Renault Acquires Full Ownership of RNAIPL: What It Means for India’s Auto Industry

Renault has made a decisive move in the Indian automotive landscape by acquiring the remaining 51% stake in Renault Nissan Automotive India Private Ltd (RNAIPL) from its longtime partner, Nissan Motor Corp. This strategic acquisition gives Renault 100% control over the Chennai-based manufacturing plant, signaling a bold new phase in its India operations.

This development follows the landmark $600 million investment deal the two companies made in 2023 to co-develop six new models for the Indian market. Renault’s latest move not only reshapes its manufacturing autonomy in India but also reflects the broader restructuring underway within the global alliance.

Let’s break down what this acquisition means for Renault, Nissan, and the future of India’s automotive industry.

Table of Contents

- About RNAIPL: A Legacy of Partnership

- Details of the Acquisition Deal

- Renault’s New Manufacturing Strategy in India

- Nissan’s Exit: Implications for its India Operations

- The 2023 $600M Joint Investment: What Happens Now?

- Impact on India’s Automotive Sector

- Expert Insights: Renault’s Road Ahead

- FAQs: Renault-Nissan India Deal Explained

- Conclusion: A Bold Bet on the Future of Indian Manufacturing

About RNAIPL: A Legacy of Partnership

Renault Nissan Automotive India Private Ltd (RNAIPL) was founded in 2010 as a joint venture between Renault (30%) and Nissan (70%). The collaboration brought together engineering, production, and design expertise to serve one of the fastest-growing auto markets in the world — India.

The ownership dynamics began to shift in 2023, when Renault and Nissan restructured their global alliance and realigned equity in the joint venture, reducing Nissan’s stake to 51% and Renault’s to 49%. The Chennai facility, under RNAIPL, became a vital asset in the production of several popular models for both brands.

Details of the Acquisition Deal

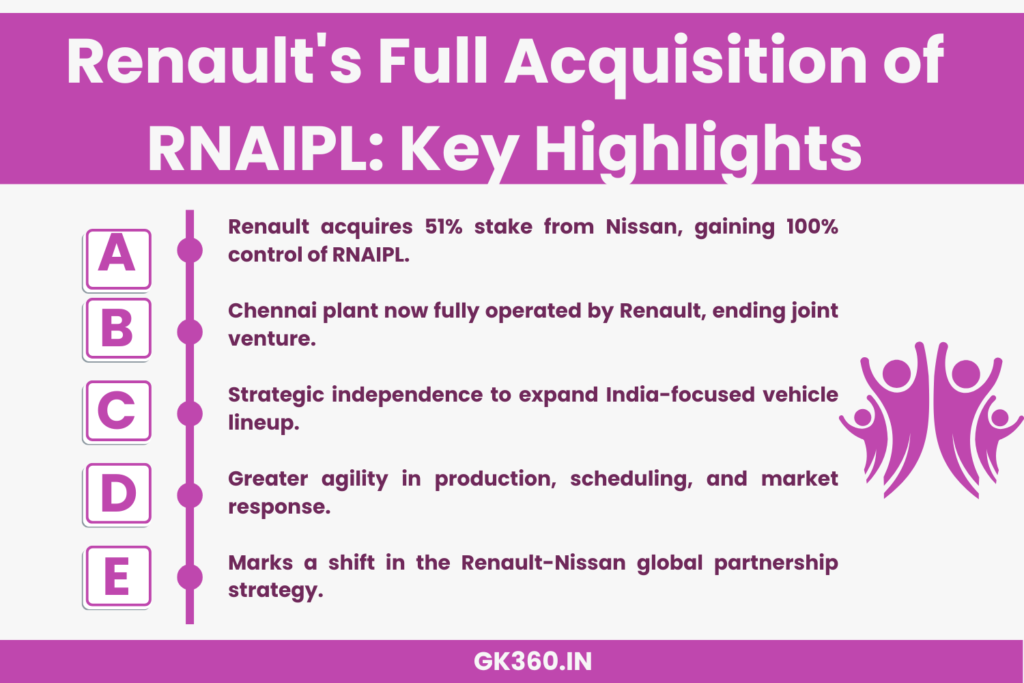

In 2025, Renault took a pivotal step by acquiring Nissan’s remaining 51% stake, becoming the sole owner of the RNAIPL plant. This move:

- Ends the joint manufacturing venture in its original form.

- Grants Renault full operational control of the Chennai plant.

- Marks a turning point in the Renault-Nissan partnership in India.

According to sources familiar with the deal, this acquisition aligns with Renault’s global restructuring strategy to simplify ownership structures and streamline production in key markets.

Renault’s New Manufacturing Strategy in India

With full ownership of RNAIPL, Renault is now poised to:

- Expand its product lineup tailored to the Indian consumer.

- Have greater autonomy in production decisions, scheduling, and capacity utilization.

- Utilize the Chennai plant to potentially export vehicles to other emerging markets.

This strategic independence allows Renault to focus on flexible model development, respond more swiftly to market trends, and enhance its competitiveness in India’s dynamic automotive landscape.

Nissan’s Exit: Implications for its India Operations

Nissan’s decision to divest its remaining stake in RNAIPL signals a shift in its India strategy. While no official announcement has been made about its next steps, the move suggests:

- A potential pivot to importing high-end models rather than local manufacturing.

- Increased focus on strategic partnerships or alliance-driven collaborations.

- Possible reallocation of resources to more profitable global markets.

Whether this indicates a temporary retreat or a new long-term strategy for India remains to be seen.

The 2023 $600M Joint Investment: What Happens Now?

In early 2023, Renault and Nissan announced a joint $600 million investment aimed at developing six new vehicles for the Indian market. The roadmap included a mix of internal combustion engine (ICE) and electric vehicles (EVs), capitalizing on India’s rising demand for affordable mobility solutions.

Now that Renault has full control over RNAIPL, this investment plan may undergo the following changes:

- Renault might reassess model development timelines or prioritize models aligned with its solo strategy.

- The firm could opt for independent launches under the Renault brand, leveraging its full access to the Chennai facility.

- Joint platforms and technologies from the previous alliance may still be utilized under license or strategic collaboration frameworks.

While the spirit of the original investment remains, execution could diverge significantly from the original roadmap.

Impact on India’s Automotive Sector

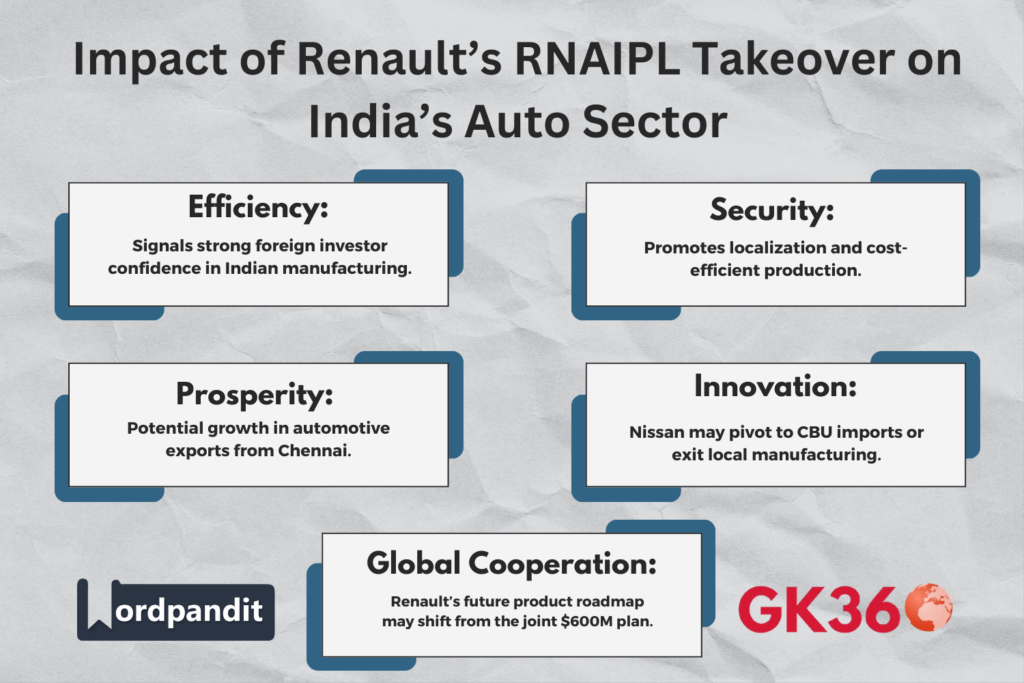

Renault’s acquisition has broader implications for the Indian automobile industry:

Positive Signals:

- Foreign investor confidence in India’s manufacturing capabilities is reinforced.

- More localized production may reduce costs and improve competitiveness.

- Potential for increased export volumes from the Chennai plant to other emerging markets.

Concerns:

- Nissan’s reduced local presence may impact supplier networks and job distribution.

- Disruption in previously planned joint product pipelines may affect launch timelines.

Overall, the move is seen as a strategic affirmation of India’s importance in Renault’s global portfolio.

Expert Insights: Renault’s Road Ahead

Industry analysts suggest that Renault’s solo move is part of a global trend among automakers to take greater control over local operations amid market unpredictability. Here’s what experts are saying:

- “India is a cost-sensitive yet high-potential market. Renault’s full ownership could streamline decision-making and improve speed to market.” – AutoCar India

- “With the right mix of EVs and compact ICE models, Renault could dominate the mid-range segment.” – ICRA Mobility Analyst

Renault’s next steps will be closely watched to see if it can turn autonomy into agility and gain market share in an increasingly competitive space.

FAQs: Renault-Nissan India Deal Explained

- Why did Renault acquire Nissan’s stake in RNAIPL?

Renault acquired the remaining 51% to gain full control over the Chennai manufacturing plant, enabling it to operate independently and restructure its India strategy. - What will happen to the 2023 Renault-Nissan investment plan?

While the original $600 million plan may continue in parts, Renault will now have full discretion over execution, possibly leading to revised timelines and product priorities. - How does this affect Nissan’s presence in India?

Nissan may shift focus to CBU (completely built unit) imports, new alliances, or exit from local manufacturing altogether, though no final strategy has been confirmed. - What does this mean for Indian auto consumers?

Consumers may see more Renault-specific vehicles, increased localization, and possibly faster product rollouts. Nissan’s model lineup may be limited in the short term. - Will this impact jobs or local vendors in Chennai?

Renault’s continued investment suggests stability or potential growth in employment and supplier contracts, depending on future production volumes.

Conclusion: A Bold Bet on the Future of Indian Manufacturing

Renault’s acquisition of full ownership in RNAIPL marks a strategic shift not just in its relationship with Nissan, but in how global automakers view India’s evolving role in the international automotive value chain.

By taking full control of its Chennai facility, Renault is betting on India’s long-term potential—from cost-effective manufacturing to a growing domestic market and export opportunities. As the company charts its solo course, all eyes will be on how it executes product development, tackles EV transition, and competes in a market where agility and localization are key.

Call-to-Action

Stay ahead of India’s evolving auto industry — Follow GK360.in for expert insights, policy updates, and in-depth analysis on global automotive trends and investment shifts.

Key Takeaways Table

| Aspect | Details |

| Acquisition Details | Renault acquired Nissan’s 51% stake in RNAIPL, gaining full ownership. |

| Manufacturing Strategy | Renault now has full control over Chennai plant operations and product plans. |

| Nissan’s Strategic Shift | Nissan may focus on imports or alliances, limiting local production. |

| Joint $600M Investment Plan | Renault may continue with revised priorities and independent launches. |

| Impact on Indian Market | Increases localization, lowers costs, and boosts potential exports. |

| Industry Expert Viewpoints | Analysts see this as a move to improve agility in a price-sensitive market. |

| Long-Term Outlook | Reinforces India’s importance in Renault’s global strategy. |