Disney-Reliance $8.5 Billion Merger: How It Transforms India’s Media Landscape

Introduction: The Disney-Reliance Mega Merger

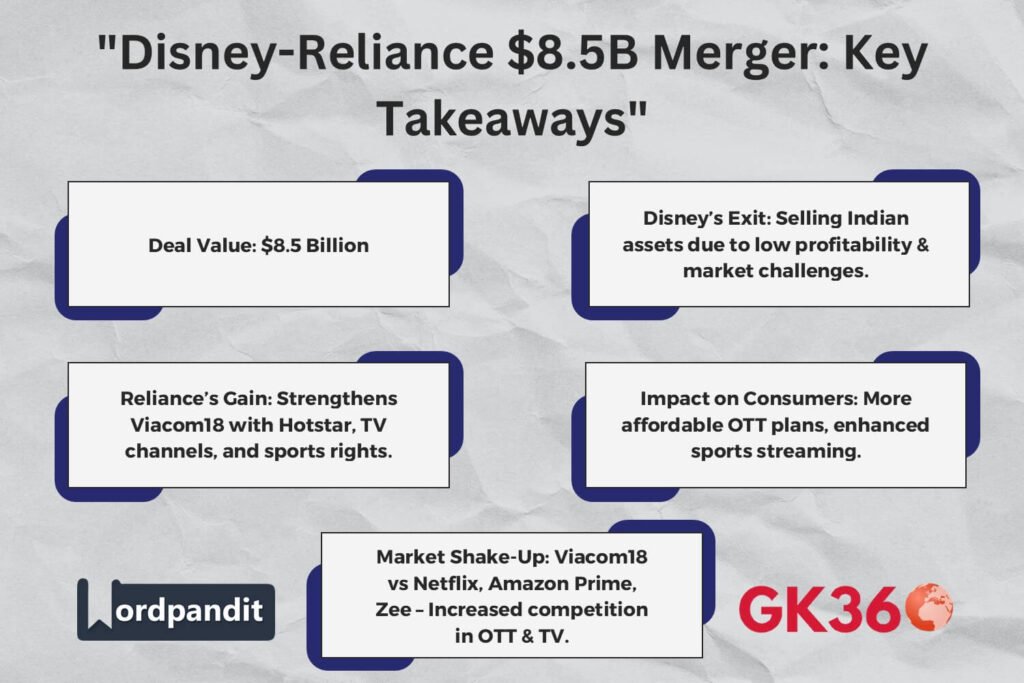

The recent $8.5 billion merger between Disney and Reliance marks a pivotal shift in the Indian media and entertainment industry. This high-stakes deal, which involves Disney selling its Indian media assets to Reliance Industries Limited (RIL), reshapes the competitive landscape in one of the world’s fastest-growing entertainment markets.

With this acquisition, Reliance, through its media arm Viacom18, is set to dominate the Indian entertainment ecosystem, including streaming, sports broadcasting, and regional networks. Meanwhile, Disney’s exit from India aligns with its global restructuring strategy, focusing on high-margin markets and core businesses.

This article explores the details of the merger, its impact on India’s media industry, challenges, and future implications for viewers and businesses alike.

Table of Contents

- Deal Breakdown: What Disney is Selling

- Why Disney is Exiting the Indian Market

- What Reliance Gains from the Merger

- Impact on India’s Entertainment Industry

- Challenges & Roadblocks

- Global Implications of the Deal

- FAQs

- Conclusion: What’s Next for India’s Media Market?

Deal Breakdown: What Disney is Selling

The merger agreement includes the transfer of Disney’s Indian assets to Reliance, encompassing:

- Hotstar Streaming Service: One of India’s most popular OTT platforms, known for its mix of regional and international content.

- Regional Broadcasting Channels: A portfolio of channels catering to India’s diverse linguistic audience.

- Sports Broadcasting Rights: Disney’s premium sports content, including cricket tournaments, a massive draw for Indian audiences.

This strategic acquisition strengthens Reliance’s media dominance, integrating these assets into Viacom18’s growing ecosystem.

Why Disney is Exiting the Indian Market

Despite being a global media powerhouse, Disney has faced profitability challenges in India due to:

- Highly competitive and price-sensitive OTT market.

- Low subscription revenues and advertising challenges.

- Strategic shift towards core markets like the US and Europe.

By offloading non-core assets, Disney aims to streamline operations and prioritize high-growth regions where profitability is stronger.

What Reliance Gains from the Merger

1. Viacom18’s Strengthened Market Position

Viacom18, Reliance’s media arm, will emerge as India’s dominant entertainment player, competing with Netflix, Amazon Prime, and Zee Entertainment.

2. The Impact on Hotstar’s Future

Reliance will likely integrate Hotstar into JioCinema, enhancing its streaming service and leveraging Hotstar’s massive user base.

3. Expansion of Regional & Sports Broadcasting

With Disney’s regional TV channels and sports rights, Reliance gains a competitive edge in local content and live sports streaming, further boosting advertising revenue.

Impact on India’s Entertainment Industry

1. Increased Competition in OTT & TV

The merger will intensify competition between Reliance’s expanded Viacom18, Netflix, Amazon Prime Video, and Zee Entertainment. Consumers will benefit from more diverse content and improved user experience.

2. Potential Changes for Indian Consumers

Reliance’s aggressive pricing strategy may lead to:

- More affordable OTT subscriptions.

- Exclusive content deals.

- Enhanced sports broadcasting experiences.

However, changes in content availability on Hotstar may impact long-time subscribers.

Challenges & Roadblocks

While the merger presents immense opportunities, Reliance faces significant challenges:

- Integration of Operations: Merging Disney’s extensive assets with Reliance’s ecosystem requires seamless technological and content integration.

- Retention of Talent: Keeping Disney India’s top creative and managerial talent will be crucial for continuity.

- Sustaining Profitability: India’s price-sensitive market demands innovative revenue models to balance affordability and profits.

Global Implications of the Deal

This merger signals broader trends in the global media industry, such as:

- India’s rising influence in digital entertainment.

- Consolidation in media sectors as major players seek dominance.

- Shifting business models to adapt to emerging markets.

Reliance’s move strengthens India’s position as a major digital media hub, attracting further global investments.

FAQs

Why did Disney sell its Indian assets?

Disney decided to exit India due to low profitability, increasing competition, and a strategic focus on core markets like the US and Europe.

How will this impact Hotstar users?

Hotstar may be integrated into JioCinema, with potential changes in content availability and pricing.

Will Reliance dominate the Indian media industry?

With Viacom18’s strengthened position, Reliance is set to become a leading force in India’s media sector, challenging global and local competitors.

Conclusion: What’s Next for India’s Media Market?

The Disney-Reliance $8.5 billion merger marks a major transformation in India’s media and entertainment sector. With Disney focusing on core markets and Reliance expanding its dominance, the industry is set for significant changes in content creation, pricing models, and market competition.

As the deal unfolds, audiences and industry stakeholders will keenly observe how Reliance leverages this acquisition to redefine India’s entertainment landscape.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Deal Value | $8.5 Billion |

| Buyer | Reliance (Viacom18) |

| Seller | Disney |

| Key Acquisitions | Hotstar, Disney’s Indian TV channels, Sports Rights |

| Why Disney Exited? | Low profitability, intense competition, shift to core markets |

| Impact on Viewers | More affordable streaming, expanded sports content |

| OTT Industry Effect | Increased rivalry between Viacom18, Netflix, Amazon, Zee |

| Future Outlook | Reliance’s dominance in India’s media sector |

Related terms

- Disney Reliance Merger India

- $8.5B Disney Hotstar Sale

- Future of Hotstar after Reliance Buyout

- India’s OTT Market Competition 2025

- Disney Exits Indian Media Industry

- Reliance Viacom18 Media Expansion

- Impact of Disney-Reliance Deal on Sports Streaming

- JioCinema vs Hotstar Future Plans

- Viacom18 vs Netflix in India

- Future of Indian Media After Disney Exit