Union Budget 2025-26: Key Highlights, Tax Changes, MSME Benefits & Economic Impact

Introduction

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, is centered around the theme “Sabka Vikas” (Development for All). With a focus on economic growth, tax relief, employment, and infrastructure, this budget aims to accelerate India’s path towards self-reliance and global competitiveness.

In her eighth consecutive budget presentation, Sitharaman highlighted key reforms for agriculture, MSMEs, healthcare, education, and taxation. She also paid tribute to India’s rich culture by wearing a saree with a Madhubani art border, honoring Padma Shri awardee Dulari Devi.

This article provides a detailed breakdown of the budget estimates, sector-wise allocations, and tax reforms, along with insights into its impact on businesses and individuals.

Table of Contents

- Budget Overview & Key Figures

- Agriculture & Rural Development Reforms

- MSMEs & Startup Benefits

- Infrastructure & Investment Announcements

- Tax Reforms (Direct & Indirect)

- Impact on Different Sectors

- FAQs on Union Budget 2025-26

- Conclusion: India’s Economic Path Ahead

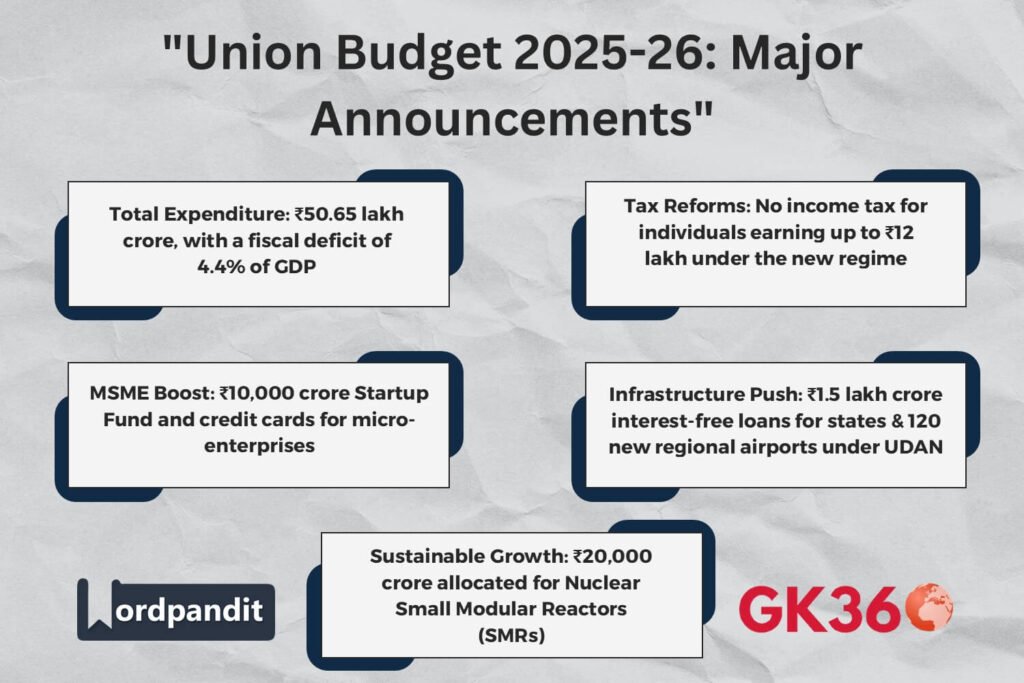

Budget Overview & Key Figures

The Union Budget 2025-26 outlines major economic goals while maintaining fiscal discipline.

Key Financial Estimates:

- Total Receipts (excluding borrowings): ₹34.96 lakh crore

- Total Expenditure: ₹50.65 lakh crore

- Net Tax Receipts: ₹28.37 lakh crore

- Fiscal Deficit: 4.4% of GDP

- Gross Market Borrowings: ₹14.82 lakh crore

- Capital Expenditure: ₹11.21 lakh crore (3.1% of GDP)

The fiscal deficit is projected at 4.4% of GDP, marking a step toward achieving the government’s target of reducing it to under 4% in the coming years.

Agriculture & Rural Development Reforms

Agriculture, being the backbone of India’s economy, has received a major boost with new initiatives focused on self-reliance, high-yield crops, and rural development.

Key Announcements:

- Prime Minister Dhan-Dhaanya Krishi Yojana: Development of 100 Agri-Districts, benefiting 7 crore farmers.

- Aatmanirbharta in Pulses: A six-year mission to enhance Tur, Urad, and Masoor production.

- National Mission on High-Yielding Seeds: Encourages research and use of high-yielding seed varieties.

- Makhana Board in Bihar: A dedicated board for Makhana production, processing, and exports.

- Sustainable Fisheries Framework: Boosts the fisheries sector in Andaman & Nicobar and Lakshadweep.

- Mission for Cotton Productivity: A five-year plan for extra-long staple cotton production.

- Kisan Credit Card (KCC) Loan Limit Increased: Raised from ₹3 lakh to ₹5 lakh.

- New Urea Plant in Assam: The Namrup Plant will produce 12.7 lakh metric tons annually.

The government is also promoting technology-driven farming and sustainable agricultural practices to increase productivity while reducing environmental impact.

MSMEs & Startup Benefits

The Micro, Small, and Medium Enterprises (MSMEs) sector has been recognized as the “Second Engine of Growth” for India. This budget introduces new incentives and financial support to boost entrepreneurship, exports, and job creation.

Key Reforms for MSMEs & Startups:

- Revised MSME Classification: Investment & turnover limits doubled, allowing more businesses to qualify for benefits.

- Credit Cards for Micro Enterprises: A new scheme with a ₹5 lakh limit (10 lakh cards to be issued in the first year).

- Fund of Funds for Startups: ₹10,000 crore allocated to support innovative startups.

- First-time Entrepreneurs Scheme: ₹2 crore term-loans for SC/ST and women entrepreneurs.

- Focus Product Scheme for Footwear & Leather: Expected to create 22 lakh jobs with a turnover target of ₹4 lakh crore.

- Boost for Toy Manufacturing: India aims to become a global leader in toy exports.

Infrastructure & Investment Announcements

A major focus of the Union Budget 2025-26 is on infrastructure expansion and economic reforms to boost investment and job creation.

Key Announcements:

- 50-Year Interest-Free Loans for States: ₹1.5 lakh crore allocated to encourage capital expenditure.

- Public-Private Partnership (PPP) Model: A three-year infrastructure pipeline unveiled for mega projects.

- Asset Monetization Plan (2025-30): Targeting ₹10 lakh crore to reinvest in roads, railways, and energy.

- Jal Jeevan Mission Extended: Now running till 2028, ensuring piped water supply to all households.

- Nuclear Energy Mission: ₹20,000 crore for Small Modular Reactors (SMRs) research.

- Maritime Development Fund: ₹25,000 crore investment for port modernization & shipping industry.

- UDAN Scheme Expansion: 120 new regional airports to connect smaller cities. Goal: 4 crore passengers in 10 years.

- New Greenfield Airport in Bihar: Boost to regional connectivity & economic growth.

These initiatives will improve logistics, attract global investors, and accelerate India’s GDP growth.

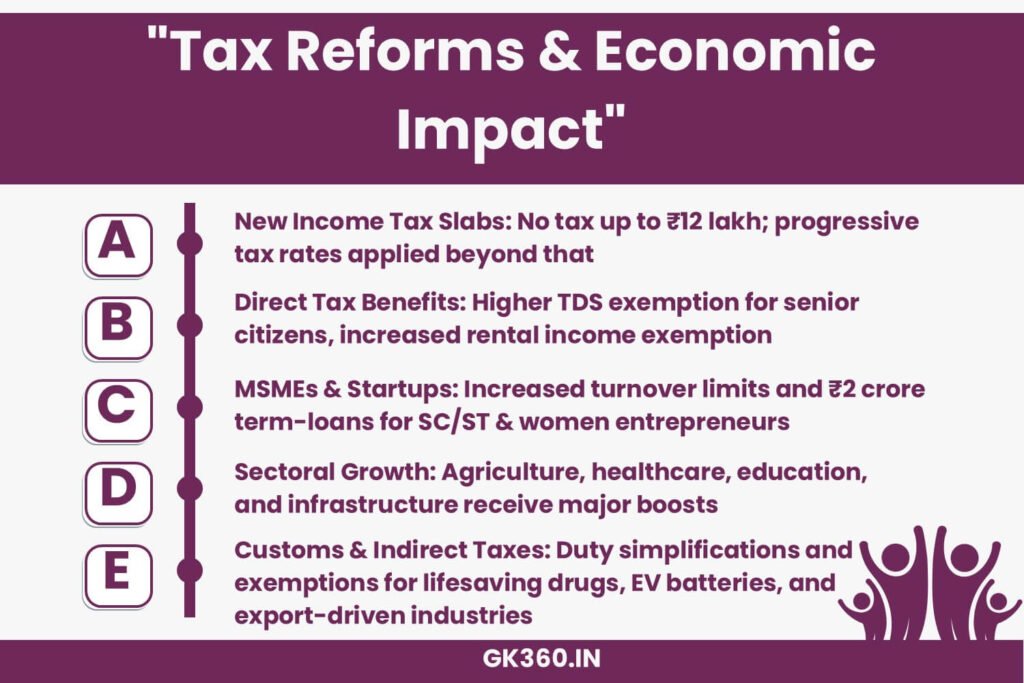

Tax Reforms (Direct & Indirect)

The budget introduces major tax reliefs for individuals and businesses, simplifying tax structures and boosting disposable income.

Direct Tax Changes:

- Income Tax Exemptions: No Income Tax for individuals earning up to ₹12 lakh (under the new regime).

New Tax Slabs:

| Income Bracket | Tax Rate |

|---|---|

| ₹0 – ₹4 lakh | Nil |

| ₹4 – ₹8 lakh | 5% |

| ₹8 – ₹12 lakh | 10% |

| ₹12 – ₹16 lakh | 15% |

| ₹16 – ₹20 lakh | 20% |

| ₹20 – ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

Standard Deduction for Salaried Taxpayers:

- ₹12.75 lakh exemption granted.

Other Tax Reforms:

- TDS Limit Increases:

- Senior Citizens: Interest deduction limit raised to ₹1 lakh.

- Rent TDS: Raised from ₹2.4 lakh to ₹6 lakh.

- Foreign Remittances (LRS): TCS threshold increased to ₹10 lakh.

Indirect Tax & Customs Tariff Reforms:

- Customs Duty Simplification: Only 8 slabs remain for better tax compliance.

- Duty Exemptions on Life-Saving Medicines: 36 essential drugs fully exempted from Basic Customs Duty (BCD).

- Electronics & Battery Sector:

- EV battery & mobile phone battery duty exemptions increased.

- Interactive Flat Panel Displays: Duty raised from 10% to 20%.

- Carrier-Grade Ethernet Switch: Duty lowered from 20% to 10%.

- Export Promotion Measures:

- Leather Industry: Full BCD exemption on wet blue leather.

- Marine Sector: Frozen fish paste duty reduced from 30% to 5%.

- Handicrafts Export Period extended to one year.

These reforms aim to increase disposable income, simplify taxation, and encourage exports & domestic manufacturing.

Impact on Different Sectors

| Sector | Key Budget Reforms | Expected Impact |

|---|---|---|

| Agriculture | Expansion of KCC, new Agri-Districts, Urea Plant in Assam | Higher farm productivity, self-reliance |

| MSMEs | ₹10,000 crore Startup Fund, new credit cards | Job creation, increased innovation |

| Healthcare | 200 new Cancer Centers, 10,000 MBBS seats | Improved healthcare accessibility |

| Education | Atal Tinkering Labs, Saksham Anganwadi program | Digital learning & childhood development |

| Infrastructure | ₹1.5 lakh crore state loans, UDAN expansion | Better connectivity & urban development |

| Taxation | Higher income tax exemptions, reduced GST slabs | More disposable income, ease of business |

| Energy & Sustainability | ₹20,000 crore for Nuclear SMRs, Jal Jeevan Mission extension | Renewable energy expansion, water security |

FAQs on Union Budget 2025-26

1. What are the major tax changes in Union Budget 2025?

The new income tax regime has raised the tax-free limit to ₹12 lakh, revised TDS limits, and introduced a simplified tax slab structure.

2. How does the budget impact MSMEs and startups?

The government has doubled investment & turnover limits, introduced ₹10,000 crore for startups, and credit cards for micro-enterprises to support business expansion.

3. What are the new government schemes introduced?

New initiatives include the Prime Minister Dhan-Dhaanya Krishi Yojana, Sustainable Fisheries Framework, and the Focus Product Scheme for MSMEs.

4. How will the budget affect income tax slabs?

A new progressive tax system reduces the burden on the middle class, while corporate tax remains unchanged for now.

5. What is India’s fiscal deficit target for 2025-26?

The fiscal deficit is projected at 4.4% of GDP, aiming for further reduction in the coming years.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Fiscal Outlook | Fiscal deficit at 4.4% of GDP, with a focus on fiscal discipline |

| Tax Reforms | Higher income exemption limit (₹12 lakh), revised tax slabs for individuals |

| MSME & Startup Boost | ₹10,000 crore Fund of Funds, ₹2 crore loans for first-time entrepreneurs |

| Infrastructure Push | ₹1.5 lakh crore for states, new UDAN airports, and expanded Jal Jeevan Mission |

| Agriculture Focus | 100 Agri-Districts, expanded KCC, and a new Urea plant in Assam |

| Sectoral Growth | Investments in healthcare, education, renewable energy, and nuclear power |

| Customs & Duty Reforms | Simplified customs duties, exemptions on life-saving drugs, and export promotion |

Related Terms:

- Union Budget 2025-26

- India Budget Highlights 2025

- New Income Tax Slabs 2025

- MSME Benefits in Budget 2025

- Startup Fund 2025 India

- Infrastructure Investments India 2025

- Agriculture Schemes 2025 Budget

- Customs Duty Changes 2025

- Renewable Energy Budget 2025

- Economic Growth India 2025

Conclusion: India’s Economic Path Ahead

The Union Budget 2025-26 is a pro-growth, pro-investment, and pro-innovation budget, prioritizing infrastructure, MSMEs, and tax relief to stimulate the economy.

With bold tax cuts, higher capital expenditure, and incentives for self-reliance, this budget lays the foundation for a stronger, globally competitive India.