Income Tax Bill 2025: Key Reforms, Impact, and What Taxpayers Need to Know

Introduction

On February 13, 2025, Finance Minister Nirmala Sitharaman introduced the Income Tax Bill 2025 in the Lok Sabha during the Budget session. This bill aims to replace the Income Tax Act, 1961, bringing a simplified, modernized, and compliance-friendly tax framework for individuals and businesses.

Despite strong opposition, the bill was passed via voice vote and has now been referred to a Select Committee for further scrutiny before final implementation.

Table of Contents

- Legislative Process & Political Debate

- Objectives of the Income Tax Bill 2025

- Major Terminology Changes

- Structural Reforms in Taxation Laws

- Comparison with the Income Tax Act, 1961

- Impact on Different Stakeholders

- Challenges & Criticism

- FAQs on the Income Tax Bill 2025

- Conclusion & Future Outlook

Legislative Process & Political Debate

The Income Tax Bill 2025 was introduced in the Lok Sabha on February 13, 2025, as part of the Union Budget discussions.

📌 Key Legislative Developments:

- Strong opposition from political parties citing the need for further consultation.

- Passed in the Lok Sabha via a voice vote.

- The bill has been referred to a Select Committee for further scrutiny.

- The Lok Sabha was adjourned until March 10, 2025, marking the second phase of the Budget session.

Objectives of the Income Tax Bill 2025

The bill is designed to bring simplification, modernization, and improved tax compliance to India’s taxation system.

🎯 Key Goals:

- Simplification of Tax Laws: Removes legal jargon, making tax provisions easier to understand.

- Replacing Outdated Terminologies: Updates definitions to align with global taxation standards.

- Reducing Tax Litigation: Clearer provisions to minimize legal disputes.

- Modernizing Tax Frameworks: New principles ensuring better alignment with international tax systems.

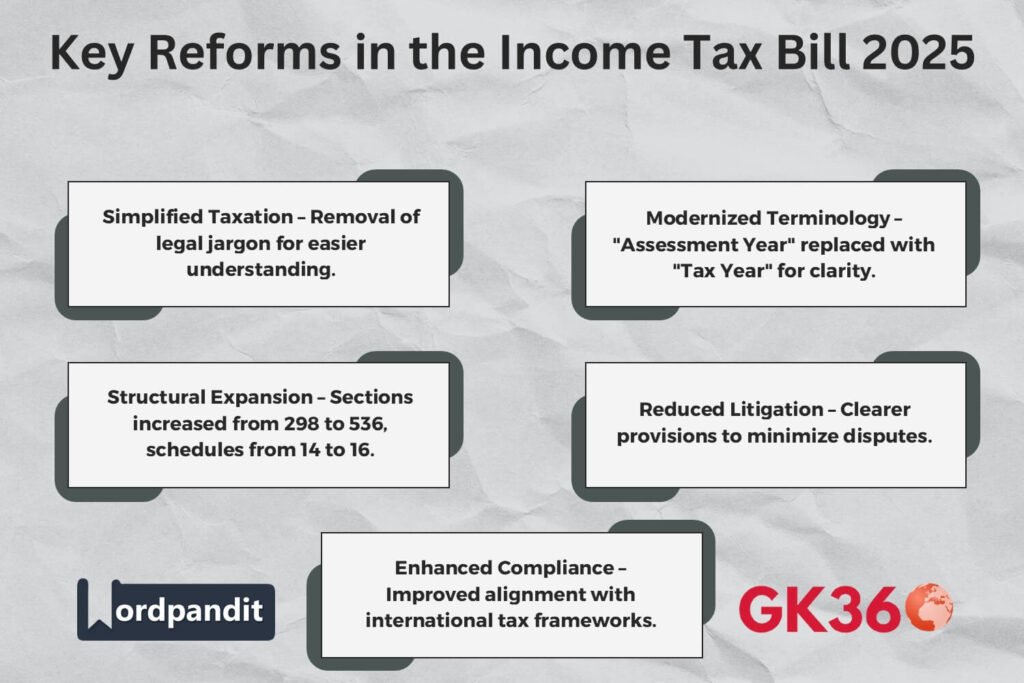

Major Terminology Changes

One of the key highlights of the Income Tax Bill 2025 is the simplification of tax-related terminology to make compliance easier for taxpayers.

🔄 Key Terminology Changes:

- From “Assessment Year” to “Tax Year”: Income will now be taxed in the same year it is earned.

- Updated Definitions: Certain terms have been aligned with international tax laws for better clarity.

📊 Before vs. After:

| Old System | New System |

|---|---|

| Income earned in Financial Year 2023-24 taxed in Assessment Year 2024-25. | Income earned in Tax Year 2025 will be taxed in the same year. |

This change removes confusion and simplifies tax filing for individuals and businesses.

Structural Reforms in Taxation Laws

The bill brings major structural changes, making tax provisions more comprehensive and user-friendly.

📌 Key Modifications:

- Increase in the number of sections: From 298 to 536 sections.

- Expansion of tax schedules: Increased from 14 to 16 schedules.

- Elimination of redundant clauses: Removing outdated provisions for better clarity.

These structural changes ensure that tax laws remain comprehensive, clear, and adaptable to India’s evolving economic landscape.

Comparison with the Income Tax Act, 1961

The Income Tax Bill 2025 introduces several key improvements over the Income Tax Act, 1961.

📊 Key Differences:

| Feature | Income Tax Act, 1961 | Income Tax Bill, 2025 |

|---|---|---|

| Terminology | Used complex legal jargon | Simplified & modernized language |

| Assessment System | Taxed income in the next year | Income taxed in the same year (Tax Year) |

| Sections & Schedules | 298 sections, 14 schedules | 536 sections, 16 schedules |

| Litigation | Frequent legal disputes | Clearer provisions to reduce disputes |

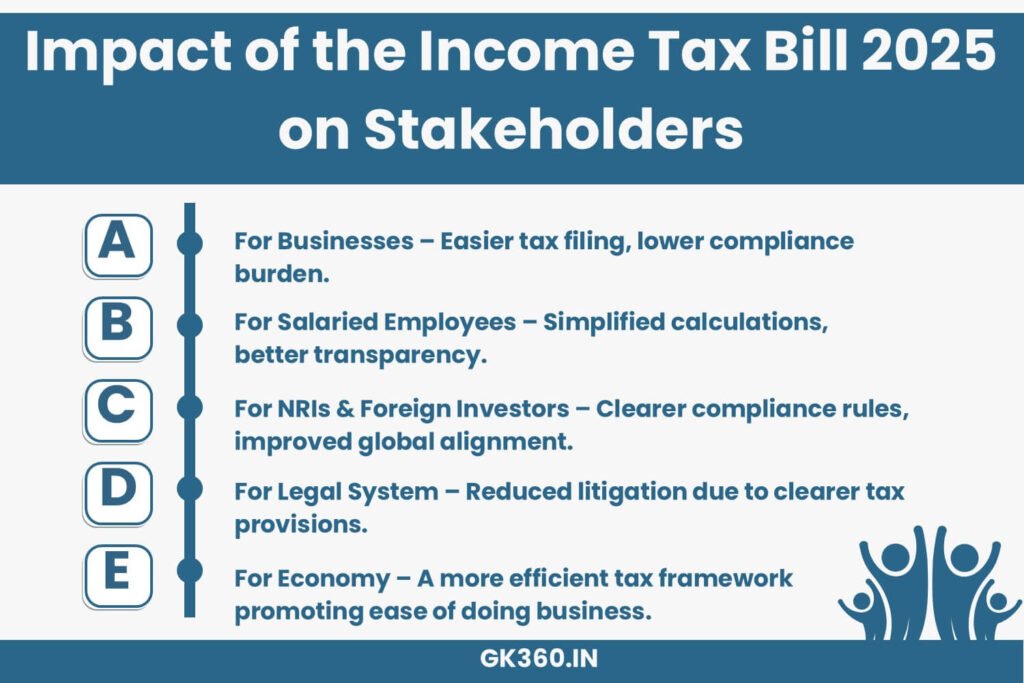

Impact on Different Stakeholders

The new tax bill is expected to simplify compliance for various groups, reducing confusion and increasing efficiency.

🏢 For Businesses & Startups:

- Simplified tax filing reduces compliance burden.

- Clarity in provisions minimizes litigation risk.

👩💼 For Salaried Employees:

- Easier tax calculations due to clear provisions.

- More transparency in deductions and exemptions.

🌏 For NRIs & Foreign Investors:

- More straightforward compliance rules for global investors.

- Improved alignment with international tax systems.

Challenges & Criticism

While the Income Tax Bill 2025 introduces significant improvements, it has also faced criticism from opposition parties, tax experts, and businesses.

⚠ Key Challenges:

- ❌ Lack of Consultation: Critics argue that the bill was introduced too quickly without adequate discussion with stakeholders.

- ❌ Ambiguity in Certain Provisions: Some sections need further clarification to prevent misinterpretation.

- ❌ Transition Period Issues: Businesses may struggle to adapt to the new tax structure, requiring additional time and resources.

Despite these concerns, the government maintains that the bill is a step towards tax reform and will be refined based on recommendations from the Select Committee.

FAQs on the Income Tax Bill 2025

1️⃣ How does the “Tax Year” change affect taxpayers?

The new system removes confusion by taxing income in the same year it is earned, rather than the following year.

2️⃣ Will tax rates change under this new bill?

No, the Income Tax Bill 2025 focuses on simplification and structural changes, not on modifying tax rates.

3️⃣ How will businesses adapt to these reforms?

Businesses will need to update their accounting systems and train personnel to comply with the new tax laws.

4️⃣ What happens to pending tax disputes under the old system?

Existing disputes will be resolved under the provisions of the Income Tax Act, 1961, unless specified otherwise.

5️⃣ When will the new tax bill come into effect?

Once approved by Parliament, the bill is expected to be implemented in the Financial Year 2025-26.

Conclusion & Future Outlook

The Income Tax Bill 2025 marks a major step in modernizing India’s tax system. By replacing the Income Tax Act, 1961, the bill aims to simplify tax provisions, introduce modern terminology, and enhance compliance mechanisms.

While the bill faces political resistance and concerns about implementation, its ultimate goal is to streamline taxation, reduce litigation, and improve efficiency. As it undergoes Select Committee review, further refinements may address stakeholder concerns.

Key Takeaways

| Aspect | Details |

|---|---|

| Introduction | Finance Minister Nirmala Sitharaman presented the bill in Lok Sabha on February 13, 2025. |

| Purpose | To replace the Income Tax Act, 1961 with a simplified and modern framework. |

| Key Terminology Change | “Assessment Year” replaced with “Tax Year” for clarity. |

| Structural Expansion | Sections increased from 298 to 536, schedules from 14 to 16. |

| Impact on Businesses | Easier tax filing, reduced compliance burden. |

| Challenges & Criticism | Lack of consultation, ambiguous provisions, transition issues. |

| Expected Implementation | Financial Year 2025-26 (after parliamentary approval). |

Related Terms:

- Income Tax Bill 2025

- Income Tax Reforms India

- New Tax Law India 2025

- Tax Year vs Assessment Year

- Simplified Taxation India

- Business Tax Compliance 2025

- Nirmala Sitharaman Budget 2025

- Impact of New Tax Bill

- Income Tax Act 1961 vs 2025

- Taxpayer Guide 2025