Razorpay Turbo UPI Plugin: Seamless In-App Payments Powered by BHIM Vega & Axis Bank

India’s fintech sector took a leap forward with the launch of Razorpay’s Turbo UPI Plugin, an innovative solution aimed at eliminating one of the most common pain points in digital payments: UPI redirection. Built in partnership with NPCI BHIM Services Limited (NBSL) and Axis Bank, and powered by the advanced BHIM Vega platform, this plugin enables in-app UPI transactions with higher speed, success rates, and security—setting a new benchmark for merchant and user experience.

Table of Contents

- What is Razorpay’s Turbo UPI Plugin?

- Why Traditional UPI Redirection Fails

- How Turbo UPI Works: BHIM Vega Integration Explained

- Business Benefits of Seamless In-App UPI

- Key Partners: Razorpay, NBSL & Axis Bank

- Real-World Impact & Industry Use Cases

- Future of UPI Payments in India

- FAQs

- Conclusion + Call to Action

What is Razorpay’s Turbo UPI Plugin?

The Turbo UPI Plugin is Razorpay’s latest breakthrough in digital payments. It allows users to complete UPI transactions directly within an app—without being redirected to third-party UPI apps like Google Pay or PhonePe.

This frictionless payment experience:

- Reduces transaction failures

- Speeds up checkout

- Improves merchant conversion rates

- Boosts user trust and satisfaction

It’s particularly useful for businesses in e-commerce, digital services, subscriptions, and other online-first industries.

Why Traditional UPI Redirection Fails

For years, UPI payments involved a clunky redirection step:

- User selects UPI as the payment mode.

- Gets redirected to an external UPI app.

- Waits for the app to open, authenticate, and redirect back.

Problems with this approach:

- App crashes or hangs

- Users abandoning cart during the wait

- Network errors or timeouts

- Lower payment success rates

Razorpay’s Turbo UPI Plugin eliminates this altogether—offering a native, in-app UPI flow with zero redirection.

How Turbo UPI Works: BHIM Vega Integration Explained

At the core of this innovation lies BHIM Vega, a next-gen UPI infrastructure developed by NPCI BHIM Services Limited (NBSL). Razorpay’s Turbo UPI is the first of its kind to be powered by this robust platform.

Key Features of BHIM Vega:

- Optimized Transaction Routing: If one bank fails, the transaction is auto-routed to another.

- Faster Payment Processing: Reduces latency and improves real-time success.

- Scalable Infrastructure: Designed to handle massive volumes during peak times.

- Reliable APIs: For merchants to integrate UPI seamlessly into their apps.

The result? Instant, reliable, and secure UPI payments, every time.

Business Benefits of Seamless In-App UPI

For merchants and businesses, the Turbo UPI Plugin unlocks a range of benefits:

- Higher Conversion Rates: No drop-offs due to app switches or failed redirections.

- Improved Customer Experience: Fast, secure, and uninterrupted payments.

- Increased Revenue: Fewer failed payments mean better revenue realization.

- Future-Ready Infrastructure: Easy integration for startups and scale-ups alike.

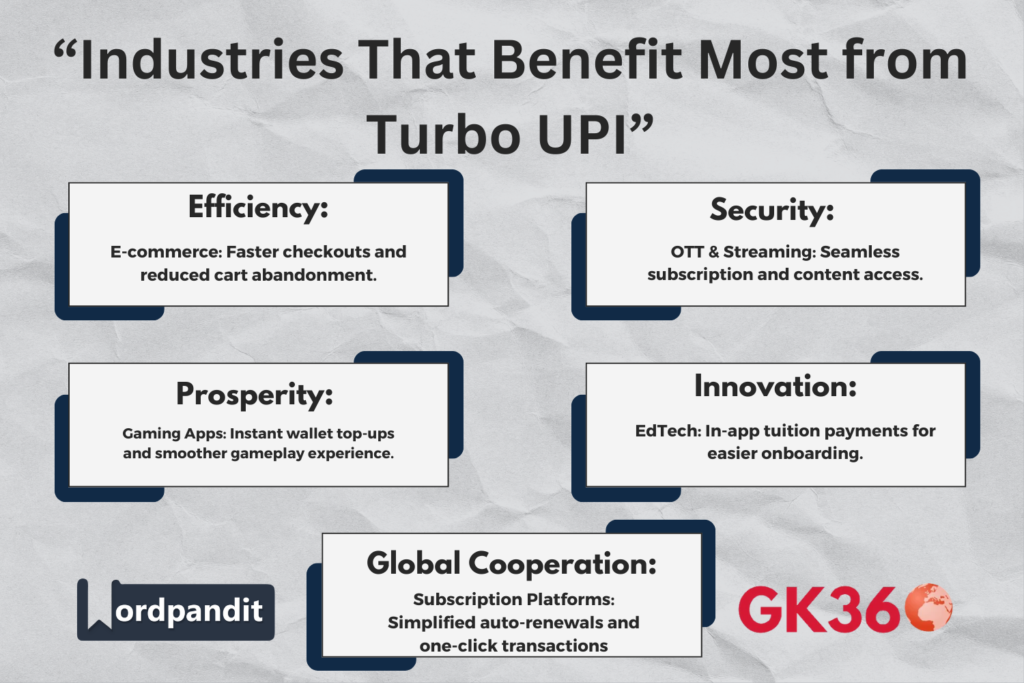

Industries like e-commerce, OTT platforms, edtech, and gaming stand to benefit the most from this enhanced payment flow.

Key Partners: Razorpay, NBSL & Axis Bank

This groundbreaking solution is the result of a strategic collaboration between three major players in India’s digital finance ecosystem:

Razorpay

A leading Indian fintech company, Razorpay specializes in providing cutting-edge payment solutions. With its deep merchant network and integration capabilities, Razorpay is at the forefront of making digital transactions effortless.

NPCI BHIM Services Limited (NBSL)

A subsidiary of the National Payments Corporation of India (NPCI), NBSL is the technology driver behind BHIM Vega. Their infrastructure ensures the plugin is scalable, reliable, and future-ready for all UPI-based transactions.

Axis Bank

As one of India’s top private banks, Axis Bank supports the backend for seamless UPI routing and transaction processing. Its strong banking backbone helps power the Turbo UPI Plugin’s transaction stability.

Together, these entities exemplify the successful convergence of fintech innovation and traditional banking strength.

Real-World Impact & Industry Use Cases

The Turbo UPI Plugin is poised to transform UPI adoption across high-volume digital sectors:

E-commerce

Faster, in-app checkouts mean reduced cart abandonment and better user retention.

Digital Services & Apps

Streaming platforms, OTTs, and gaming apps benefit from instant subscription activation and top-ups.

Edtech

Course and tuition payments can be completed in-app, enabling smoother onboarding for students.

Subscription-Based Platforms

Auto-renewals and seamless one-click payments boost customer lifetime value.

With fewer redirects and failures, businesses can build trust and improve payment funnel performance.

Future of UPI Payments in India

India’s UPI ecosystem has grown exponentially, but friction in the checkout process still limits its full potential. Innovations like Razorpay’s Turbo UPI Plugin pave the way for:

- Hyper-integrated payment ecosystems

- Improved analytics on payment behavior

- Customized UPI flows for businesses

- Even stronger fraud protection mechanisms

As UPI continues to evolve beyond peer-to-peer transfers and enters the B2C and enterprise space, this plugin sets a new standard for next-gen, in-app digital transactions.

FAQs

- What is Razorpay’s Turbo UPI Plugin?

It’s an in-app UPI payment solution that allows users to complete transactions without being redirected to third-party apps. - How is this different from traditional UPI payments?

Traditional UPI often involves redirection to apps like GPay or PhonePe. Turbo UPI eliminates that step, offering native, seamless payments inside the app. - What is BHIM Vega?

BHIM Vega is a high-speed, next-generation UPI infrastructure developed by NPCI BHIM Services Limited. It enables optimized routing and improved transaction success rates. - Which industries benefit the most from Turbo UPI?

E-commerce, edtech, gaming, OTT platforms, and any digital-first business with high checkout volumes. - How can my business integrate this plugin?

Businesses using Razorpay’s payment gateway can connect with their support or developer resources to activate and configure the Turbo UPI Plugin.

Conclusion: A Fintech Milestone for India

Razorpay’s Turbo UPI Plugin—developed with NBSL and supported by Axis Bank—ushers in a new era of frictionless, in-app digital payments. By solving the long-standing issue of UPI redirection and reducing failure rates, it empowers businesses to offer faster, more secure, and user-friendly transactions.

As India continues to lead globally in UPI innovation, this plugin represents a decisive leap toward a seamless digital economy.

Key Takeaways Table

| Aspect | Details |

| Core Innovation | Razorpay’s Turbo UPI Plugin enables in-app UPI payments with zero redirection. |

| Technology Backbone | Powered by BHIM Vega platform by NPCI BHIM Services Limited (NBSL). |

| Business Impact | Higher conversion rates, improved CX, fewer failures, and better revenue. |

| Strategic Partnerships | Collaboration between Razorpay, Axis Bank, and NBSL. |

| Major Industry Beneficiaries | E-commerce, OTT, EdTech, gaming, and subscription services. |

| Problem Solved | Eliminates UPI app switching, reducing transaction drop-offs and delays. |

| Future Outlook | Lays the foundation for hyper-integrated UPI ecosystems in India. |