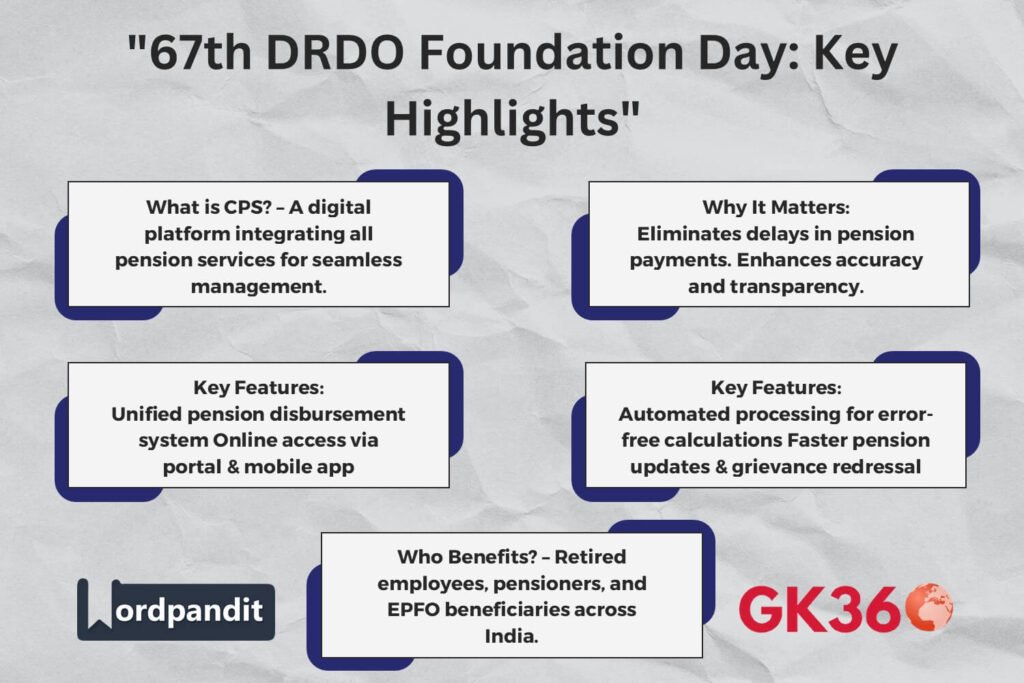

EPFO’s Centralized Pension System (CPS): A Digital Transformation in Pension Management

Introduction to EPFO’s Centralized Pension System

The Employees’ Provident Fund Organisation (EPFO) has launched the Centralized Pension System (CPS) to enhance pension services for millions of retirees across India. This initiative is part of EPFO’s commitment to leveraging technology for streamlining pension disbursement, improving efficiency, and addressing challenges faced by pensioners.

The CPS replaces the earlier fragmented system with a unified digital platform, ensuring timely pension payments and enhanced user accessibility.

Table of Contents

- Introduction to EPFO’s Centralized Pension System

- Key Features of CPS

- How CPS Benefits Pensioners

- Impact on India’s Pension Ecosystem

- Challenges & Future Developments

- FAQs on EPFO’s Centralized Pension System

- Conclusion: The Future of Digital Pension Management

Key Features of CPS

1. Unified Pension Disbursement

- CPS consolidates all pension-related activities onto a central platform.

- Eliminates discrepancies caused by decentralized operations.

2. Real-Time Processing

- Pensioners receive instant updates on transactions, ensuring transparency.

- Reduces delays in payments and enhances accountability.

3. Enhanced Accuracy

- Automation minimizes manual errors in calculations and data entry.

- Ensures precise pension disbursement every month.

4. Efficient Grievance Redressal

- Pensioners can raise concerns through a dedicated online grievance system.

- Timely resolutions improve service satisfaction.

5. Ease of Access for Pensioners

- Pensioners can access their accounts via an online portal or mobile app.

- A user-friendly interface caters to all age groups, including the digitally unfamiliar.

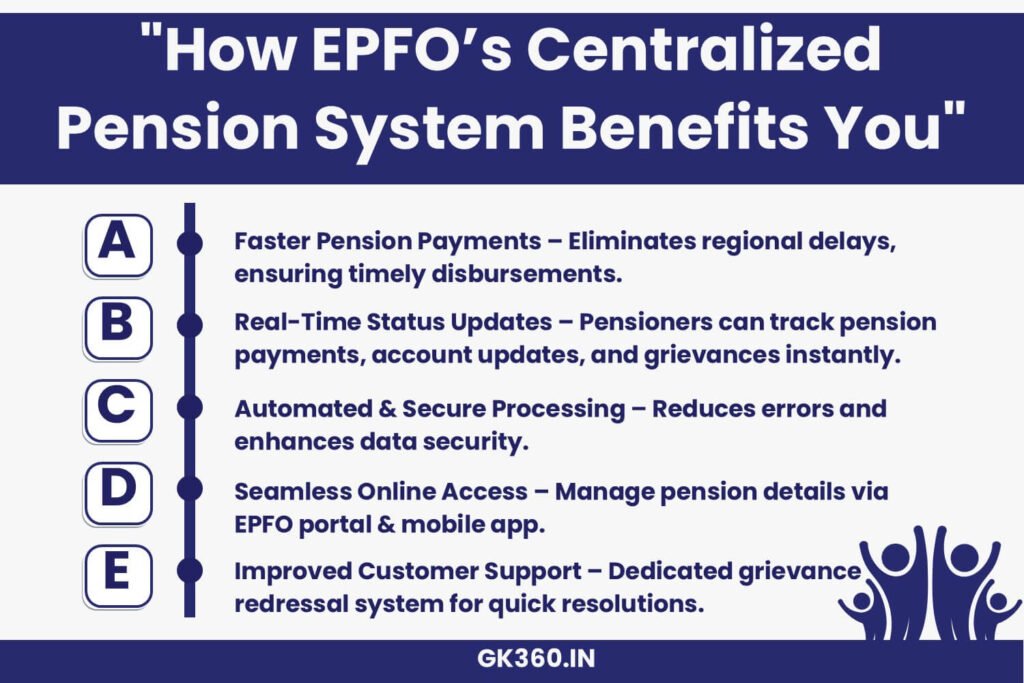

How CPS Benefits Pensioners

The transition to a centralized system resolves many of the longstanding issues faced by pensioners, offering:

- Faster Disbursements: Eliminates regional processing delays, ensuring timely payments.

- Streamlined Communication: Direct interaction with EPFO without intermediaries.

- Transparency: Real-time tracking of pension status and payments.

- Simplified Updates: Easy updates of personal details or pension accounts.

Impact on India’s Pension Ecosystem

The CPS is poised to redefine India’s pension landscape by:

- Enhancing pension service delivery for millions of retirees.

- Preparing EPFO to manage the growing number of pensioners efficiently.

- Aligning with Digital India, promoting e-governance and financial inclusion.

- Bridging accessibility gaps, particularly for pensioners in remote areas.

Challenges & Future Developments

Challenges:

- Digital Adaptation: Senior pensioners unfamiliar with technology may face initial difficulties.

- Cybersecurity Risks: As pension data becomes centralized, robust measures must protect against breaches.

Future Developments:

- AI & Predictive Analytics: Potential integration for fraud detection and personalized pensioner support.

- Multi-Language Support: Enhancing accessibility for pensioners across diverse linguistic backgrounds.

- Improved Customer Support: More interactive tools to assist pensioners in real-time.

FAQs on EPFO’s Centralized Pension System

1. What is the Centralized Pension System (CPS)?

The CPS is a digital initiative by EPFO that integrates all pension-related services into a unified online platform for seamless pension management.

2. How does CPS improve pension disbursement?

It eliminates regional processing delays, ensures real-time updates, and minimizes errors through automation.

3. Can pensioners access their accounts online?

Yes, pensioners can manage their pension details via EPFO’s online portal or mobile application.

4. What if a pensioner faces an issue with their pension payment?

The CPS includes a dedicated grievance redressal system where pensioners can lodge complaints and receive timely resolutions.

5. Is the CPS secure?

EPFO has implemented robust cybersecurity measures to protect pensioners’ sensitive information from breaches.

Conclusion: The Future of Digital Pension Management

The launch of EPFO’s Centralized Pension System is a significant milestone in modernizing pension management in India. By addressing inefficiencies and prioritizing pensioners’ needs, CPS fosters trust and ensures financial security for retirees.

As the system evolves with enhanced features and AI-driven improvements, it sets a benchmark for digital transformation in governance, paving the way for a more inclusive and transparent pension ecosystem.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Policy Name | Centralized Pension System (CPS) |

| Developed By | Employees’ Provident Fund Organisation (EPFO), India |

| Purpose | Digital transformation of pension disbursement & management |

| Key Features | Real-time processing, Unified platform, Online grievance redressal, Digital security |

| Who Benefits? | Retirees, pensioners, and EPFO beneficiaries |

| How It Works | Centralized pension database, automated payments, instant status tracking |

| Impact | Reduces delays, improves security, enhances ease of access |

| Challenges | Digital adaptation for senior citizens, cybersecurity measures |

| Future Prospects | AI-based fraud detection, expanded multi-language support, enhanced service features |

Related terms

- EPFO Centralized Pension System India

- Digital Pension Management by EPFO

- CPS EPFO Pensioner Benefits 2025

- India’s Pension System Modernization

- Online Pension Grievance Redressal EPFO

- Secure Pension Disbursement in India

- EPFO CPS Portal Login and Features

- Digital India Initiative in Pension Sector

- AI-Based Pension Processing EPFO

- EPFO Retirement Pension Reforms