HPE Acquires Juniper Networks: Market Impact & Regulatory Approval Explained

Introduction: HPE Acquires Juniper Networks – A Market-Shaping Move

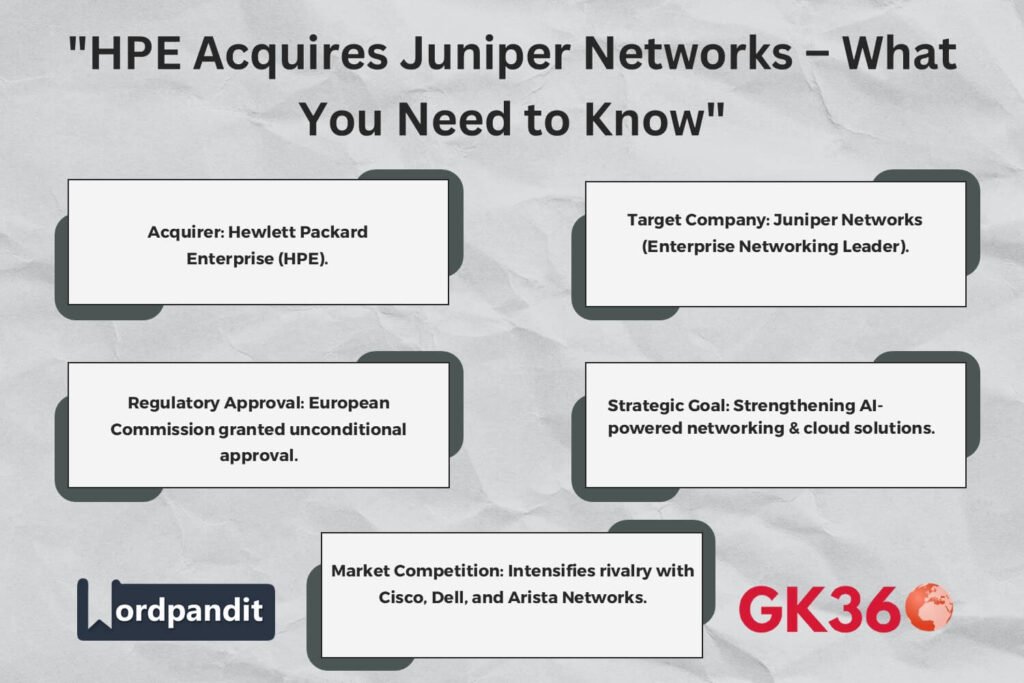

In a landmark move within the technology sector, Hewlett Packard Enterprise (HPE) has successfully acquired Juniper Networks. The European Commission’s unconditional approval of this acquisition signals a major shift in the competitive landscape of AI-driven networking solutions. This development highlights the importance of regulatory oversight in large corporate mergers and its implications for market competition.

For students and professionals preparing for competitive exams, this acquisition serves as a valuable case study in understanding market strategies, antitrust regulations, and corporate investment in future technologies.

Table of Contents

- Regulatory Approval & Market Impact

- Strategic Importance of the Acquisition

- Competitive Landscape & Post-Merger Strategy

- Pending Reviews & Future Implications

- Key Takeaways & FAQs

1. Regulatory Approval & Market Impact

EU Commission’s Decision

- Unconditional Approval: The European Commission approved the merger without imposing any conditions, indicating that the deal does not significantly reduce market competition.

- Market Areas Evaluated: The review focused on key segments such as wireless local area network (WLAN) equipment, Ethernet campus switches, and data center networking solutions.

- Impact on Market Competition: Post-merger, HPE and Juniper Networks will maintain a moderate market position, facing competition from tech giants like Cisco, Arista Networks, and Dell.

Practical Tip: Competitive exam aspirants should analyze how antitrust laws ensure fair competition and prevent monopolies in major industries.

Competitive Landscape & Market Reaction

- The acquisition has positioned HPE as a stronger competitor in enterprise networking.

- Market analysts predict increased innovation in AI-powered cloud networking as a result of this merger.

- Stock market reactions indicate investor confidence in HPE’s long-term strategy.

2. Strategic Importance of the Acquisition

AI & Cloud Technology Integration

- HPE aims to integrate Juniper’s advanced networking solutions into its cloud and AI-driven services.

- The acquisition aligns with industry trends where networking infrastructure plays a crucial role in AI data processing.

Long-Term Business Strategy

- By acquiring Juniper, HPE strengthens its position against competitors like Cisco.

- The move aligns with the increasing demand for AI-driven cloud solutions in enterprise networks.

Practical Tip: Relate this acquisition to broader economic concepts such as technological advancement and corporate growth strategies.

3. Competitive Landscape & Post-Merger Strategy

Challenges & Opportunities

- Challenges: Integration of Juniper’s operations, regulatory compliance in different markets, and competition from established tech firms.

- Opportunities: Expansion of AI-powered networking services, increased customer base, and enhanced technological capabilities.

Porter’s Five Forces Analysis

- Industry Rivalry: Competition remains high with Cisco, Dell, and Arista Networks.

- Threat of New Entrants: High barriers to entry due to required technological expertise and capital investment.

- Bargaining Power of Suppliers: Limited impact as HPE has an established supply chain.

- Bargaining Power of Buyers: Customers have multiple options, leading to continued competition.

- Threat of Substitutes: Low, as AI-driven networking infrastructure is crucial for digital transformation.

4. Pending Reviews & Future Implications

UK Antitrust Review

- Britain’s Competition and Markets Authority (CMA) is expected to make a decision by August 14.

- Different jurisdictions have unique criteria and implications for mergers, making global approval complex.

Global Expansion Strategy

- HPE plans to leverage Juniper’s global presence to expand its AI and cloud-based solutions worldwide.

- Future acquisitions and partnerships may follow to strengthen market position.

Practical Tip: Exam candidates should explore how international regulatory bodies impact mergers and acquisitions in global business.

5. Key Takeaways & FAQs

Key Takeaways

- The HPE-Juniper acquisition enhances HPE’s competitive edge in AI-powered networking solutions.

- Regulatory approval highlights the role of antitrust laws in maintaining market fairness.

- Future regulatory reviews in the UK and other jurisdictions will shape the final market impact.

- The deal reflects a broader trend of technological firms investing in AI and cloud computing.

FAQs on the Merger & Industry Trends

1. Why did HPE acquire Juniper Networks?

HPE aims to enhance its networking infrastructure and AI-driven services by integrating Juniper’s expertise.

2. What was the EU Commission’s verdict on this acquisition?

The European Commission approved the merger without conditions, finding no major competition concerns.

3. How does this impact the enterprise networking industry?

The merger strengthens HPE’s market position and intensifies competition in AI-powered networking solutions.

4. What challenges does HPE face post-merger?

Challenges include integrating Juniper’s operations, competing with major players like Cisco, and gaining approval in all required markets.

5. What is the significance of the UK antitrust review?

The UK’s decision, expected by August 14, could influence future acquisitions and competition policies in the industry.

Conclusion: The Future of AI-Driven Networking

The HPE-Juniper Networks acquisition marks a significant milestone in the technology sector, reflecting the growing importance of AI and cloud-driven networking solutions. By securing regulatory approval and strategically positioning itself in a competitive market, HPE is set to redefine enterprise networking solutions.

For competitive exam aspirants and business professionals alike, this acquisition offers a real-world case study in corporate strategy, regulatory compliance, and market dynamics. Understanding such industry-shaping deals provides valuable insights into global business trends and economic principles.