Japan 2026 Crypto Law: Digital Assets to Be Recognized as Financial Products

Introduction

Japan is taking a bold leap in the world of cryptocurrency regulation. By 2026, the country plans to legally classify crypto assets as financial products under a new legislative framework led by the Financial Services Agency (FSA). This landmark move aims to place digital currencies like Bitcoin and Ethereum on the same legal footing as stocks and bonds, potentially transforming Japan into one of the most progressive crypto markets in the world.

As the global crypto landscape continues to evolve, Japan’s proposed amendments to the Financial Instruments and Exchange Act could usher in a new era of financial legitimacy, market transparency, and investor protection. Here’s everything you need to know about the upcoming changes, their implications, and what it means for the future of crypto in Japan and beyond.

“Infographic summarizing major changes under Japan’s 2026 crypto law, including asset classification, insider trading controls, and compliance upgrades.”

Table of Contents

- Japan’s Crypto Regulation Journey

- Inside the 2026 Law: What’s Changing?

- Implications of the Legal Shift

- How Japan’s Model Could Influence Global Regulation

- What Happens Next? Timeline to 2026

- FAQ Section

- Conclusion: Japan Leading the Charge in Legalizing Crypto Finance

- Key Takeaways Table

Japan’s Crypto Regulation Journey

Japan has long been at the forefront of crypto regulation. In 2017, it became one of the first countries to officially legalize Bitcoin as a payment method, setting a benchmark for digital finance. However, subsequent cyberattacks on exchanges and illicit activities prompted a more cautious, risk-managed approach from the government.

The Financial Services Agency (FSA) has since strengthened its oversight, gradually tightening compliance requirements for crypto exchanges and focusing on consumer protection, anti-money laundering (AML), and operational transparency.

Now, with the proposed 2026 legislation, Japan is preparing to take its most ambitious step yet—treating cryptocurrencies as full-fledged financial products.

Inside the 2026 Law: What’s Changing?

Crypto Assets Redefined as Financial Products

The proposed amendment to the Financial Instruments and Exchange Act will formally categorize cryptocurrencies as financial instruments, similar to traditional assets like:

- Stocks

- Bonds

- Derivatives

This change aims to:

- Provide clear legal status for digital assets.

- Enable the creation of crypto-based financial products like ETFs.

- Expand regulatory oversight by financial watchdogs.

For investors, this translates into greater protections and legal clarity, while for businesses, it opens doors to new crypto-linked instruments under Japan’s financial system.

New Insider Trading Rules for Digital Assets

Currently, insider trading laws in Japan apply only to conventional securities. Under the 2026 proposal:

- Privileged information-based crypto trades would be illegal.

- Crypto companies would be required to implement internal compliance programs.

- Violations could result in penalties, trading bans, or prosecution.

This marks a significant milestone in bringing ethical standards and fair play to crypto trading, aligning it with traditional financial markets.

Enhanced Market Transparency and Compliance

To further protect consumers and strengthen the market:

- Mandatory disclosures will be required for firms dealing in crypto.

- Enhanced KYC (Know Your Customer) and AML procedures will be enforced.

- A centralized monitoring system will be introduced to track suspicious activity.

These changes are designed to promote a stable, secure, and transparent crypto ecosystem, appealing to both retail and institutional participants.

Implications of the Legal Shift

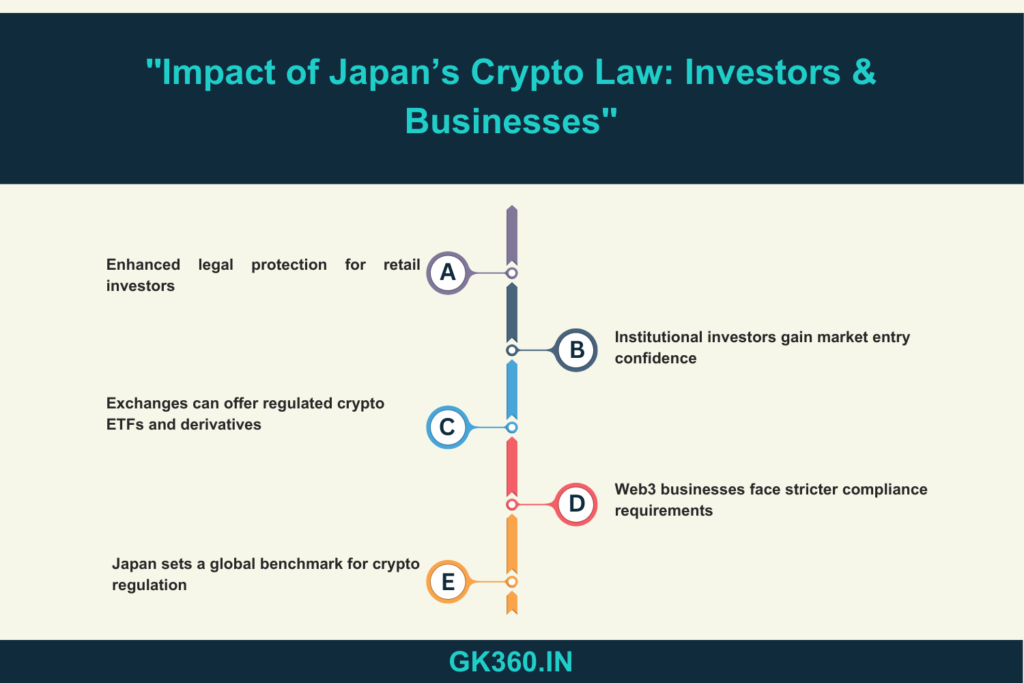

For Retail and Institutional Investors

With crypto assets officially recognized as financial products, investors in Japan stand to benefit from:

- Stronger legal protections against fraud, scams, and market manipulation.

- Access to new financial products such as cryptocurrency-based ETFs and structured investment funds.

- Increased credibility and trust in crypto markets, encouraging participation from risk-averse investors.

- Integration of crypto into mainstream portfolio diversification strategies.

The move is especially encouraging for institutional investors—including banks, pension funds, and asset managers—who typically require a well-regulated environment before entering new markets.

For Crypto Exchanges and Businesses

Crypto exchanges and Web3 companies will face both opportunities and new challenges:

Opportunities:

- Legitimacy under Japanese financial law may attract global partnerships and institutional funding.

- Ability to offer regulated crypto derivatives and investment vehicles.

Responsibilities:

- Compliance upgrades to meet stricter oversight (AML, KYC, reporting).

- Adoption of insider trading controls and employee monitoring systems.

- Potential increases in operational and legal costs.

While the compliance burden will rise, it will likely result in a more mature and stable ecosystem, paving the way for long-term growth.

How Japan’s Model Could Influence Global Regulation

Japan’s initiative may serve as a blueprint for responsible crypto regulation worldwide.

Global Ripple Effects May Include:

- Inspiration for other countries to formally classify crypto under existing financial laws (e.g., South Korea, Singapore, EU).

- More unified international standards, encouraging cross-border crypto investments.

- Greater adoption by financial institutions that had previously avoided the unregulated space.

As the first major economy to align crypto with traditional finance, Japan is positioning itself as a global leader in digital asset policy.

What Happens Next? Timeline to 2026

The legislative roadmap includes several key milestones:

-

2024–2025:

- Drafting of the amendment by the Financial Services Agency (FSA).

- Public consultations with crypto firms, legal experts, and consumer groups.

- Finalization of the bill based on stakeholder feedback.

-

2026:

- Submission to Japan’s National Diet (Parliament).

- Expected debate, revisions, and formal passage into law.

-

Post-2026 (Phased Implementation):

- Transitional period for existing crypto exchanges to become compliant.

- Development of industry guidance by the FSA and other regulatory bodies.

“Infographic showing how Japan’s 2026 crypto legislation benefits investors and businesses, while boosting global crypto regulatory influence.”

FAQ Section

What does it mean for crypto to be classified as a financial product in Japan?

It means cryptocurrencies like Bitcoin and Ethereum will be subject to the same legal treatment as stocks and bonds. This includes investor protections, insider trading rules, and regulated market participation.

When will Japan’s new crypto regulations come into effect?

The law is expected to be presented in 2026. Full implementation may take an additional 1–2 years following its passage.

How will insider trading rules apply to crypto?

Anyone trading crypto based on confidential or non-public information—such as exchange listings or policy changes—could face legal penalties under Japan’s revised insider trading laws.

Will new crypto investment products be allowed?

Yes. The reclassification may lead to the creation of crypto-based ETFs, derivatives, and other financial instruments within a regulated framework.

How does Japan’s move compare to other countries?

Japan is among the first to align crypto with traditional finance law. Other nations, like the EU (MiCA framework) and South Korea, are moving in similar directions but at varying paces.

Conclusion: Japan Leading the Charge in Legalizing Crypto Finance

Japan’s groundbreaking initiative to legally recognize cryptocurrencies as financial products represents a pivotal moment in the global evolution of digital asset regulation. By revising its Financial Instruments and Exchange Act, Japan is not only setting a national standard but also offering a scalable framework that other nations may look to emulate.

This bold step signifies Japan’s commitment to bridging the gap between traditional finance and decentralized innovation. It acknowledges the growing significance of cryptocurrencies in modern financial ecosystems while ensuring that this growth is accompanied by robust legal safeguards.

For investors, this means increased legitimacy, regulatory clarity, and market protections — all essential for mainstream adoption. For businesses and startups in the blockchain and crypto space, Japan’s regulatory clarity could lead to an influx of institutional capital, talent, and cross-border collaborations.

Moreover, by introducing insider trading laws, enhanced AML/KYC protocols, and mandatory disclosures, Japan is taking tangible steps to deter fraud, protect market participants, and elevate the transparency of the entire digital finance sector.

Key Takeaways Table

| Aspect | Details |

| Legal Classification | Crypto assets to be recognized as financial instruments (e.g., stocks, bonds). |

| Insider Trading Laws | Digital assets included under insider trading regulations for the first time. |

| Compliance Measures | Enhanced KYC, AML protocols, and mandatory disclosures introduced. |

| Investor Benefits | Improved legal protections, access to regulated crypto ETFs, and stronger market trust. |

| Business Implications | Web3 firms and exchanges to meet tighter compliance; gain legitimacy. |

| Global Influence | Japan’s model could serve as a regulatory blueprint for countries like South Korea and the EU. |

| Timeline | Drafting (2024–2025), legislation (2026), phased rollout post-2026. |