EPF Interest Rate 2024–25 Retained at 8.25%: What It Means for You

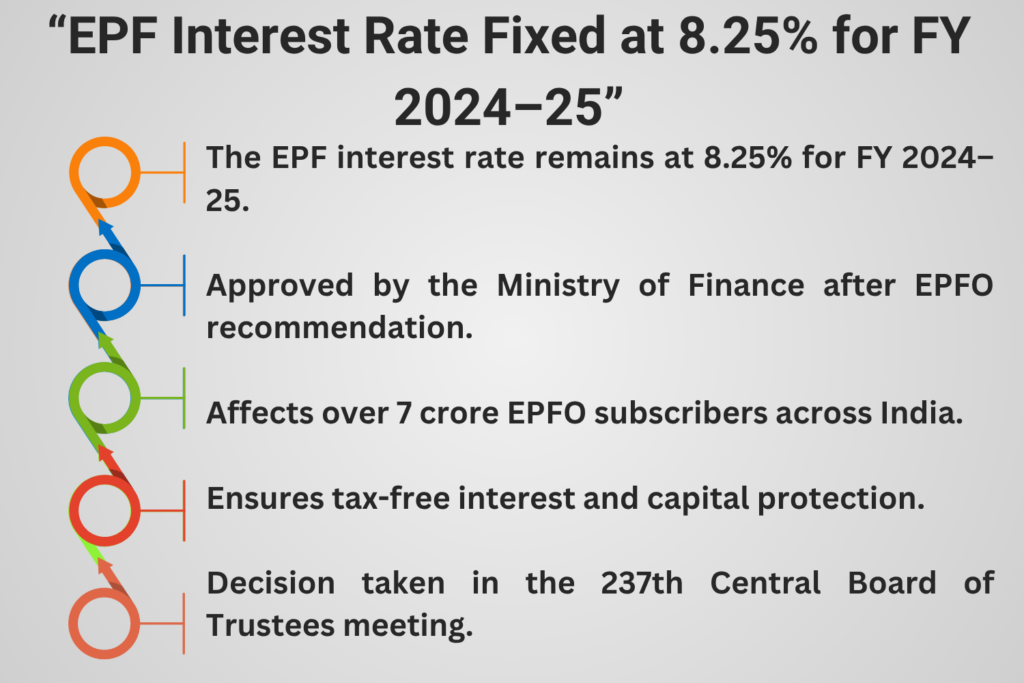

The Indian government has officially retained the Employees’ Provident Fund (EPF) interest rate at 8.25% for the financial year 2024–25, offering continued stability for millions of salaried individuals. This decision, backed by the Central Board of Trustees (CBT) and ratified by the Ministry of Finance, reinforces the EPF’s status as one of the most reliable long-term savings instruments in India. Amid fluctuating returns from market-linked schemes, this move ensures predictability and tax-free growth for over 7 crore EPFO subscribers.

Table of Contents

- EPF Interest Rate 2025: Latest Update

- Background: What is EPF and EPFO?

- Decision Timeline: CBT Meeting & Government Approval

- Historical Interest Rate Trends (FY2020–2025)

- Impact on 7 Crore EPF Subscribers

- EPF vs Other Retirement Options (PPF, NPS, FD)

- EPF Interest Calculation: How It Works

- Frequently Asked Questions (FAQs)

- Suggested Internal & External Links

- Conclusion: EPF Remains a Reliable Wealth-Builder

- Key Takeaways Table

EPF Interest Rate 2025: Latest Update

On May 26, 2025, the Ministry of Finance confirmed that the EPF interest rate for FY2024–25 will remain at 8.25%. This follows the 237th meeting of the Central Board of Trustees (CBT), chaired by Union Labour Minister Mansukh Mandaviya, held earlier this year. The recommendation was initially proposed in February 2024 and was formally approved to ensure consistency in retirement earnings for salaried employees.

- Interest Rate: 8.25%

- Applies To: Over 7 crore EPF account holders

- Approved By: Ministry of Finance, Government of India

Background: What is EPF and EPFO?

The Employees’ Provident Fund (EPF) is a government-mandated retirement savings scheme for salaried workers in India. It is regulated by the Employees’ Provident Fund Organisation (EPFO), under the Ministry of Labour & Employment.

Key Features of EPF:

- Both employee and employer contribute 12% of basic salary and dearness allowance.

- Interest is compounded annually and remains tax-free under Section 80C.

- EPF is seen as a low-risk, government-backed retirement instrument.

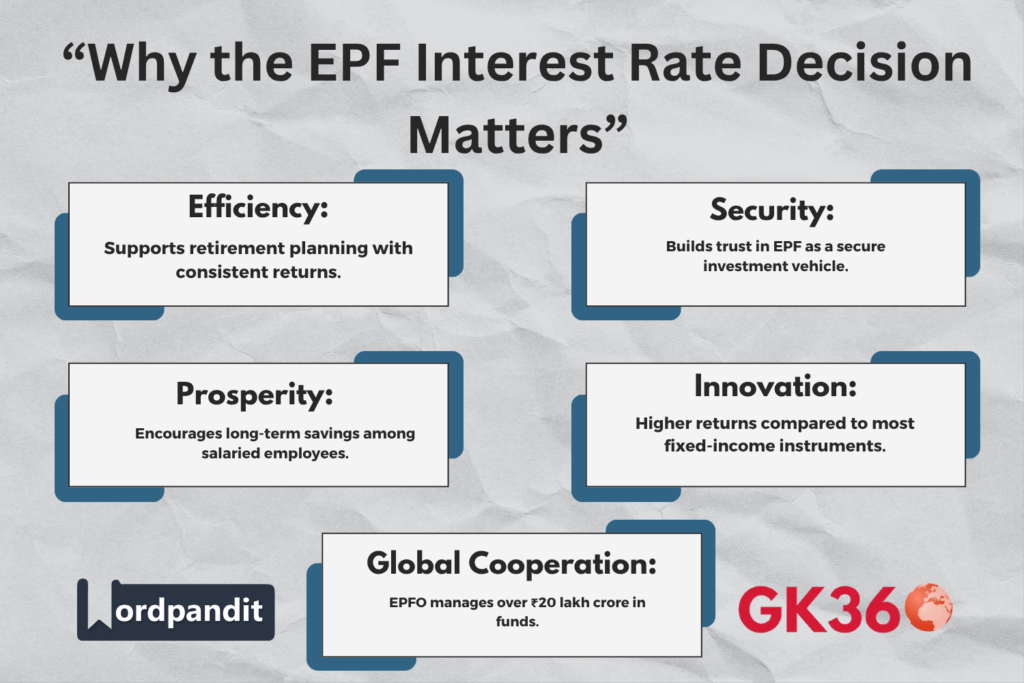

The EPFO currently manages a corpus exceeding ₹20 lakh crore, making it one of the largest social security organizations globally.

Decision Timeline: CBT Meeting & Government Approval

- February 2024: EPFO’s Central Board of Trustees recommended retaining the 8.25% interest rate.

- May 2025: Ministry of Finance granted its official approval.

- 237th CBT Meeting: Presided by Labour Minister Mansukh Mandaviya, the board emphasized maintaining investor trust and offering stable returns in a volatile economic environment.

Historical Interest Rate Trends (FY2020–2025)

| Financial Year | Interest Rate (%) |

|---|---|

| 2024–25 | 8.25 |

| 2023–24 | 8.25 |

| 2022–23 | 8.15 |

| 2021–22 | 8.10 |

| 2020–21 | 8.50 |

Compared to Fixed Deposits (FDs) and Public Provident Fund (PPF), EPF offers one of the highest tax-free interest returns backed by government guarantees.

Impact on 7 Crore EPF Subscribers

The retained rate benefits:

- Salaried employees in the private and public sector

- Long-term investors relying on EPF for post-retirement income

- Tax planners who use EPF as part of their Section 80C savings

Significance of the Move:

- Ensures capital safety and predictable returns

- Supports financial inclusion by securing retirement funds

- Strengthens confidence in government social security schemes

EPF vs Other Retirement Options (PPF, NPS, FD)

Choosing the right retirement plan involves understanding the differences in return, risk, and tax treatment. Here’s how EPF compares to other popular long-term saving options:

| Feature | EPF (2024–25) | PPF | NPS | Fixed Deposits (FD) |

|---|---|---|---|---|

| Interest Rate | 8.25% | ~7.1% | Market-linked (~9–12%) | ~6–7.5% (taxable) |

| Tax Benefit (Sec 80C) | ✅ Up to ₹1.5 lakh | ✅ Up to ₹1.5 lakh | ✅ Up to ₹50k extra under 80CCD(1B) | ✅ Up to ₹1.5 lakh |

| Tax on Maturity | Tax-Free | Tax-Free | Partially taxable | Fully Taxable |

| Risk Profile | Low | Low | Moderate to High | Low to Moderate |

| Lock-in Period | Till Retirement | 15 Years | Till Age 60 | 1–5 Years or more |

Verdict: EPF remains one of the safest and most tax-efficient options for salaried individuals in 2025.

EPF Interest Calculation: How It Works

To help visualize the benefit of the 8.25% interest rate, here’s a simplified example:

Example:

- Basic Salary + DA: ₹30,000/month

- Employee + Employer Contribution (24%): ₹7,200/month

- Annual Contribution: ₹86,400

- Interest Earned in Year 1 @ 8.25%: ≈ ₹3,558

- Total EPF Balance at Year-End: ≈ ₹89,958

(Assuming no withdrawals and basic monthly interest compounding)

As the corpus grows with monthly contributions and compounding interest, the returns over 20–30 years become substantial—especially since it’s completely tax-free.

Frequently Asked Questions (FAQs)

- What is the EPF interest rate for FY2024–25?

The government has retained the EPF interest rate at 8.25% for 2024–25. - Who decides the EPF interest rate in India?

The Central Board of Trustees (CBT) of the EPFO recommends the rate, which is then approved by the Ministry of Finance. - Is the EPF interest taxable in 2025?

No, EPF interest remains tax-free if your annual employee contribution is within ₹2.5 lakh. - How does EPF compare to PPF and NPS?

EPF offers higher interest and full tax exemption, making it a preferred option for salaried individuals, while NPS has better flexibility for high returns but partial taxability. - Can I withdraw EPF before retirement?

Yes, partial withdrawal is allowed under certain conditions like medical emergencies, home purchase, or unemployment. However, premature full withdrawal may have tax implications.

Suggested Internal & External Links

Internal Articles:

- How to Check Your EPF Balance Online

- Understanding Section 80C Deductions

Authoritative External Links:

- EPFO Official Portal

- Ministry of Labour & Employment

- Income Tax Rules on EPF

Conclusion: EPF Remains a Reliable Wealth-Builder

The government’s decision to retain the 8.25% EPF interest rate for FY2024–25 reflects a commitment to financial stability and retirement security. In an era of uncertain market returns, EPF continues to offer guaranteed, tax-free growth, making it an essential part of every salaried professional’s financial strategy.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Interest Rate FY25 | Retained at 8.25% for 2024–25 |

| Approval Authority | Ministry of Finance based on EPFO recommendation |

| Meeting Reference | 237th Central Board of Trustees meeting chaired by Union Labour Minister |

| Previous Year Rates | 8.25% (FY2023–24), 8.15% (FY2022–23) |

| Beneficiaries | Over 7 crore EPFO subscribers |

| Objective | Ensure post-retirement fund growth and investor confidence |

| Significance | High returns, capital protection, and social security |