Bima-ASBA: How Bajaj Allianz is Revolutionizing Insurance Payments in India

Introduction

Bajaj Allianz Life Insurance has introduced Bima-ASBA (Application Supported by Blocked Amount), an innovative payment method that enhances transparency, security, and convenience for policyholders. With this launch, Bajaj Allianz becomes the first insurance company in India to implement this system, aligning with IRDAI’s digital payment vision.

What makes Bima-ASBA unique? It allows policyholders to block a predetermined premium amount in their bank account instead of making an upfront payment. This ensures financial security, reduces refund delays, and gives customers better control over their funds.

As the Indian insurance sector undergoes rapid digitization, Bima-ASBA sets a new benchmark for secure, seamless premium transactions. In this article, we’ll explore how Bima-ASBA works, its benefits, and its potential impact on the insurance industry.

Table of Contents

- What is Bima-ASBA?

- How Does Bima-ASBA Work?

- Key Features & Benefits for Policyholders

- Why is Bima-ASBA a Game-Changer in Insurance?

- Impact on the Indian Insurance Industry

- Comparison: Bima-ASBA vs. Traditional Payment Methods

- FAQs on Bima-ASBA

- Conclusion: The Future of Insurance Payments in India

What is Bima-ASBA?

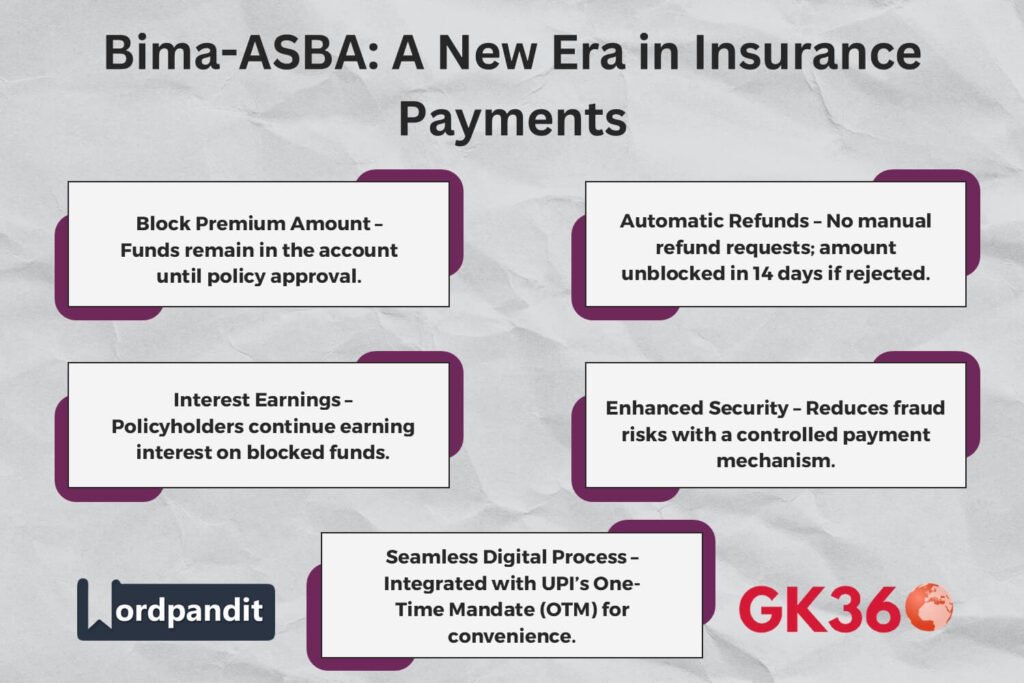

Bima-ASBA is a digital-first insurance premium payment system launched on February 22, 2025. It allows policyholders to block up to ₹2 lakh in their bank account to cover their premium payments. Unlike traditional methods where payments are deducted immediately, Bima-ASBA keeps the amount in the policyholder’s account until the insurer approves the policy.

If the policy is accepted, the premium amount is debited automatically. If rejected or unprocessed within 14 days, the blocked amount is automatically released back to the policyholder—eliminating the hassle of refund requests.

How Does Bima-ASBA Work?

Bima-ASBA integrates UPI’s One-Time Mandate (OTM) feature for secure and seamless transactions. Here’s how the process works:

- Policy Selection: The customer chooses an insurance policy from an insurer offering the Bima-ASBA facility.

- Blocking of Funds: Instead of transferring the money immediately, the policyholder authorizes blocking of the premium amount (up to ₹2 lakh) in their bank account.

- Underwriting Process: The insurer reviews the application and decides whether to approve or reject the policy.

- Policy Approval: If the policy is approved, the blocked amount is debited, and the policy is issued.

- Policy Rejection or Delayed Processing: If the policy is rejected or not processed within 14 days, the blocked amount is automatically released back to the policyholder without manual refund requests.

This system ensures a secure, efficient, and transparent insurance payment structure.

Key Features & Benefits for Policyholders

1. Financial Security & Control

Traditionally, policyholders pay premiums upfront, even if their policy is under review. Bima-ASBA ensures that funds stay in their account until the insurer finalizes the policy decision.

2. No Refund Delays

In cases of policy rejection, customers often face refund delays with traditional payment methods. With Bima-ASBA, there’s no need to manually request a refund—the blocked amount is automatically unblocked within 14 days.

3. Interest Earnings on Blocked Amount

Unlike conventional payments where money is immediately deducted, Bima-ASBA allows policyholders to continue earning interest on the blocked amount until the final payment is processed.

Why is Bima-ASBA a Game-Changer in Insurance?

Bima-ASBA enhances customer trust and streamlines premium transactions, making it a groundbreaking initiative in India’s insurance landscape. Here’s why it’s a major breakthrough:

- ✅ Zero upfront payment: Block funds instead of transferring them.

- ✅ Automatic refunds: Eliminates refund-related complexities.

- ✅ Security & transparency: Customers have complete control over their funds.

- ✅ Simplified process: Fully digital, reducing paperwork & processing time.

Impact on the Indian Insurance Industry

The launch of Bima-ASBA aligns with IRDAI’s vision of increasing insurance penetration in India through digital innovation. Here’s how it benefits the industry:

- Boosts Trust in Insurance: Enhances policyholder confidence with secure, transparent payments.

- Encourages Digital Transactions: Integrates seamlessly with UPI-based banking, making insurance payments faster and more accessible.

- Supports IRDAI’s Simplification Goals: Reduces reliance on manual processes and improves customer experience.

With other insurers expected to adopt Bima-ASBA, it could become the industry standard for premium payments.

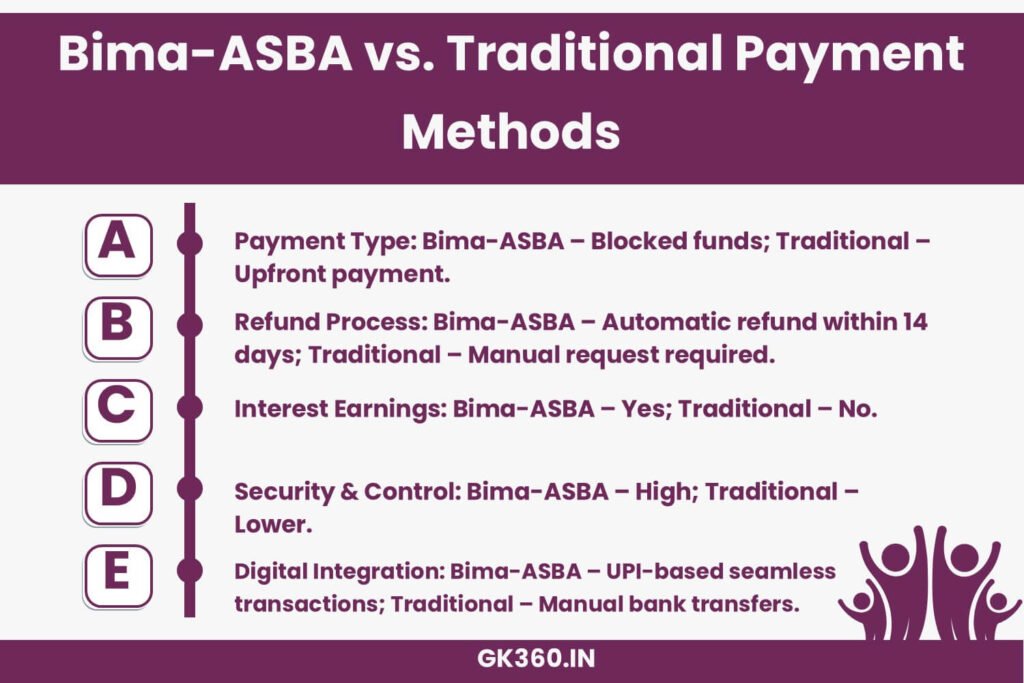

Comparison: Bima-ASBA vs. Traditional Payment Methods

| Feature | Bima-ASBA | Traditional Payment |

|---|---|---|

| Payment Type | Blocked Amount | Upfront Payment |

| Refunds on Rejection | Automatic within 14 days | Manual Request Required |

| Interest Earnings | Yes, until debited | No |

| Security & Control | High | Lower |

FAQs on Bima-ASBA

1️⃣ How is Bima-ASBA different from traditional premium payments?

Unlike traditional payments, Bima-ASBA allows blocking funds instead of upfront payment, reducing refund delays and ensuring better financial control.

2️⃣ What happens if my policy is not approved?

The blocked amount is automatically released within 14 days, eliminating refund hassles.

3️⃣ Can I use Bima-ASBA for all insurance policies?

Currently, it depends on the insurer. Bajaj Allianz Life Insurance is the first to introduce this method.

4️⃣ Does blocking the premium amount affect my bank balance?

No, the money remains in your bank account, and you continue to earn interest on it.

5️⃣ Is Bima-ASBA available for all banks in India?

Most major banks support UPI One-Time Mandate, but availability may vary.

Conclusion: The Future of Insurance Payments in India

Bima-ASBA by Bajaj Allianz Life Insurance represents a paradigm shift in premium payment methods. By offering financial security, transparency, and convenience, it is poised to become the new industry standard.

As more insurers adopt this innovative model, Bima-ASBA will drive the digital transformation of India’s insurance sector, making policies more accessible, secure, and customer-friendly.

Key Takeaways Table

| Aspect | Details |

|---|---|

| What is Bima-ASBA? | A new digital insurance payment method allowing policyholders to block premium funds instead of upfront payments. |

| How It Works | Funds are blocked in the policyholder’s bank account until policy approval; automatic refunds if rejected. |

| Key Benefits | Financial security, no refund delays, interest earnings, and enhanced transparency. |

| Why It’s a Game-Changer | Reduces refund complexities, integrates with UPI, and offers complete financial control. |

| Impact on Industry | Encourages digital payments, increases trust in insurance, and aligns with IRDAI’s simplification goals. |

| Comparison | Offers higher security, automatic refunds, and interest earnings compared to traditional premium payments. |

Related Terms:

- Bima-ASBA insurance payments

- Bajaj Allianz Life Bima-ASBA

- Digital insurance payment India

- Secure premium payment method

- IRDAI insurance payment innovation

- UPI-based insurance payments

- Insurance refund process India

- Bima-ASBA benefits and features

- Bajaj Allianz policy payment method

- Seamless insurance transactions