India’s New Income Tax Bill 2025: Key Changes, Benefits & Impact on Taxpayers

Introduction: The Need for a New Income Tax Bill

India is set to witness a landmark shift in its taxation system with the introduction of the Income Tax Bill 2025, replacing the Income Tax Act of 1961. This new legislation aims to simplify, modernize, and enhance transparency in the country’s taxation framework.

For decades, the 1961 Act has undergone numerous amendments, making tax compliance complicated and ambiguous for businesses and individuals. The new bill, approved by the Union Cabinet, is designed to remove outdated provisions, reduce litigation, and foster a business-friendly tax environment.

Key Highlights of the New Income Tax Bill:

- ✅ No additional tax burden on individuals or businesses.

- ✅ Simplified tax structure with clearer provisions.

- ✅ Dispute resolution mechanisms to reduce litigation.

- ✅ Easier compliance for taxpayers with fewer documentation requirements.

With Finance Minister Nirmala Sitharaman announcing the bill in the Budget 2025-26, it is now under parliamentary review. This article breaks down the key changes, benefits, and expected impact of this historic reform.

Table of Contents

- Key Reasons for the Tax System Overhaul

- Major Features of the New Income Tax Bill

- Stakeholder Consultation and Public Feedback

- Implementation Process and Legislative Approval

- Expected Impact on Taxpayers and the Economy

- FAQs: Everything You Need to Know

- Conclusion & What’s Next for India’s Taxation System

Key Reasons for the Tax System Overhaul

The need for a new Income Tax Bill stems from several longstanding challenges in the existing system. Over time, the 1961 Income Tax Act has become overly complex, leading to confusion, tax disputes, and compliance difficulties. Here’s why the overhaul was necessary:

1. Simplification of Tax Laws

- 📌 The current tax code is burdened with amendments, legal jargon, and conflicting provisions.

- 📌 The new bill aims to introduce a clear, easy-to-understand structure that benefits both taxpayers and professionals.

2. Minimizing Disputes & Litigation

- 📌 Tax disputes clog the judicial system, with thousands of pending cases.

- 📌 The new bill introduces alternative dispute resolution mechanisms to speed up settlements and reduce litigation costs.

3. Enhancing Tax Certainty & Compliance

- 📌 A transparent tax code ensures that businesses and individuals know exactly what they owe.

- 📌 The new framework reduces scope for misinterpretation and unintended violations.

4. Removing Outdated Provisions

- 📌 Many redundant clauses in the 1961 Act no longer align with modern business and financial practices.

- 📌 The new tax bill removes such obsolete regulations, ensuring a more relevant and efficient tax system.

5. Boosting Economic Growth & Investment

- 📌 A stable, predictable tax environment attracts foreign and domestic investment.

- 📌 The government expects that a simplified and business-friendly tax regime will encourage economic growth.

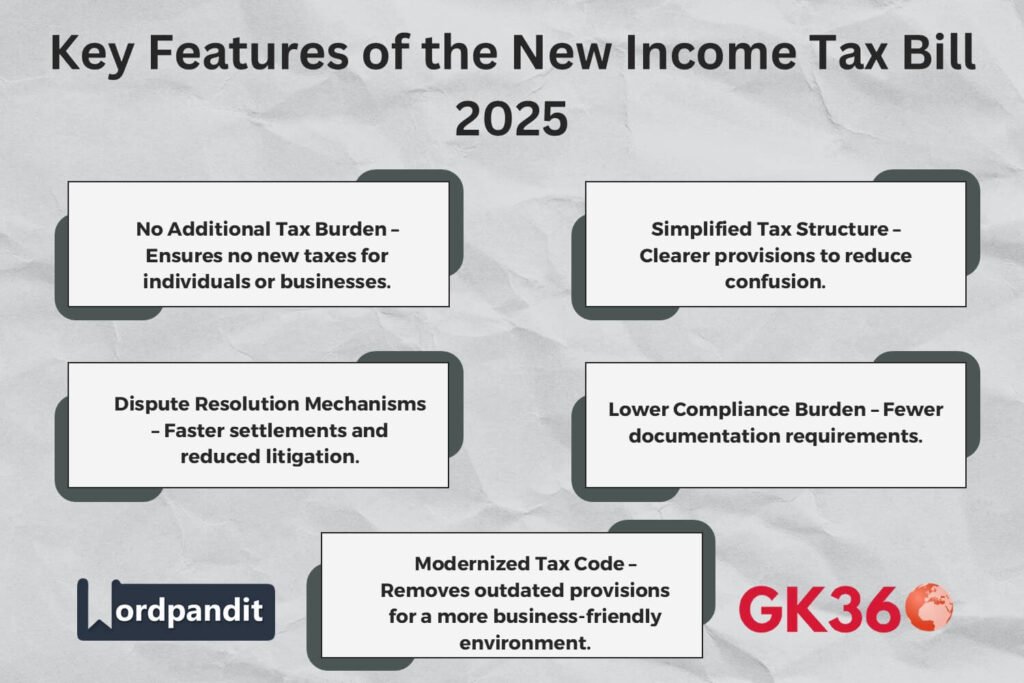

Major Features of the New Income Tax Bill

No Additional Tax Burden

- 🔹 No new taxes will be introduced under this bill. The focus is on simplification, not increasing tax rates.

- 🔹 The bill is designed to ensure better compliance and ease of filing, rather than creating additional financial burdens on taxpayers.

Simplified Language and Structure

- 🔹 The Income Tax Act, 1961 is known for complex legal language and long-winded provisions.

- 🔹 The new bill is drafted in clear, concise, and understandable terms, making it easier for taxpayers to interpret their obligations without requiring expert assistance.

Reduction in Tax Litigation

One of the biggest challenges in India’s taxation system is long-drawn legal battles due to ambiguous tax laws. The new bill proposes:

- ✔ More transparent and precise tax provisions to minimize disputes.

- ✔ Alternative dispute resolution (ADR) mechanisms for faster settlements.

- ✔ Clearer tax definitions to reduce ambiguity and misinterpretation.

Lower Compliance Burden

- 📌 Reduced documentation requirements for individuals and businesses.

- 📌 Simplified return filing process with fewer tax forms.

- 📌 Use of digital platforms to automate tax compliance and reduce manual errors.

Stakeholder Consultation and Public Feedback

The development of the new Income Tax Bill has been an inclusive process, with extensive stakeholder consultations. The Central Board of Direct Taxes (CBDT) and the Finance Ministry sought inputs from:

- 📌 Industry Leaders & Business Owners – to address compliance concerns.

- 📌 Tax Experts & Chartered Accountants – for simplifying tax provisions.

- 📌 Individual Taxpayers – to enhance ease of filing and reduce ambiguity.

Public Response & Key Takeaways:

- ✅ Over 6,500 suggestions were received from taxpayers and experts.

- ✅ Strong demand for simplified tax language & digital filing mechanisms.

- ✅ Concerns raised about retrospective tax disputes—expected to be addressed in the final bill.

By integrating stakeholder inputs, the government aims to create a transparent, fair, and taxpayer-friendly system.

Implementation Process and Legislative Approval

The implementation of the new Income Tax Bill follows a structured legislative process:

1️⃣ Approval by the Union Cabinet & Introduction in Parliament

- 📌 The Union Cabinet has already approved the bill.

- 📌 It has been introduced in the Budget 2025-26 parliamentary session.

2️⃣ Review by the Standing Committee on Finance

- 📌 Once tabled in Parliament, the bill is reviewed in detail by the Standing Committee on Finance.

- 📌 The committee will:

- ✔ Examine key provisions.

- ✔ Seek feedback from tax professionals, businesses, and citizens.

- ✔ Suggest modifications if required.

3️⃣ Final Approval & Presidential Assent

- 📌 Once reviewed, the bill will be debated and passed in both Houses of Parliament.

- 📌 After receiving the President’s assent, it will become law, replacing the Income Tax Act, 1961.

4️⃣ Rollout & Transition Period

- 📌 The government is expected to announce a transition period to help businesses and individuals adapt to the new framework.

- 📌 Taxpayers will receive guidelines, FAQs, and digital assistance to ensure a smooth transition.

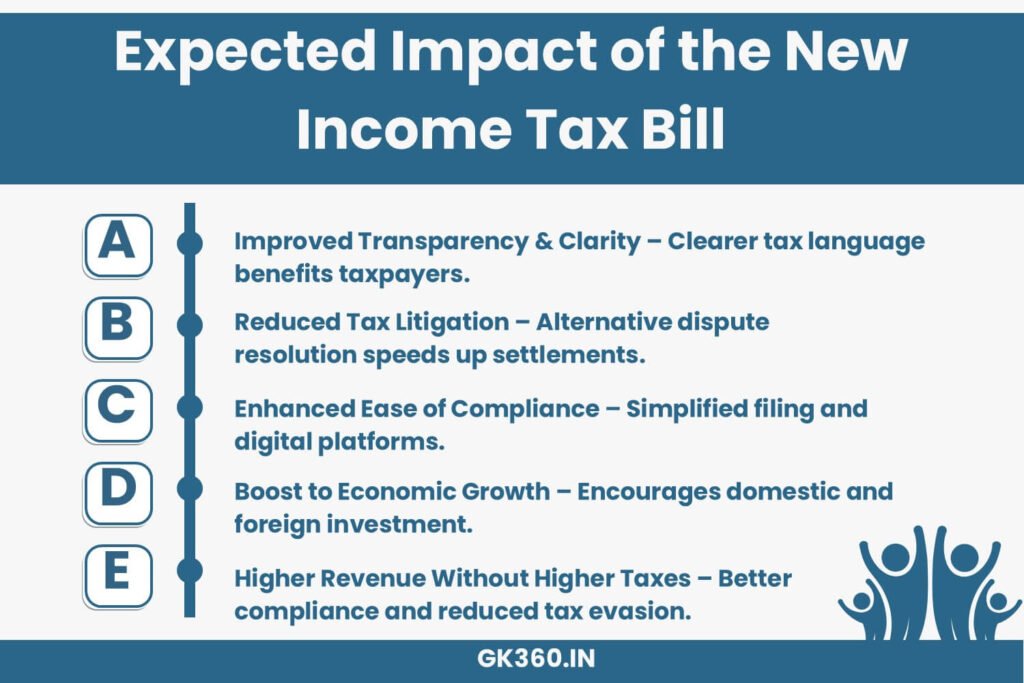

Expected Impact on Taxpayers and the Economy

1️⃣ Improved Transparency and Clarity

- Simplified language will ensure better taxpayer understanding.

- Ambiguity will be eliminated, reducing tax disputes and confusion.

2️⃣ Reduction in Tax Litigation

- With clearer provisions and dispute resolution mechanisms, tax-related litigation will significantly decrease.

3️⃣ Enhanced Ease of Compliance

- Fewer tax forms for individuals and businesses.

- Streamlined digital tax return filing systems.

- Reduced paperwork, making tax compliance faster and easier.

4️⃣ Boost to Economic Growth & Investments

- A predictable and business-friendly tax structure encourages foreign and domestic investment.

- Simplified taxation will support entrepreneurship and job creation.

5️⃣ Increased Revenue Collection Without Higher Taxes

- Better compliance rates due to reduced complexities.

- Lower tax evasion, ensuring higher government revenue.

FAQs: Everything You Need to Know

1️⃣ What is the main objective of the new Income Tax Bill?

✅ To replace the Income Tax Act of 1961 with a simpler, modern, and efficient tax framework.

2️⃣ Will this bill increase taxes for individuals or businesses?

✅ No. The bill does not introduce any new taxes—its focus is on simplification, compliance, and transparency.

3️⃣ How will this bill reduce tax disputes?

✅ By removing ambiguous provisions and introducing dispute resolution mechanisms.

4️⃣ When will the new tax law come into effect?

✅ Once it passes Parliament and receives the President’s assent, it will replace the 1961 Income Tax Act.

✅ A transition period is expected for smooth implementation.

5️⃣ How will businesses benefit from this new tax law?

✅ Lower compliance burden with streamlined filing.

✅ More clarity on taxation rules—reducing legal battles.

✅ Encourages investment by making India’s tax system more predictable.

Conclusion & What’s Next for India’s Taxation System

The new Income Tax Bill 2025 represents a transformative shift in India’s taxation system, aiming to:

- ✔ Simplify tax laws for individuals & businesses.

- ✔ Reduce litigation and enhance compliance.

- ✔ Remove outdated provisions from the 1961 Act.

With no additional tax burden, strong public consultation, and a focus on transparency, this reform is expected to strengthen India’s fiscal framework and boost economic growth.

Key Takeaways

| Aspect | Details |

|---|---|

| Purpose of the Bill | To replace the 1961 Act with a modern, efficient, and transparent tax framework. |

| Key Features | No new tax burden, simplified structure, reduced litigation, lower compliance requirements. |

| Benefits for Taxpayers | Easier tax filing, clear provisions, reduced documentation, digital assistance. |

| Economic Impact | Encourages investment, fosters business growth, ensures better revenue collection without tax hikes. |

| Implementation Process | Approved by Union Cabinet, under review in Parliament, transition period expected. |

| Stakeholder Consultation | Over 6,500 suggestions from taxpayers, businesses, and experts considered. |

| Expected Rollout | Post parliamentary approval and presidential assent, replacing the 1961 Act. |

Related Terms:

- Income Tax Bill 2025

- India New Tax Law 2025

- Tax Reform India

- Simplified Income Tax India

- Tax Compliance India 2025

- India Budget 2025 Tax Changes

- Income Tax Act 1961 Repeal

- Taxpayer Benefits India

- Business-Friendly Tax India

- Digital Tax Filing India