Indian Public Sector Banks (PSBs) Achieve Record 25% Profit Growth in H1 FY25 – Key Factors & Insights

Introduction

Indian Public Sector Banks (PSBs) have demonstrated remarkable financial growth, reporting a 25% increase in net profits in the first half (H1) of the fiscal year 2024-25. Net profits surged to ₹85,520 crore, compared to ₹68,500 crore in H1 FY24. This strong performance indicates that PSBs are on track to exceed ₹1.5 trillion in net profits by the end of FY25.

Several key factors have contributed to this growth, including a significant reduction in non-performing assets (NPAs), robust credit expansion, and strengthened capital adequacy ratios. This article explores these elements in detail and assesses the challenges and opportunities ahead for India’s banking sector.

Table of Contents

- Financial Performance of PSBs in H1 FY25

- Declining NPAs & Stronger Capital Health

- Digital Fraud in Banking: Challenges & Solutions

- Economic Implications of PSB Growth

- FAQs on Public Sector Banks Performance in FY25

- Conclusion & Future Outlook

Financial Performance of PSBs in H1 FY25

Net Profit Growth Analysis

- The 25% YoY growth in net profits marks one of the strongest performances in recent years.

- PSBs achieved their highest-ever annual net profit of ₹1.41 trillion in FY24, setting a new benchmark for profitability.

- The banking sector has benefited from higher interest margins, improved credit demand, and effective risk management strategies.

Key Financial Indicators

- Return on Assets (RoA): Increased to 1.4% in FY24.

- Return on Equity (RoE): Reached 14.6%, showcasing improved capital efficiency.

- Dividend Distribution: Over ₹61,964 crore distributed in the last three years, highlighting financial stability and investor confidence.

Declining NPAs & Stronger Capital Health

Gross NPA Trends & Impact

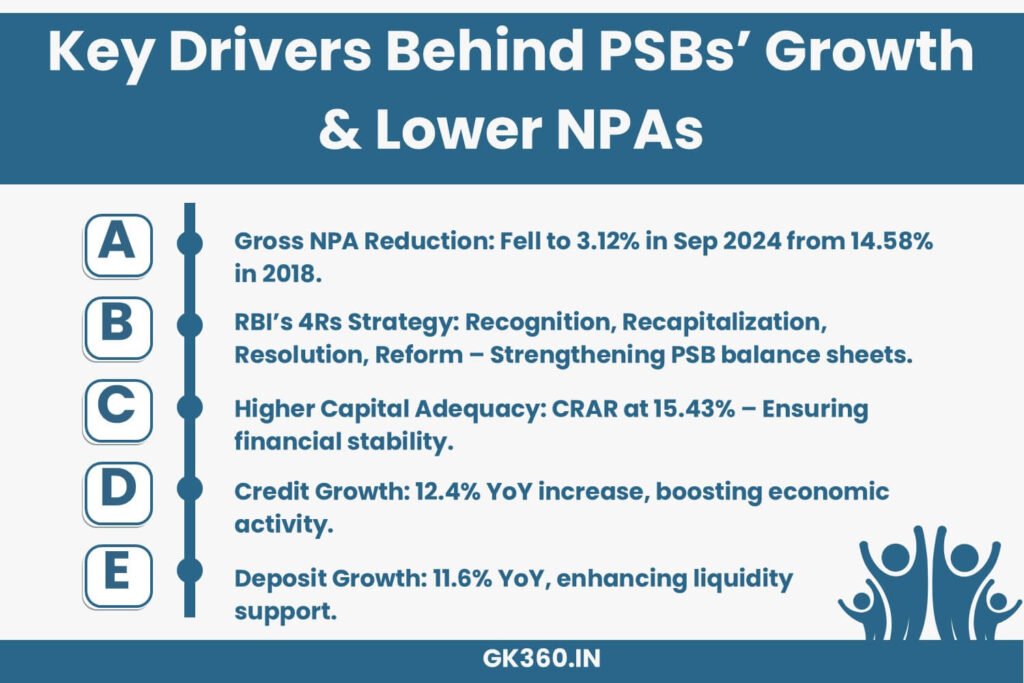

- Sharp Reduction: Gross NPA ratio fell to 3.12% in September 2024, a significant decline from 14.58% in March 2018.

- Enhanced Recovery Mechanisms: The success of insolvency and bankruptcy proceedings has contributed to cleaning up balance sheets.

- Lower Credit Risk: Strengthened lending policies have resulted in fewer defaults.

RBI’s 4Rs Strategy: A Game Changer

The 4Rs framework (Recognition, Recapitalization, Resolution, and Reform), initiated by the Reserve Bank of India (RBI) in 2015, has played a pivotal role in improving asset quality:

- Recognition: Transparent acknowledgment of stressed assets.

- Recapitalization: Strengthened balance sheets through government-backed capital infusions.

- Resolution: Timely interventions to recover bad debts.

- Reform: Structural changes improving overall banking efficiency.

Capital Adequacy & Resilience

- Capital to Risk-Weighted Assets Ratio (CRAR): Surpassed 15.43% in September 2024, well above RBI’s 11.5% minimum requirement.

- Higher CRAR: Ensures that PSBs can withstand economic fluctuations and maintain lending momentum.

Digital Fraud in Banking: Challenges & Solutions

Growing Threats & Financial Losses

- Cybercrime Losses: Indian banking customers lost approximately ₹11,333 crore in 2024 due to digital fraud.

- Rise in Phishing & Identity Theft: Online scams targeting users have escalated significantly.

RBI’s AI-Based Fraud Prevention Measures

To combat digital fraud, RBI has introduced advanced AI/ML models, including MuleHunter.AITM, which:

- Detects suspicious transactions in real time.

- Prevents fraudulent withdrawals by analyzing transaction patterns.

- Strengthens security protocols across banking networks.

Economic Implications of PSB Growth

Impact on Credit & Deposit Growth

- Credit Growth: Increased by 12.4% YoY as of November 2024.

- Deposit Growth: Rose by 11.6% YoY, ensuring liquidity stability.

PSBs’ Role in India’s Economic Expansion

- Increased lending: To priority sectors such as MSMEs, agriculture, and infrastructure development.

- Greater financial inclusion: Initiatives expanding banking access in rural areas.

- Enhanced foreign investment confidence: Signaling a robust banking sector.

FAQs on Public Sector Banks Performance in FY25

1. What has driven the 25% profit growth of PSBs in H1 FY25?

The growth is attributed to lower NPAs, higher credit demand, improved capital adequacy, and strong risk management practices.

2. How has the reduction in NPAs impacted PSBs?

A lower Gross NPA ratio (3.12%) has improved overall financial stability, increased investor confidence, and reduced provisioning costs.

3. What role does the RBI’s 4Rs strategy play in strengthening PSBs?

The 4Rs strategy (Recognition, Recapitalization, Resolution, Reform) has been crucial in reducing stressed assets and ensuring a healthier banking ecosystem.

4. How is RBI addressing digital fraud in PSBs?

RBI has implemented AI-driven fraud detection models like MuleHunter.AITM to identify and prevent cyber threats in real time.

5. What is the outlook for PSBs in the remainder of FY25?

PSBs are expected to surpass ₹1.5 trillion in net profits, maintain strong credit growth, and enhance digital banking infrastructure for greater financial security.

Conclusion & Future Outlook

The Indian banking sector is on a strong growth trajectory, with PSBs improving their profitability, reducing NPAs, and strengthening capital health. While digital fraud remains a concern, RBI’s proactive measures are expected to mitigate risks. Looking ahead, PSBs are well-positioned to support India’s economic ambitions by driving credit expansion, boosting financial inclusion, and adopting digital innovations.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Net Profit (H1 FY25) | ₹85,520 crore, a 25% YoY growth. |

| Gross NPA Ratio | 3.12% (Sep 2024), down from 14.58% (2018). |

| RBI’s 4Rs Strategy | Recognition, Recapitalization, Resolution, Reform – Driving financial stability. |

| Capital Adequacy (CRAR) | 15.43%, exceeding RBI’s 11.5% minimum requirement. |

| Credit Growth (YoY) | 12.4%, supporting economic expansion. |

| Deposit Growth (YoY) | 11.6%, ensuring liquidity for lending. |

| Digital Fraud Impact (2024) | ₹11,333 crore lost; RBI introduced AI-based fraud detection models. |

Related Terms:

- PSB profit growth FY25 India

- Public Sector Banks record earnings 2024

- India banking sector NPA reduction

- RBI 4Rs strategy for PSBs

- Indian bank capital adequacy trends

- Digital fraud in banking sector 2024

- AI-driven fraud prevention in Indian banks

- PSBs’ role in India’s economic growth

- Credit and deposit growth trends in India

- Financial performance of Indian banks FY25