Sri Lanka’s Economic Transformation: Deflation in 2025 and Recovery Under IMF Reforms

Introduction

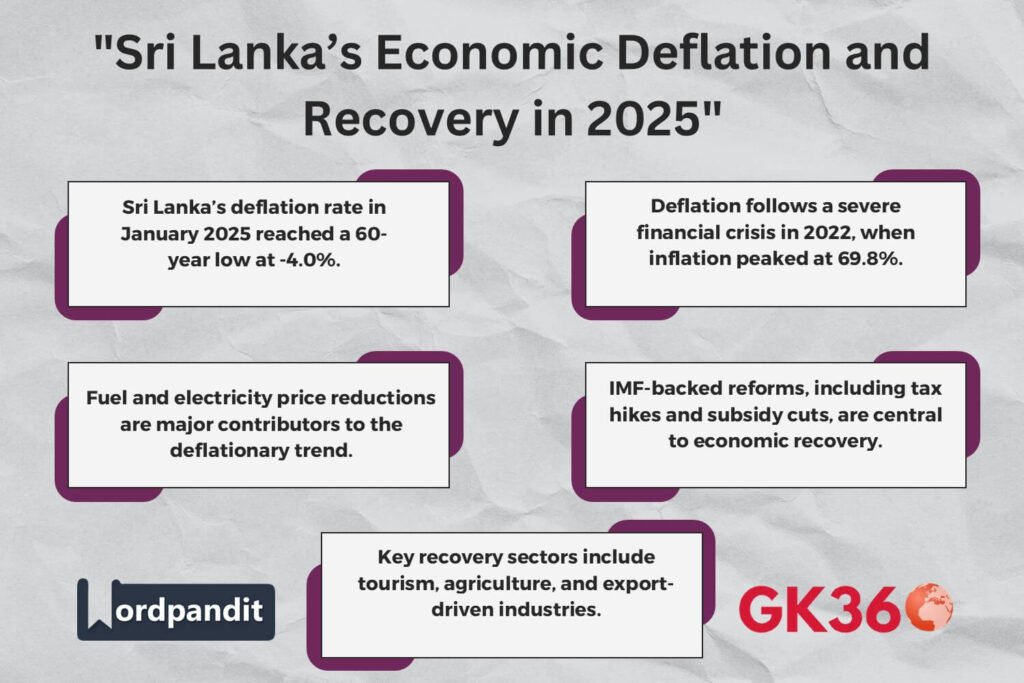

Sri Lanka is currently navigating an unprecedented economic shift, with the country experiencing its highest deflation rate in over six decades. In January 2025, consumer prices dropped by 4.0%, the sharpest decline since July 1960, marking the fifth consecutive month of deflation. This marks a striking contrast to the economic turmoil the country faced during its severe financial crisis in 2022. In this article, we explore the key factors contributing to this deflation, its impact on businesses and consumers, and the government’s recovery efforts, spearheaded by the International Monetary Fund (IMF)-backed reforms.

Table of Contents

- Introduction

- What Is Deflation and How It Affects Sri Lanka’s Economy?

- Sri Lanka’s Path to Recovery: Economic Reforms After the Crisis

- Economic Impacts of Deflation in Sri Lanka: A Deep Dive

- Government Measures and IMF’s Role in Sri Lanka’s Stabilization

- Sri Lanka’s Economic Outlook and Projections for 2025

- FAQs about Sri Lanka’s Economic Crisis and Recovery

- Conclusion: Navigating Sri Lanka’s Economic Transition

What Is Deflation and How It Affects Sri Lanka’s Economy?

Deflation is a sustained decrease in the general price level of goods and services. Unlike inflation, where prices rise over time, deflation typically occurs when demand weakens while supply remains abundant, leading to lower consumer spending. For Sri Lanka, deflation began to take hold in late 2024, following a series of economic events that disrupted the country’s financial structure.

In January 2025, Sri Lanka saw a 4.0% drop in consumer prices, a significant change from the staggering inflation rate of 69.8% recorded in September 2022. The drop in fuel and electricity costs has been one of the primary drivers of this deflationary trend. As a result, consumers are experiencing reduced living costs, but this has not come without its challenges for the broader economy.

Sri Lanka’s Path to Recovery: Economic Reforms After the Crisis

The 2022 Financial Crisis

Sri Lanka’s current deflationary scenario follows one of the most severe financial crises in its history. Inflation reached its peak in September 2022, causing widespread hardship. Essential goods became unaffordable, leading to shortages of food, fuel, and medicine. Public frustration erupted in protests, and the country was forced to default on foreign debt.

In response, Sri Lanka secured a $2.9 billion bailout package from the IMF in 2023. This financial aid came with stringent conditions, including tax hikes, cuts to public sector wages, and reductions in subsidies. The IMF’s involvement marked a turning point in Sri Lanka’s recovery, guiding the government through fiscal consolidation and a series of economic reforms.

The Role of IMF in Stabilization

Under IMF’s guidance, Sri Lanka is implementing a comprehensive set of policies aimed at stabilizing the economy and restoring investor confidence. These reforms, including liberalizing fuel and electricity pricing, increasing taxes, and controlling government expenditure, are intended to strengthen the country’s financial foundations over the long term.

Economic Impacts of Deflation in Sri Lanka: A Deep Dive

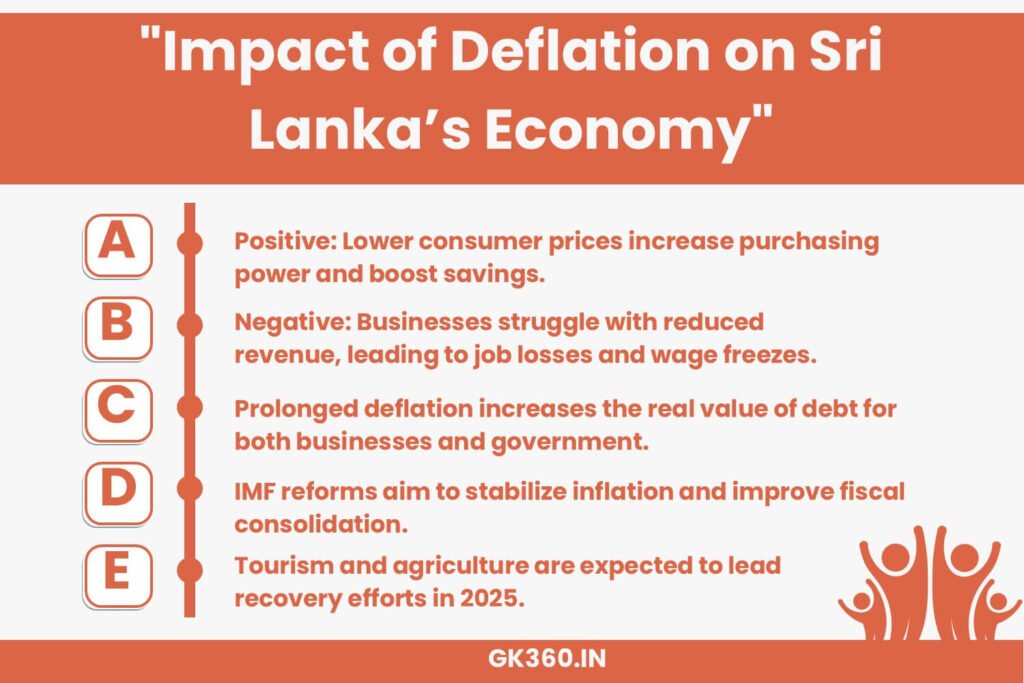

Positive Impacts of Deflation

While deflation often signals economic distress, it brings certain advantages to consumers in the short term.

- Lower Consumer Prices: Households benefit from reduced costs of daily necessities, boosting purchasing power.

- Decreased Cost of Living: With essentials like fuel and electricity becoming more affordable, living standards may improve for many citizens.

- Boost to Savings: As prices fall, consumers may choose to save more, which could contribute to financial stability.

Negative Impacts of Deflation

However, prolonged deflation can have adverse effects on the economy.

- Business Slowdown and Job Losses: Businesses may struggle to generate revenue, leading to layoffs and wage freezes.

- Reduced Investment: With falling profits, companies are less likely to invest in growth or expansion.

- Increased Debt Burden: Deflation increases the real value of debt, making it more difficult for both the government and businesses to meet their obligations.

Government Measures and IMF’s Role in Sri Lanka’s Stabilization

IMF’s Economic Reforms

IMF-backed reforms continue to play a crucial role in Sri Lanka’s recovery process. The government has focused on fiscal consolidation to reduce debt and control inflation. These structural changes are designed to create a more sustainable economic environment in the long run.

Additionally, the IMF’s support for currency stabilization efforts and its recommendations for reducing the country’s reliance on foreign debt are expected to gradually ease inflationary pressures and provide a more balanced economy in 2025.

Strengthening Key Sectors for Growth

Sri Lanka is focusing on key sectors to drive economic recovery, particularly in tourism and agriculture. The resurgence of tourism as global travel rebounds, along with a focus on export-driven industries, is expected to generate foreign exchange and reduce dependence on imports.

Sri Lanka’s Economic Outlook and Projections for 2025

As Sri Lanka heads into 2025, the Central Bank projects that inflation will stabilize at 5.0%, suggesting that deflationary pressures will gradually ease. The trajectory of Sri Lanka’s recovery will depend on several factors, including the continued implementation of economic reforms, external trade dynamics, and geopolitical stability in South Asia.

FAQs about Sri Lanka’s Economic Crisis and Recovery

What caused the deflation in Sri Lanka?

The primary factors contributing to deflation include the decrease in fuel and electricity prices and reduced consumer spending.

What is the role of IMF in Sri Lanka’s recovery?

IMF has provided financial assistance, guided policy reforms, and helped stabilize the country’s finances through fiscal consolidation.

How will deflation impact businesses in Sri Lanka?

While consumers may benefit from lower prices, businesses are facing reduced revenues, layoffs, and limited investment opportunities.

Is Sri Lanka’s economy expected to fully recover in 2025?

The recovery is expected to take time, with projections showing stabilization by 2025, but full recovery will depend on the success of ongoing reforms.

What sectors will drive Sri Lanka’s recovery in 2025?

Tourism and agriculture, among others, will be key sectors driving the economy, along with export-driven industries.

Conclusion: Navigating Sri Lanka’s Economic Transition

Sri Lanka’s experience with deflation in 2025 reflects a significant shift in its economic landscape. While short-term relief in the form of lower prices is evident, the government must continue its structural reforms to ensure long-term stability and growth. Balancing deflationary pressures with sustainable economic policies will be critical as the nation moves forward.

By adopting strategic fiscal policies and strengthening key sectors, Sri Lanka can navigate its economic recovery successfully. The nation’s journey toward financial stability will be a careful balancing act, but with continued effort, Sri Lanka can pave the way for a more resilient and prosperous future.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Deflation in 2025 | Sri Lanka’s consumer prices dropped by 4.0%, the sharpest decline since 1960. |

| Cause of Deflation | Key factors: Reduced fuel and electricity prices, along with lower consumer spending. |

| Impact on Businesses | Deflation leads to business slowdowns, job losses, and reduced investments. |

| IMF-backed Reforms | IMF reforms include tax hikes, subsidy cuts, and liberalization of pricing. |

| Economic Recovery Focus | Sectors like tourism, agriculture, and exports will drive the recovery in 2025. |

| Projected Inflation for 2025 | Central Bank forecasts inflation to stabilize at 5.0% in 2025. |

| Long-term Outlook | Recovery hinges on successful implementation of reforms and external factors. |

Related Terms:

- Sri Lanka Economic Deflation

- IMF Reforms 2025

- Sri Lanka Recovery 2025

- Deflation Impact Sri Lanka

- Sri Lanka Financial Crisis 2022

- Economic Reforms IMF Sri Lanka

- Tourism and Agriculture Sri Lanka

- Inflation and Deflation in Sri Lanka

- Sri Lanka Economic Stabilization

- IMF Bailout Sri Lanka 2023