Amazon Pay ICICI Bank Credit Card: Lifetime Free, Cashback Benefits & Exclusive Features

Introduction

The Amazon Pay ICICI Bank Credit Card has rapidly become one of India’s most sought-after credit cards, achieving a milestone of over 5 million users. Its customer-friendly approach, lifetime-free offering, and lucrative cashback rewards make it an unbeatable choice for online shoppers, especially Amazon users.

With seamless digital onboarding, exclusive no-cost EMI benefits, and a high Net Promoter Score (NPS), this card offers a superior user experience. Let’s explore its features, benefits, and why it’s the perfect addition to your wallet.

Table of Contents

- Introduction

- Key Features & Benefits

- Digital-First Experience & User Satisfaction

- Cashback Rewards & Spending Patterns

- Exclusive No-Cost EMI & Tap & Pay Features

- User Testimonials & Success Stories

- FAQs (Amazon Pay ICICI Credit Card)

- Conclusion & Call to Action

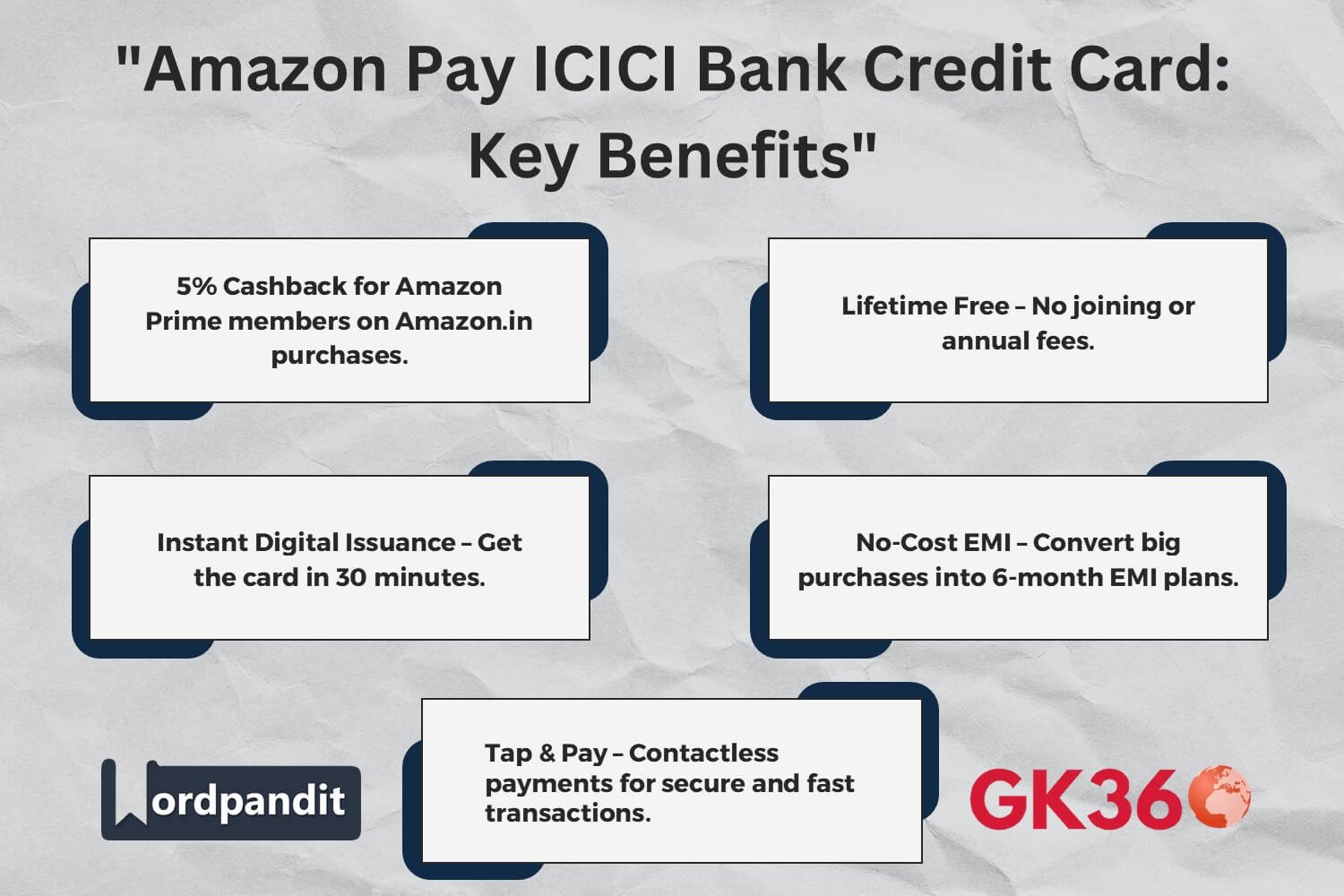

Key Features & Benefits

Unlimited Cashback for Amazon Shoppers

- 5% Cashback for Amazon Prime members on every Amazon.in purchase.

- 3% Cashback for non-Prime members on Amazon purchases.

- 2% Cashback on 100+ Amazon Pay partner merchants.

- 1% Cashback on all other transactions, including dining, fuel, and travel.

Lifetime Free Credit Card

- No joining fee.

- No annual fee—ever.

Instant Digital Issuance

- Get your card within 30 minutes through a seamless online process.

- Start using it immediately via the Amazon Pay app.

Tap & Pay Contactless Payments

- Quick, secure payments without swiping or entering a PIN for transactions up to ₹5,000.

Digital-First Experience & User Satisfaction

- Industry-Leading NPS Score: One of the highest-rated credit cards in India.

- Real-Time Tracking: Manage transactions and rewards effortlessly through the Amazon Pay app.

- Hassle-Free Customer Support: 24/7 digital support for instant query resolution.

Cashback Rewards & Spending Patterns

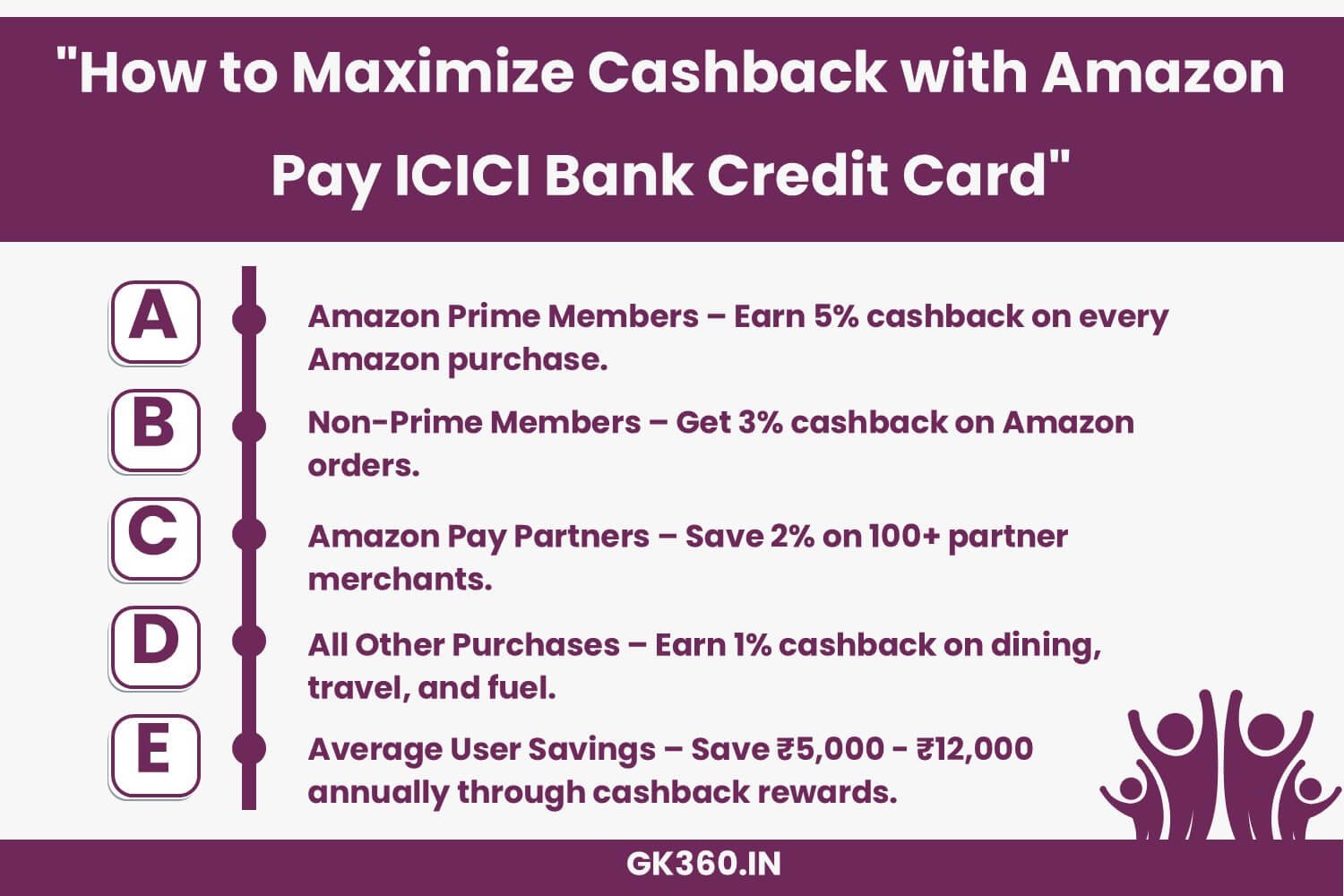

How to Maximize Cashback

- Use for all Amazon purchases to earn maximum cashback.

- Pay via Amazon Pay at 100+ partner merchants.

- Utilize for everyday spending to benefit from 1% cashback on all transactions.

Average Spend Statistics

- The average spend per user is 22% higher than the industry standard.

- Users save ₹5,000 – ₹12,000 annually just through cashback benefits.

Exclusive No-Cost EMI & Tap & Pay Features

- Six-Month No-Cost EMI on millions of Amazon.in products, including:

- Electronics & Gadgets

- Home Appliances

- Fashion & Accessories

- Tap & Pay Transactions: A secure and convenient option for in-store purchases.

User Testimonials & Success Stories

Case Study 1: Rajesh

A Prime member, Rajesh saved ₹15,000+ in a year through cashback on grocery and electronics purchases.

Case Study 2: Neha

Neha, a small business owner, uses this card to manage business expenses via Amazon Pay, earning 2% extra savings.

FAQs (Amazon Pay ICICI Credit Card)

1. Who is eligible for the Amazon Pay ICICI Bank Credit Card?

Any salaried or self-employed individual with a good credit history.

2. How do I maximize cashback rewards?

Shop on Amazon as a Prime member and use Amazon Pay partner merchants.

3. Does the card have any hidden charges?

No, it’s a lifetime free card with no hidden fees.

4. How does the no-cost EMI work?

Convert large purchases into 6-month EMI plans without interest.

5. Can I use this card for international transactions?

Yes, it supports both domestic and international transactions.

Conclusion & Call to Action

The Amazon Pay ICICI Bank Credit Card is a game-changer for online shoppers, offering unlimited cashback, lifetime free access, no-cost EMI options, and a superior digital experience. Whether you’re a frequent Amazon shopper or looking for a cost-effective, high-reward credit card, this is the perfect choice.

Key Takeaways

| Aspect | Details |

|---|---|

| Card Type | Amazon Pay ICICI Bank Credit Card |

| Annual Fee | ₹0 (Lifetime Free) |

| Cashback on Amazon (Prime Members) | 5% |

| Cashback on Amazon (Non-Prime Members) | 3% |

| Cashback on Amazon Pay Partner Merchants | 2% |

| Cashback on Other Transactions | 1% |

| No-Cost EMI | 6-month installment plans on Amazon purchases |

| Digital Issuance | Get the card instantly and use it online |

| Contactless Payments | Tap & Pay for secure transactions up to ₹5,000 |

| Average Savings Per Year | ₹5,000 – ₹12,000 |

Related terms

- Amazon Pay ICICI Bank Credit Card

- Lifetime Free Credit Card India

- Best Cashback Credit Card India

- No-Cost EMI Amazon Card

- Amazon Pay Cashback Offers

- Best Credit Card for Online Shopping

- Instant Approval Credit Cards India

- Contactless Payment Credit Card

- Amazon Prime Credit Card Benefits

- How to Apply for Amazon Pay ICICI Card