CRED Money: The Ultimate Fintech Dashboard for Smart Financial Management

Introduction

CRED, the innovative fintech platform, has unveiled CRED Money, a cutting-edge money management dashboard designed to transform how affluent users oversee their finances. This powerful, unified platform integrates various financial sources to provide a comprehensive, real-time overview of an individual’s financial health. With seamless data aggregation and user-friendly features, CRED Money aims to be the go-to financial management tool for high-net-worth individuals.

Table of Contents

- What is CRED Money?

- Key Features & Benefits

- Built on the Account Aggregator Framework

- Understanding Account Aggregators

- How CRED Money Empowers Users

- About CRED

- FAQs

- Conclusion & Call-to-Action

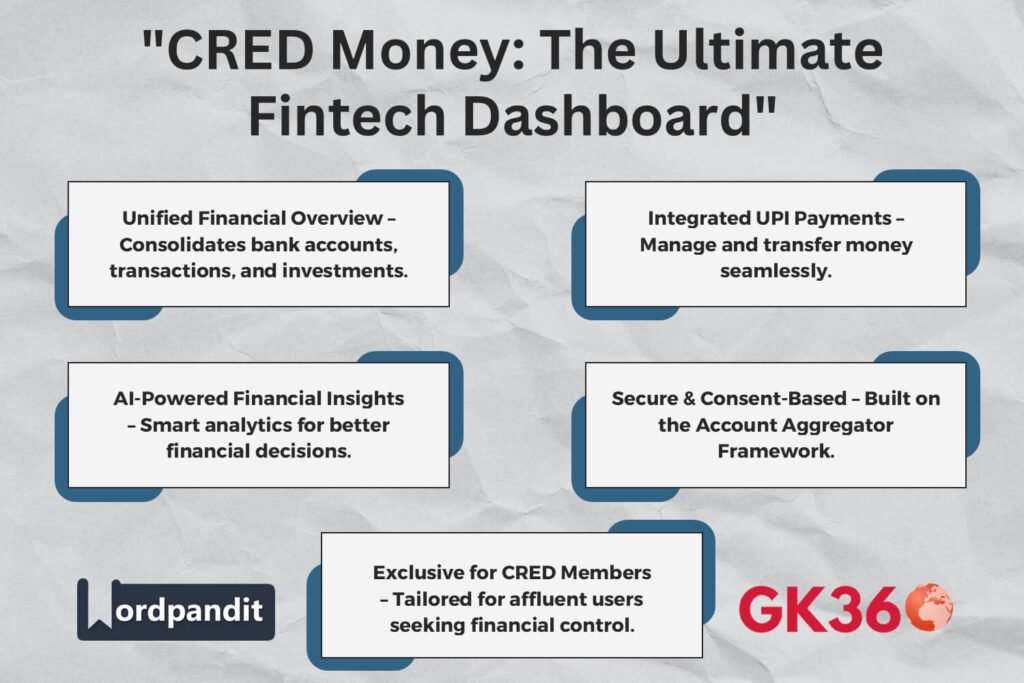

What is CRED Money?

CRED Money is a comprehensive financial management platform that consolidates data from multiple sources into one intuitive dashboard. By aggregating financial information from bank accounts, transactions, demat accounts, bill payments, and more, it offers users a holistic and real-time snapshot of their financial standing.

Key Features & Benefits

1. Financial Data Aggregation

- Tracks financial transactions across multiple bank accounts.

- Provides insights into spending patterns and financial habits.

- Centralizes data from subscriptions, insurance premiums, and dividends.

2. Integrated UPI Payments

- Built-in UPI functionality allows seamless payments.

- Users can transfer funds directly within the platform.

3. Secure, Consent-Based Data Management

- Users have complete control over data-sharing permissions.

- Built on the Account Aggregator Framework for encrypted transactions.

4. Personalized Financial Insights

- AI-powered analysis offers recommendations for better financial planning.

- Helps users optimize expenses, investments, and savings strategies.

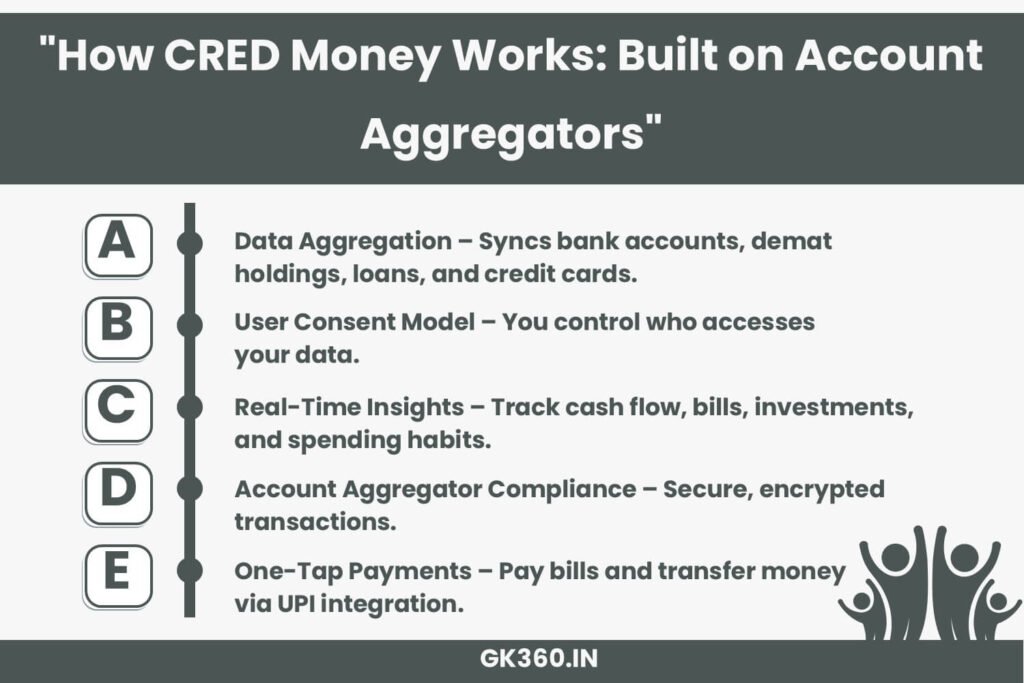

Built on the Account Aggregator Framework

CRED Money leverages India’s Account Aggregator (AA) framework, a secure system that allows users to consolidate and share financial data only with authorized financial institutions. This framework ensures:

- Encrypted data sharing to protect user privacy.

- Regulatory compliance and transparency.

- Seamless integration with banks, investment platforms, and lenders.

Understanding Account Aggregators

Account Aggregators (AAs) act as intermediaries between Financial Information Providers (FIPs) (banks, investment firms) and Financial Information Users (FIUs) (such as lending institutions). CRED, classified as an FIU, uses the AA network to provide users with tailored financial insights and services.

How CRED Money Empowers Users

Scenario 1: A Business Professional’s Overview

A high-income executive can track salary credits, investments, tax refunds, and spending habits in one place, allowing for better financial planning.

Scenario 2: A Frequent Investor’s Portfolio Management

Investors can sync demat accounts, track dividends, and analyze portfolio performance without logging into multiple platforms.

About CRED

- Founded: 2018

- Headquarters: Bangalore, Karnataka, India

- CEO: Kunal Shah

CRED has revolutionized financial management by offering rewards-driven credit card bill payments, lending services, and now, an all-in-one money management dashboard. With CRED Money, the platform continues its mission to enhance financial control and transparency for its elite user base.

FAQs

What is CRED Money and how does it work?

CRED Money is a money management platform that consolidates your financial data from various sources into a single, intuitive dashboard.

Is CRED Money secure?

Yes, it uses the Account Aggregator Framework, ensuring encrypted and consent-based data sharing for maximum security.

Can I make payments using CRED Money?

Absolutely! It comes with built-in UPI functionality to manage and transfer money effortlessly.

How do Account Aggregators benefit users?

They enable users to securely share financial data with authorized institutions, allowing for better financial insights and services.

How do I enable CRED Money?

You can activate it via the CRED app, granting permissions for financial data aggregation through the Account Aggregator system.

Conclusion & Call-to-Action

CRED Money is poised to redefine financial management for affluent users, offering a unified, secure, and insight-driven experience. By integrating financial aggregation, UPI payments, and AI-driven insights, CRED is setting new benchmarks in fintech innovation.

For those seeking complete control over their finances, CRED Money presents an advanced, effortless solution. Activate it today via the CRED app and experience the future of financial management.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Platform Name | CRED Money |

| Purpose | Unified financial management dashboard |

| Key Features | Financial aggregation, UPI payments, AI-driven insights |

| Security Framework | Account Aggregator (AA) compliance |

| Target Audience | Affluent users and high-net-worth individuals |

| Launch Partner | CRED, led by CEO Kunal Shah |

| How to Access | Available within the CRED App |

Related terms

- CRED Money Fintech Dashboard

- Account Aggregator Framework India

- CRED App UPI Payments

- Best Money Management Apps 2025

- AI-Driven Financial Insights

- CRED Money Secure Data Sharing

- Fintech Innovations in India

- Smart Budgeting Tools for High Earners

- CRED Money vs Traditional Banking Apps

- Unified Finance Tracking with CRED