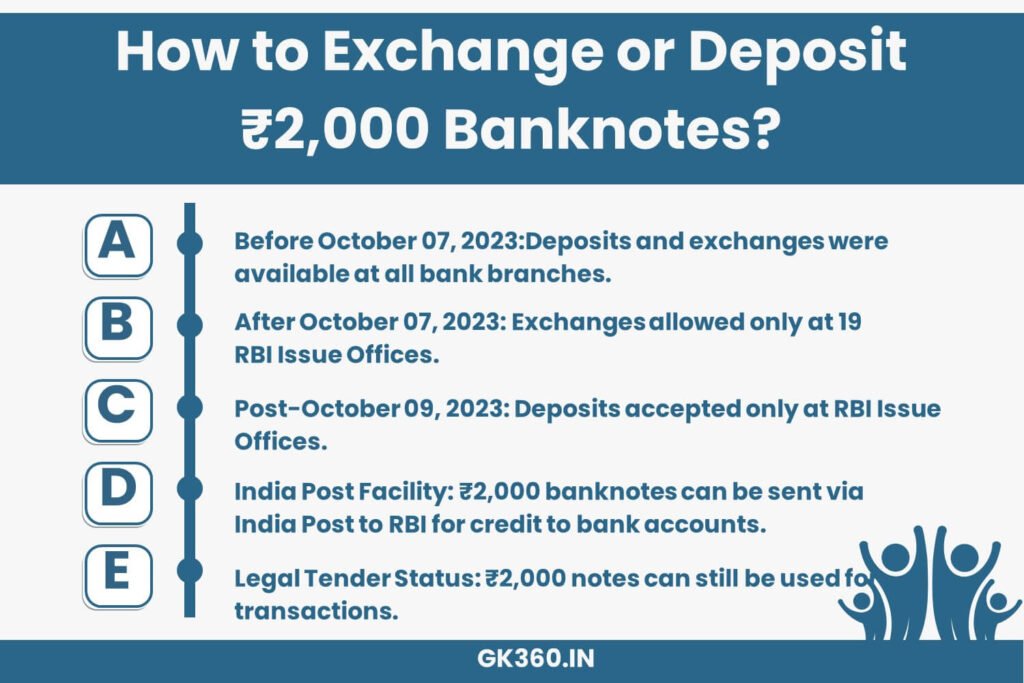

- Until October 07, 2023: The public could deposit and exchange ₹2,000 banknotes at all bank branches.

- After October 07, 2023: The exchange facility was available only at 19 RBI Issue Offices.

- Post-October 09, 2023: The RBI Issue Offices began accepting ₹2,000 banknotes for deposit into bank accounts.

- India Post Service: The public can send ₹2,000 banknotes via India Post from any post office to RBI Issue Offices for credit to their bank accounts.

FAQs About ₹2,000 Banknote Withdrawal

- Can I still use ₹2,000 notes for transactions? Yes, ₹2,000 banknotes remain legal tender, meaning they can still be used for transactions.

- Where can I exchange ₹2,000 notes now? As of now, exchanges can only be done at RBI Issue Offices.

- Can I deposit ₹2,000 notes into my bank account? Yes, deposits are accepted at RBI Issue Offices, and they can also be sent via India Post for credit to bank accounts.

- Why did RBI withdraw ₹2,000 notes? The withdrawal was due to their infrequent use in transactions and as part of the Clean Note Policy.

- What happens if I miss the exchange deadline? Even after deadlines, ₹2,000 banknotes remain legal tender, but exchange and deposit options are limited to RBI Issue Offices.

Conclusion

This initiative by the RBI aims to streamline currency usage and enhance the quality of banknotes in circulation while ensuring that the public’s currency needs are effectively met. Despite the withdrawal, the ₹2,000 note remains legal tender, and individuals still have accessible options to deposit or exchange their holdings.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Total ₹2,000 Notes in Circulation (May 2023) | ₹3.56 lakh crore |

| Remaining ₹2,000 Notes in Circulation (July 2024) | ₹7,409 crore |

| Percentage of Notes Returned | 97.92% |

| Legal Tender Status | Still valid for transactions |

| Reason for Withdrawal | Infrequent use & Clean Note Policy |

| Exchange Availability | Only at RBI Issue Offices |

| Deposit Options | RBI Issue Offices & India Post (via bank account credit) |

Related termss

- RBI ₹2,000 Note Withdrawal 2024

- 97.92% ₹2,000 Banknotes Returned

- How to Exchange ₹2,000 Notes in 2024

- ₹2,000 Notes Still Legal Tender?

- RBI Clean Note Policy ₹2,000

- Where to Deposit ₹2,000 Notes Now

- RBI Report on ₹2,000 Notes Return

- ₹2,000 Banknotes Exchange at RBI

- India Post ₹2,000 Note Deposit Option

- RBI Monetary Policy ₹2,000 Note Update