MPS Norm Deadline Extended to 2026: Impact on CPSEs & Public Sector Banks

Introduction

In a significant regulatory update, the Finance Ministry has extended the deadline for Central Public Sector Enterprises (CPSEs) and public sector financial institutions to comply with the Minimum Public Shareholding (MPS) norm until August 1, 2026. This extension provides these entities with additional time to meet the Securities Contract (Regulation) Rules, 1957 (SCRR) requirements, preventing market disruptions and allowing a structured reduction of government stakes. Understanding the implications of this move is crucial for investors, policymakers, and exam aspirants preparing for competitive exams in finance and governance.

Table of Contents

- What is the Minimum Public Shareholding (MPS) Norm?

- Extension of Deadline: Key Highlights

- Impact on Public Sector Banks & CPSEs

- Regulatory Framework & SEBI’s Role

- Market & Investor Implications

- Government’s Rationale Behind the Extension

- Challenges in Implementation

- FAQs on MPS Norms Extension

- Conclusion & Key Takeaways

What is the Minimum Public Shareholding (MPS) Norm?

The MPS norm, as mandated by SEBI, requires all listed companies, including CPSEs, to maintain a minimum public shareholding of 25%. This regulation ensures market transparency, wider investor participation, and reduced government control over public sector entities.

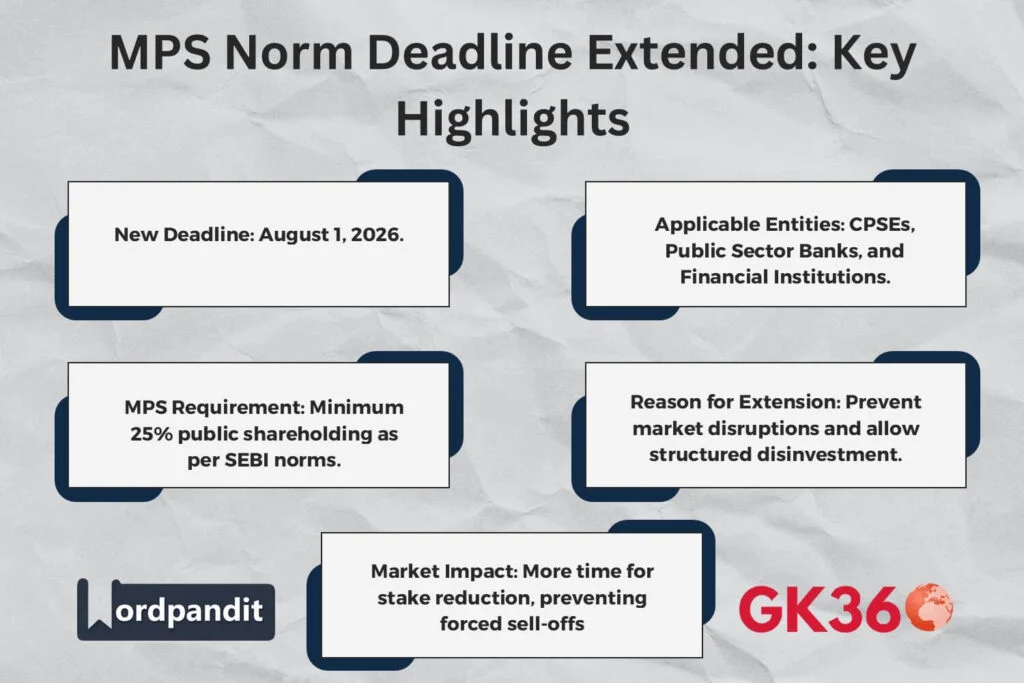

Extension of Deadline: Key Highlights

Extended Deadline

- The Finance Ministry has granted CPSEs, public sector banks, and financial institutions an extension until August 1, 2026, to comply with the MPS norm.

Implications of the Extension

- Market Stability: Avoids sudden sell-offs that could lead to stock price volatility.

- Compliance Flexibility: Allows banks and CPSEs to gradually divest government holdings without financial strain.

- Regulatory Adjustments: SEBI will oversee the transition to ensure compliance with SCRR regulations.

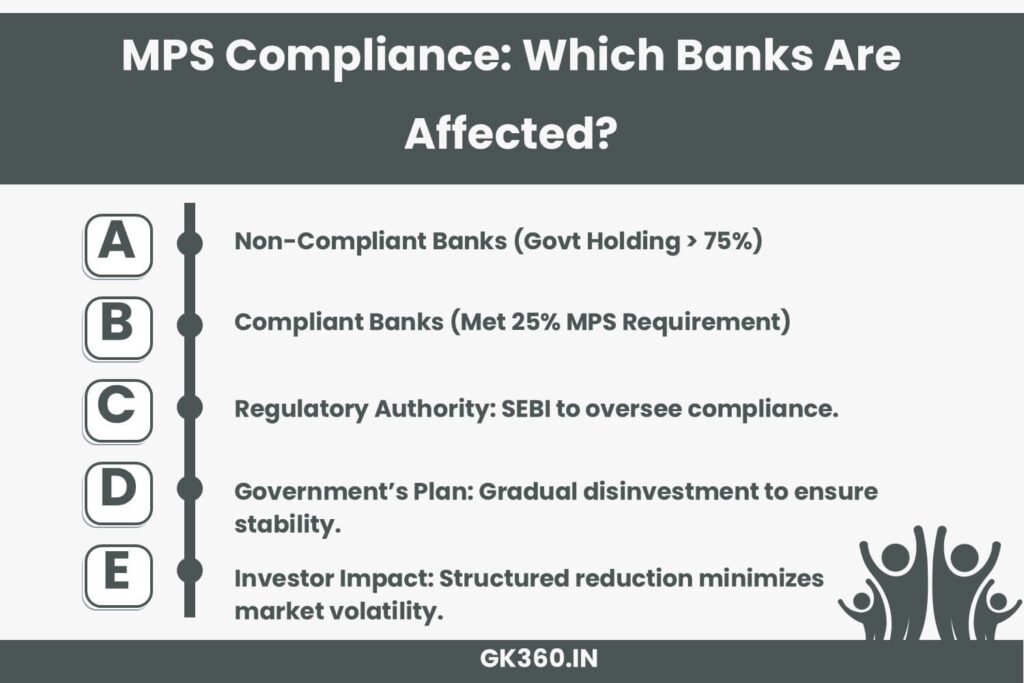

Impact on Public Sector Banks & CPSEs

Non-Compliant Public Sector Banks

Several banks need to reduce government stakes to below 75%:

- Punjab & Sind Bank – 98.25%

- Indian Overseas Bank – 96.38%

- UCO Bank – 95.39%

- Central Bank of India – 93.08%

- Bank of Maharashtra – 86.46%

Compliant Banks

As of March 31, 2024, seven out of twelve public sector banks have already met the 25% MPS requirement:

- SBI

- PNB

- Canara Bank

- Bank of Baroda

- Indian Bank

- Union Bank of India

- Bank of India

Regulatory Framework & SEBI’s Role

The extension has been implemented under sub-rule (6) of Rule 19A of the SCRR. SEBI will oversee compliance and guide CPSEs through the transition process, ensuring that stock exchanges are informed about necessary adjustments.

Market & Investor Implications

- For Investors: More time for public investors to participate in CPSE stocks, potentially leading to stable investment opportunities.

- For the Government: Enables gradual disinvestment, preventing abrupt market disruptions.

- For CPSEs & Banks: Reduces the risk of forced sell-offs, allowing structured compliance.

Government’s Rationale Behind the Extension

- Preventing Market Disruptions: A sudden reduction of government stakes could lead to price crashes.

- Economic Recovery Considerations: Post-pandemic economic conditions require a careful approach to disinvestment.

- Strategic Timing: Aligns with broader fiscal and economic policy goals.

Challenges in Implementation

- Gradual Stake Reduction: Finding buyers for large government stakes without negatively impacting stock prices.

- Investor Confidence: Ensuring that the delay does not discourage retail and institutional investors.

- Regulatory Compliance: SEBI’s role in balancing compliance with market stability.

FAQs on MPS Norms Extension

1. What is the new deadline for CPSEs to meet the MPS norm?

The Finance Ministry has extended the deadline to August 1, 2026.

2. Which banks need to comply with the MPS norm?

Non-compliant banks include Punjab & Sind Bank, Indian Overseas Bank, UCO Bank, Central Bank of India, and Bank of Maharashtra.

3. What happens if CPSEs fail to meet the MPS requirement?

Failure to comply may result in regulatory actions from SEBI, including penalties or trading restrictions.

4. Why was the deadline extended?

To prevent market instability, allow structured stake reductions, and align with broader economic policies.

5. How does this impact investors?

Investors get a more stable market with gradual public participation in CPSE stocks, reducing volatility.

Conclusion & Key Takeaways

The extension of the MPS norm deadline to 2026 provides CPSEs and public sector banks additional time to comply with regulatory requirements, ensuring market stability and structured disinvestment. This move reflects a balanced approach between financial governance and economic stability. Understanding these changes is crucial for investors, policymakers, and competitive exam aspirants.

Stay informed on financial regulations and market trends by following the latest updates!

Key Takeaways Table

| Aspect | Details |

|---|---|

| MPS Requirement | Minimum 25% public shareholding in listed CPSEs and public sector banks. |

| New Deadline | August 1, 2026 (extended from 2024). |

| Regulatory Authority | SEBI (Securities and Exchange Board of India). |

| Non-Compliant Banks | Punjab & Sind Bank, Indian Overseas Bank, UCO Bank, Central Bank of India, Bank of Maharashtra. |

| Compliant Banks | SBI, PNB, Canara Bank, Bank of Baroda, Indian Bank, Union Bank of India, Bank of India. |

| Government Rationale | Prevent market disruptions, enable structured disinvestment, and stabilize financial markets. |

| Market Impact | Ensures smooth public participation and reduces stock volatility risks. |

- MPS Norm Deadline Extension 2026

- Minimum Public Shareholding SEBI Rules

- CPSE MPS Compliance 2025

- Public Sector Banks MPS Status

- SEBI MPS Regulations Explained

- Government Disinvestment Plan India

- Impact of MPS Rules on Indian Stock Market

- Public Shareholding Rules for PSU Banks

- Stock Market Regulatory Updates India

- Investor Guide to SEBI MPS Norms