RBI Launches Unified Lending Interface (ULI) to Transform Credit Access in India

Introduction

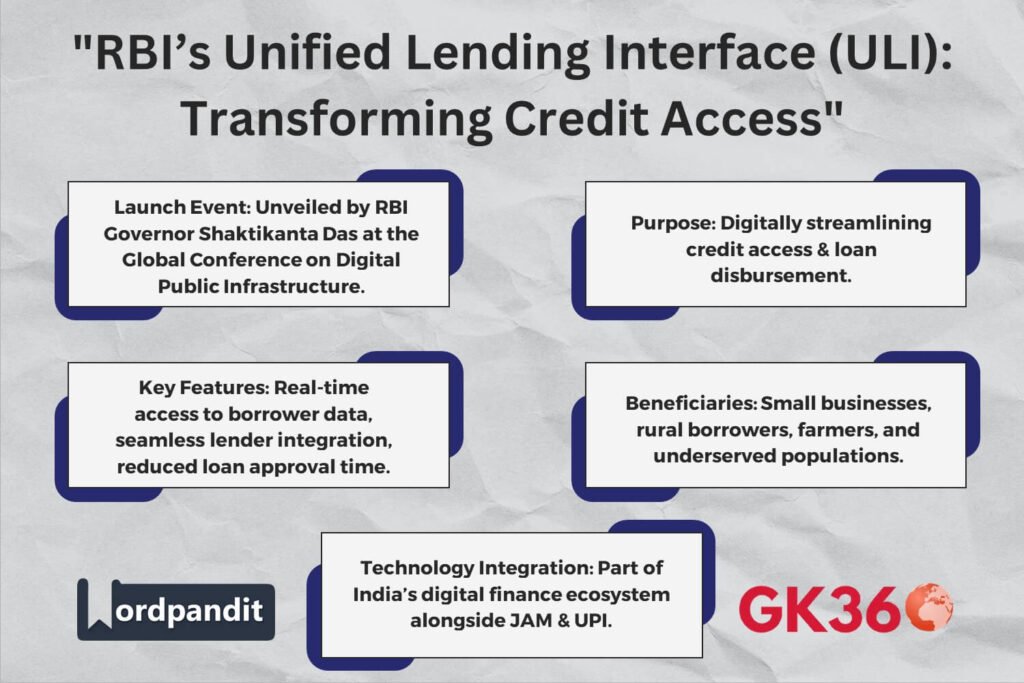

In a significant stride towards enhancing India’s financial ecosystem, Reserve Bank of India (RBI) Governor Shaktikanta Das recently unveiled the Unified Lending Interface (ULI) during the Global Conference on Digital Public Infrastructure and Emerging Technologies in Bengaluru, Karnataka. This initiative aims to revolutionize credit access and disbursement, particularly benefiting underserved segments of the population.

Table of Contents

- Understanding the Unified Lending Interface (ULI)

- The Purpose of ULI: Enhancing Credit Access

- Integration and Efficiency: The Role of ULI in the Financial Ecosystem

- ULI’s Impact on Credit Access

- The New Trinity: JAM-UPI-ULI and India’s Digital Infrastructure

- The Reserve Bank of India: Steadfast in Financial Innovation

- FAQs

- Conclusion

Understanding the Unified Lending Interface (ULI)

- ULI is a digital platform designed to streamline the lending process.

- Connects banks, NBFCs, and fintech firms with data service providers.

- Enables real-time access to borrower financial data, reducing loan approval times.

- Leverages land records and digital financial databases for quick credit assessments.

The Purpose of ULI: Enhancing Credit Access

- Addresses credit challenges faced by rural and underserved populations.

- Simplifies integration of financial systems, minimizing physical documentation.

- Accelerates loan approvals, benefiting farmers, small businesses, and individuals.

- Empowers lenders to extend credit more efficiently, boosting financial inclusion.

Integration and Efficiency: The Role of ULI in the Financial Ecosystem

- ULI seamlessly integrates with banks, NBFCs, and fintech firms.

- Reduces complexity in lending, cutting delays and administrative burdens.

- Provides holistic credit evaluation by aggregating data from multiple sources.

- Enhances risk assessment, reducing defaults and improving credit quality.

ULI’s Impact on Credit Access

- Simplifies borrowing process, making credit more accessible.

- Benefits India’s underbanked and unbanked population.

- Reduces barriers to obtaining loans, particularly in rural areas.

- Promotes economic development by enabling access to growth capital.

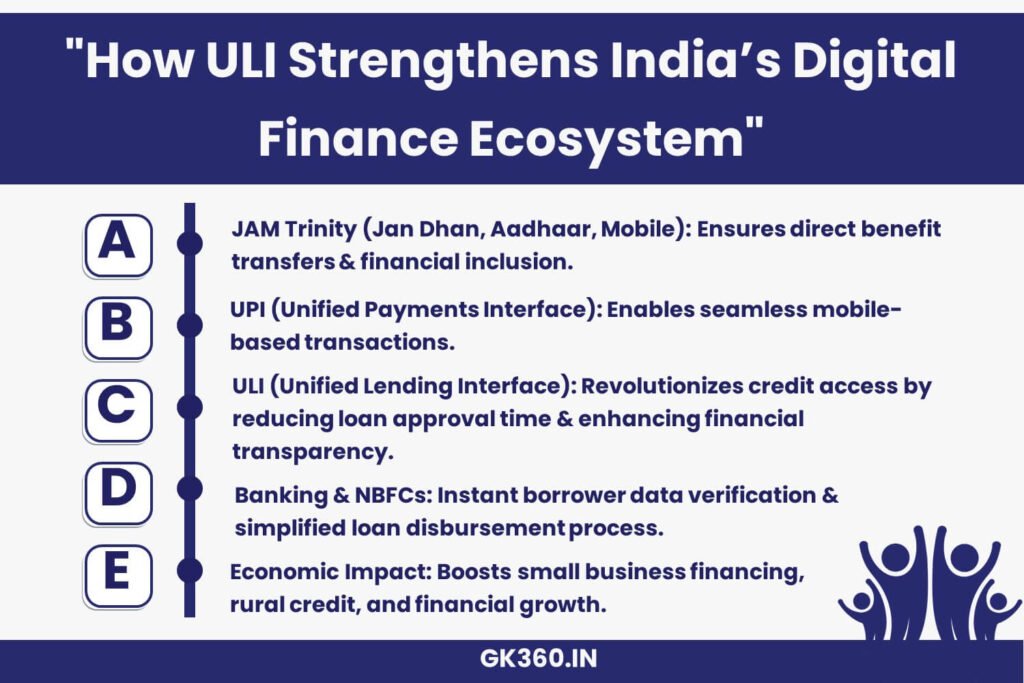

The New Trinity: JAM-UPI-ULI and India’s Digital Infrastructure

JAM Trinity (Jan Dhan, Aadhaar, Mobile):

- Facilitates direct benefit transfers, improving government service efficiency.

- Links bank accounts, Aadhaar numbers, and mobile devices for seamless financial transactions.

Unified Payments Interface (UPI):

- Enables instant mobile-based fund transfers.

- Drives financial inclusion and digitization in India’s economy.

Unified Lending Interface (ULI):

- Complements JAM and UPI by providing accessible and efficient credit solutions.

- Reduces reliance on physical documentation, streamlining credit access.

The Reserve Bank of India: Steadfast in Financial Innovation

- Established on April 1, 1935, with headquarters in Mumbai.

- Governor Shaktikanta Das has led initiatives like ULI to enhance financial inclusion.

- RBI’s focus on leveraging emerging technologies ensures an inclusive, efficient financial system.

FAQs

- What is the purpose of ULI?

ULI aims to simplify and accelerate credit access by providing a digital lending ecosystem that connects financial institutions with borrowers. - How does ULI benefit borrowers?

Borrowers, especially in rural areas, can access credit faster with minimal documentation, making loans more affordable and accessible. - What role do banks and NBFCs play in ULI?

Banks, NBFCs, and fintech firms leverage ULI to assess borrower creditworthiness quickly, reducing approval times and improving loan distribution. - How does ULI compare to traditional lending?

Unlike traditional lending, which relies on manual documentation and lengthy approvals, ULI digitally integrates financial data for instant credit assessments. - How does ULI fit into India’s digital financial infrastructure?

ULI complements JAM (Jan Dhan, Aadhaar, Mobile) and UPI (Unified Payments Interface), forming a comprehensive framework for financial inclusion.

Conclusion

The launch of Unified Lending Interface (ULI) is a transformative step in India’s financial ecosystem. By making credit more accessible, reducing loan approval times, and integrating seamlessly with India’s digital infrastructure, ULI paves the way for a financially inclusive and digitally empowered India. This initiative not only benefits individual borrowers but also strengthens India’s economic foundation, fostering sustainable growth and development.

Key Takeaways Table

| Aspect | Details |

|---|---|

| Initiative | Unified Lending Interface (ULI) |

| Launched By | Reserve Bank of India (RBI) |

| Launch Event | Global Conference on Digital Public Infrastructure, Bengaluru |

| Objective | Enhancing credit access through digital integration |

| Key Benefits | Faster loan approvals, minimal documentation, greater financial inclusion |

| Target Beneficiaries | Small businesses, farmers, and underserved borrowers |

| Part of Digital Trinity | JAM (Jan Dhan, Aadhaar, Mobile) – UPI – ULI |

| Governor of RBI | Shaktikanta Das |

Relative Terms

- RBI Unified Lending Interface ULI

- Digital Credit Access India 2025

- RBI Digital Financial Reforms

- ULI Banking Integration India

- JAM-UPI-ULI Digital Finance System

- Small Business Loans India Digital

- Financial Inclusion in India RBI

- NBFC Digital Lending India

- Fast Loan Approvals ULI India

- Shaktikanta Das Digital Banking Reforms