India’s Startup Crisis 2025: Gensol Fraud and BluSmart Collapse, and the End of Easy Money

Introduction

In 2025 It is Gensol Fraud and BluSmart Collapse and the End of Easy Money as India’s booming startup ecosystem was rocked by a scandal that exposed the cracks beneath its glossy surface. At the center of the storm was Gensol Engineering, a publicly listed renewable energy firm turned electric mobility player, whose founders allegedly diverted ₹262 crore in loans meant for EV purchases to fund luxury apartments and personal indulgences. The fallout was swift: SEBI stepped in, BluSmart — Gensol’s EV taxi startup — shut down overnight, and Gensol’s stock plummeted over 85%.

This incident is not isolated. It reflects a broader pattern of cash-burn-driven growth, inflated valuations, and weak governance across several of India’s most-hyped startups — from Byju’s and Paytm to Zepto. As the era of cheap capital fades and funding tightens, these examples serve as dire warnings: building businesses on vanity metrics and investor optimism is no substitute for sound fundamentals.

This in-depth report dissects the Gensol-BluSmart debacle, draws parallels with other high-profile collapses, and explains how the startup bubble in India is beginning to burst. It also offers insights into what lies ahead and how investors, regulators, and founders must respond.

Table of Contents

- Introduction

- The Gensol Fraud: Anatomy of a Scandal

- The Rise and Fall of BluSmart: A Startup Built on Sand

- The Startup Bubble: Easy Money and the Culture of Burn

- Case Studies of Collapse

- The Red Flags: Common Patterns Behind Startup Failures

- The Next Wave: What Happens When the Music Stops?

- How Investors and Founders Can Rebuild Trust

- FAQs About India’s Startup Collapse in 2025

- Conclusion: From Vanity Metrics to Value Creation

The Gensol Fraud: Anatomy of a Scandal

Gensol Engineering, a solar EPC company turned EV player, went public in 2019 and gained attention for its clean-energy credentials. But in early 2025, SEBI dropped a bombshell: the company’s promoters, Anmol and Puneet Singh Jaggi, siphoned off ₹262 crore in loans — originally intended to buy 1,700 electric vehicles — for personal luxuries, including a ₹50 crore luxury apartment and golf equipment.

These were not simple financial irregularities. SEBI labeled them as “egregious misuse of funds” through complex related-party transactions. The regulatory crackdown was immediate and severe:

- The Jaggi brothers were barred from securities markets and all directorial roles.

- Gensol’s stock entered a freefall, losing over 85% of its value in just six months.

- Investors were left blindsided.

- BluSmart, Gensol’s EV ride-hailing offshoot, ground to a complete halt overnight.

An independent director even resigned after his repeated inquiries into Gensol’s mounting debt were ignored. He revealed in a letter that he was pressured to stay until the IPO of a Gensol affiliate — a now-defunct plan.

This collapse is not just about one company — it exposed the dangerous dependency of startups on manipulated capital pipelines and opaque governance.

The Rise and Fall of BluSmart: A Startup Built on Sand

BluSmart was billed as India’s answer to Uber and Ola, but with a twist: a fully electric taxi fleet. It attracted eco-conscious consumers and media attention, rapidly expanding in metro cities. But the fairy tale unraveled when it became clear that BluSmart’s growth was fueled by Gensol’s diverted loans.

After SEBI’s intervention, BluSmart abruptly suspended ride bookings in Delhi, Mumbai, and Bengaluru, even prompting airport advisories. Without Gensol’s backing, the company couldn’t survive a single day. The ride-hailing service’s collapse wasn’t gradual — it was instant and total.

This dramatic shutdown highlights the fragility of startups propped up by financial smoke and mirrors, and how regulatory failure can have immediate, real-world consequences for users and the public.

The Startup Bubble: Easy Money and the Culture of Burn

The Gensol-BluSmart story is just one flashpoint in a larger pattern of startup excess fueled by an era of easy money. Between 2020–2022, venture capitalists were pouring billions into Indian startups, often prioritizing user growth and market share over profitability.

Here’s what that looked like:

- Cash burn became a business model, not a red flag.

- Startups offered services below cost to undercut rivals.

- Investors encouraged “growth at any cost”, as long as valuation rose.

But when the global economic landscape changed — with inflation rising and interest rates climbing — the party ended. Funding into Indian startups dropped over 50% in 2023, and unicorn creation dried up.

Startups like Zepto, Paytm, and Byju’s, which had never reached profitability, suddenly found themselves scrambling for capital and facing reality.

Case Studies of Collapse

Byju’s: From $22B EdTech Darling to Distressed Debtor

Once valued at $22 billion, Byju’s was India’s biggest edtech success — until it became the country’s most dramatic cautionary tale. Funded by global giants like Sequoia and Tiger Global, the company aggressively expanded by acquiring smaller firms and borrowing $1.2 billion via U.S. lenders.

But behind the scenes:

- Revenue couldn’t match ballooning costs.

- A chunk of loan funds (over $500M) was suspiciously moved to a Miami-based hedge fund with ties to a pancake restaurant — prompting fraud allegations.

- Audited financials were repeatedly delayed.

- By 2024, its valuation had collapsed to ~$1 billion.

Byju’s downfall exposed how debt-fueled expansion and opaque accounting can destroy even the most hyped startups.

Paytm: Regulatory Backlash and Stock Market Reality

Paytm’s IPO in 2021 was India’s largest — and most disappointing. Despite being a household name in digital payments, Paytm’s unclear path to profitability and overdependence on subsidies led to a 70% stock plunge shortly after listing.

Key issues:

- RBI barred its Payments Bank from onboarding new users in 2024.

- SEBI flagged promoter misclassification, raising governance red flags.

- Enforcement Directorate investigated potential forex violations.

Although the company recovered somewhat by partnering with third-party banks, the damage was done. Valuation didn’t equate to business resilience.

Zepto: Blitzscaling Without a Brake

In the quick commerce race, Zepto sprinted ahead — but with its pockets on fire. Promising 10-minute grocery delivery, Zepto’s cash burn exploded from ₹40 crore/month to ₹300 crore/month by late 2024.

This ultra-fast expansion:

- Required heavy VC infusions.

- Prioritized user acquisition over sustainability.

- Delivered ultra-low-margin products at breakneck speed.

Though it raised ₹2,500 crore and became a unicorn, Zepto has yet to prove unit economics work at scale. If funding dries up, its business model may not survive.

The Red Flags: Common Patterns Behind Startup Failures

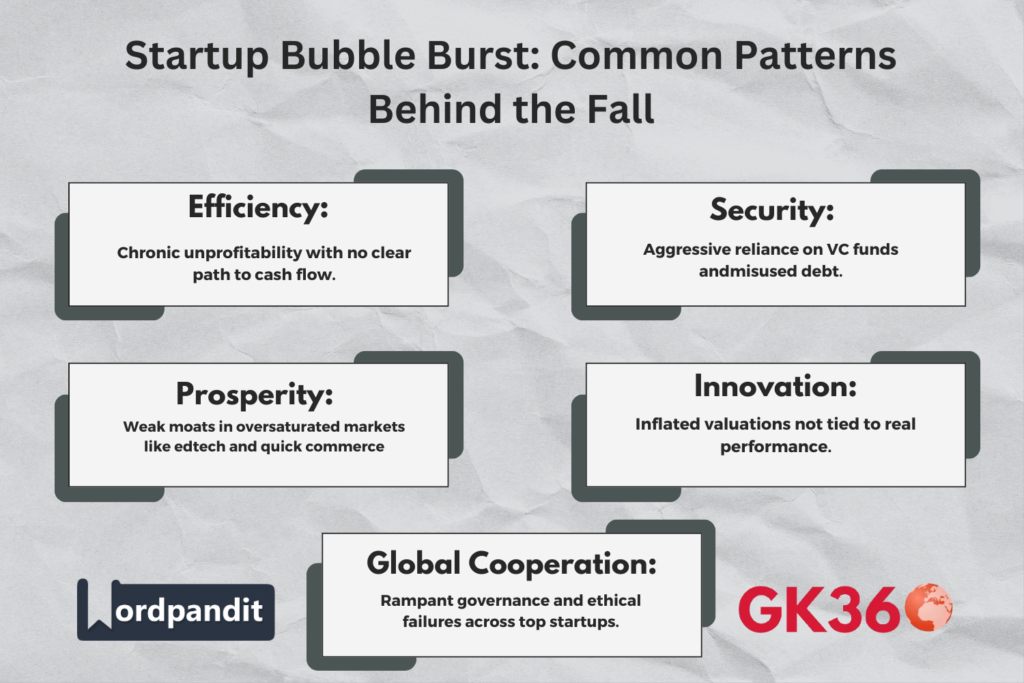

Several recurring issues tie together these cautionary tales:

- Chronic Unprofitability

Many startups postponed profitability indefinitely — assuming future scale would solve it. But without strong unit economics, growth became a liability when funding dried up. - Debt and VC Dependence

Companies like Gensol and Byju’s used loans for aggressive growth — sometimes even misusing or hiding debt — creating financial time bombs. - Weak Competitive Moats

Ride-hailing, quick commerce, and edtech have low entry barriers. Success often relied on outsized funding, not innovation — a race to burn, not to build. - Inflated Valuations

Startups raised capital at sky-high valuations with little link to revenues. The valuation bubble eventually burst, wiping out billions in paper wealth. - Ethical and Governance Failures

From Gensol’s fund diversion to Byju’s offshore transfers and Paytm’s regulatory skirting — governance lapses have become disturbingly common, eroding investor trust.

The Next Wave: What Happens When the Music Stops?

The funding winter of 2022–2024 was just the beginning. With rising interest rates and a looming recession, startups that relied on continual cash infusions now face:

- Down rounds and valuation cuts

- Mass layoffs (30,000+ in India in 2023 alone)

- Consolidation or acquisition by stronger players

- In extreme cases, defaults and bankruptcies

Regulators are also stepping up: SEBI’s crackdown on Gensol, RBI’s restrictions on Paytm, and ED’s probes into forex misuse reflect this new era of vigilance.

Yet, this shakeout may bring long-term gains: a more mature, responsible, and investor-aligned startup ecosystem.

How Investors and Founders Can Rebuild Trust

To prevent future fiascos, all ecosystem players must evolve:

For Founders:

- Prioritize transparency and governance.

- Focus on profitability and cash flow, not vanity metrics.

- Avoid debt-fueled growth unless backed by predictable returns.

For Investors:

- Demand unit economics clarity before writing checks.

- Push for audited, timely financials and oversight boards.

- Support slower, sustainable scaling.

For Regulators:

- Strengthen startup disclosure norms.

- Monitor loan utilization in public or heavily-funded startups.

- Proactively investigate early red flags.

FAQs About India’s Startup Collapse in 2025

1. What caused the Gensol scandal?

Gensol’s promoters diverted ₹262 crore in EV purchase loans for personal use, including real estate and luxury items, triggering SEBI’s intervention.

2. Why did BluSmart shut down overnight?

BluSmart relied heavily on Gensol’s funds. Once that financial support vanished, the EV taxi platform could no longer sustain operations.

3. What is meant by “cash burn culture” in startups?

It refers to spending more than the business earns to drive rapid growth — a common tactic that can backfire without sustainable revenue.

4. Why are Indian startups facing a funding crunch?

Global economic conditions, rising interest rates, and poor performance by past unicorns have made investors more cautious.

5. What lessons should founders learn from 2025’s collapses?

Build sustainable models, maintain ethical standards, and focus on long-term value over short-term hype or inflated valuations.

Conclusion: From Vanity Metrics to Value Creation

The Gensol-BluSmart implosion is not a one-off scandal — it’s a symptom of deeper dysfunctions in India’s startup ecosystem. Fueled by easy capital, many startups chased growth without guardrails, prioritizing scale over sustainability, and valuation over values.

As the market sobers up, it’s clear: the startups that survive will be those that build real businesses, with solid unit economics, transparent governance, and long-term vision. This is the beginning of a much-needed correction — painful, but ultimately healthy.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Gensol Scandal | Promoters diverted ₹262 crore, causing regulatory action and market crash. |

| BluSmart Shutdown | Heavily dependent on Gensol; operations ceased instantly after scandal. |

| Culture of Burn | Startups grew via unsustainable cash burn and undervalued services. |

| Case Study – Byju’s | Valuation collapsed from $22B to $1B due to debt misuse and lack of profits. |

| Case Study – Paytm | Faced regulatory heat; stock dropped 70% post-IPO due to governance lapses. |

| Case Study – Zepto | Blitzscaled but burned ₹300 crore/month without proving sustainable economics. |

| Investor & Founder Lessons | Emphasize transparency, governance, and profitability over vanity metrics. |