Parle: India’s Most Chosen In-Home Brand for 12 Consecutive Years (Kantar Report 2025)

Introduction

Parle continues to reign as India’s most chosen in-home brand, according to Kantar’s Brand Footprint Report 2025. With an impressive Consumer Reach Points (CRP) score of 7980 million, Parle has maintained its top position for the 12th consecutive year. This achievement highlights Parle’s deep connection with Indian households and its strong market penetration.

Table of Contents

- What is Kantar’s Brand Footprint Report?

- Understanding Consumer Reach Points (CRP)

- Top 5 In-Home Brands in India (2025)

- Parle’s Legacy and Market Dominance

- CRP Growth and Market Trends

- Out-of-Home Brand Rankings (2025)

- Competitive Analysis: How Parle Stays on Top

- Key Takeaways for Competitive Exams

- FAQs

- Conclusion & Call to Action

What is Kantar’s Brand Footprint Report?

Kantar’s Brand Footprint Report is an annual study that ranks India’s most chosen brands based on actual consumer purchases. It uses Consumer Reach Points (CRP) as a metric to evaluate brand penetration and purchase frequency across households.

Understanding Consumer Reach Points (CRP)

Consumer Reach Points (CRP) measure how often brands are chosen by consumers, considering:

- Number of households purchasing the brand

- Frequency of purchases

- Market penetration rate

This metric provides insights into brand loyalty, consumer trust, and market dominance.

Top 5 In-Home Brands in India (2025)

Based on Kantar’s latest report, the top five in-home brands in India are:

- Parle – Leading with a CRP score of 7980 million

- Britannia – Known for biscuits, dairy, and baked goods

- Amul – A staple in Indian households for dairy products

- Clinic Plus – Dominating the personal care segment

- Tata Consumer Products – Offering tea, coffee, and packaged foods

Parle’s Legacy and Market Dominance

Parle’s success is driven by factors such as:

- Affordable pricing and wide availability

- Iconic products like Parle-G biscuits

- Brand trust and loyalty built over decades

- Strong distribution network across urban and rural India

CRP Growth and Market Trends

Consumer Reach Points (CRP) have grown 33% in the last five years, showing increased market penetration. Notably, seven brands in the top 25 rankings have seen over 20% penetration increase, including:

- Britannia

- Surf Excel

- Sunfeast

- Haldiram’s

- Patanjali

- Brooke Bond

- Vim

Out-of-Home Brand Rankings (2025)

For out-of-home consumption, snack brands dominate the top rankings:

- Britannia – 628 million CRP

- Haldiram’s – Expanding its snacking portfolio

- Cadbury – The leading chocolate brand

- Balaji – Popular for chips and regional snacks

- Parle – Retaining its influence in this category as well

Competitive Analysis: How Parle Stays on Top

Parle’s sustained dominance is due to:

- Consistently expanding product lines

- Localized marketing strategies

- Innovative packaging and affordability

- Strong retailer relationships ensuring wide availability

Key Takeaways for Competitive Exams

- Consumer Reach Points (CRP): Measures how often consumers choose a brand

- Market Penetration: Key indicator of brand growth and sustainability

- Brand Longevity: The factors that contribute to a brand’s continued dominance

FAQs

- What makes Parle India’s most chosen brand?

Parle’s affordability, strong distribution, and high consumer trust contribute to its top ranking. - How does Kantar measure Consumer Reach Points (CRP)?

CRP is measured by multiplying a brand’s household penetration with purchase frequency. - Which brands have seen the most growth in CRP?

Brands like Britannia, Surf Excel, and Sunfeast have experienced notable CRP increases. - How does Parle compare with Britannia in market reach?

Both brands dominate the FMCG sector, but Parle leads in CRP due to wider rural penetration. - What factors influence a brand’s ranking in Kantar’s report?

Brand availability, affordability, marketing strategies, and purchase frequency determine rankings.

Conclusion & Call to Action

Parle’s dominance in Kantar’s Brand Footprint Report for the 12th year is a testament to its market strength and consumer loyalty. Understanding such rankings helps in analyzing brand growth, consumer behavior, and market trends.

For more in-depth market insights and brand analysis, visit gk360.in and stay informed to enhance your knowledge for competitive exams and industry trends.

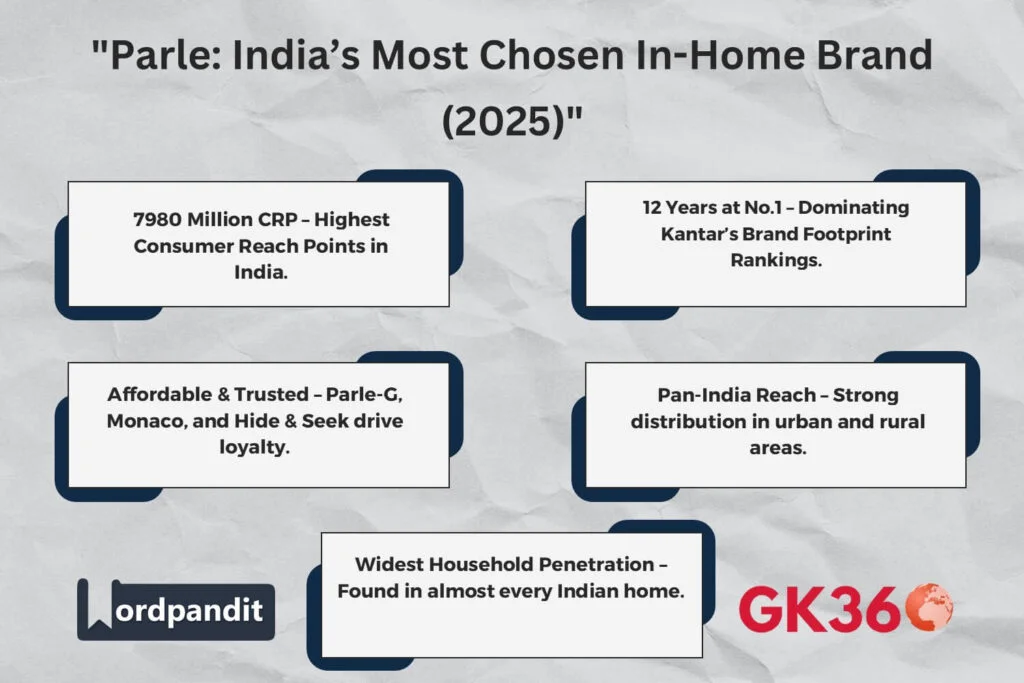

Infographic: Parle – India’s Most Chosen In-Home Brand (2025)

- 7980 Million CRP: Highest Consumer Reach Points in India.

- 12 Years at No.1: Dominating Kantar’s Brand Footprint Rankings.

- Affordable & Trusted: Parle-G, Monaco, and Hide & Seek drive loyalty.

- Pan-India Reach: Strong distribution in urban and rural areas.

- Widest Household Penetration: Found in almost every Indian home.

SEO Content:

- Alt Text: “Parle ranks as India’s top in-home brand in Kantar’s 2025 Brand Footprint Report.”

- Image Title: “Parle: India’s No.1 FMCG Brand (2025)”

- Description: “Infographic showcasing Parle’s leadership in India’s FMCG market with highest Consumer Reach Points (7980 million) and top rank for 12 consecutive years.”

Infographic: Top 5 In-Home Brands in India (2025)

- Parle – 7980 Million CRP (Biscuits, Snacks, Confectionery)

- Britannia – Leading in biscuits and dairy products.

- Amul – Dominating the dairy sector.

- Clinic Plus – Top personal care brand.

- Tata Consumer Products – Strong presence in tea, coffee, and packaged foods.

SEO Content:

- Alt Text: “India’s top 5 in-home brands of 2025 ranked by Kantar.”

- Image Title: “Top FMCG Brands in India (2025)”

- Description: “Visual representation of India’s top five in-home FMCG brands, highlighting Parle’s continued dominance in the market.”

Key Takeaways Table

| Aspect | Details |

|---|---|

| Parle’s Rank | No.1 FMCG Brand in India for 12 Consecutive Years |

| Consumer Reach Points (CRP) | 7980 Million – Highest in India |

| Key Competitors | Britannia, Amul, Clinic Plus, Tata Consumer Products |

| CRP Growth (5 Years) | 33% increase – Higher market penetration |

| Parle’s Strengths | Affordability, brand trust, extensive distribution |

| Out-of-Home Leader | Britannia (628 million CRP), followed by Haldiram’s and Cadbury |

| Market Trends | Growth in packaged snacks, biscuits, and dairy sectors |

SEO-Driven Tags

- Parle Brand Ranking 2025

- India’s Top FMCG Brands 2025

- Kantar Brand Footprint 2025

- Consumer Reach Points (CRP) Explained

- Most Chosen In-Home Brands India

- Parle vs Britannia Market Share

- Top Biscuits and Snacks Brands India

- Parle-G Success Story

- FMCG Market Trends India 2025

- Parle’s Competitive Advantage