India’s New Long-Term Capital Gains Tax Rules for Property: Key Amendments & Benefits

Introduction

In a major relief for property owners, the Indian government has introduced a new amendment to the Long-Term Capital Gains (LTCG) tax on property transactions. This change, proposed in the Finance (No. 2) Bill, 2024, reduces the LTCG tax rate from 20% to 12.5% while eliminating the indexation benefit. The amendment aims to provide flexibility to taxpayers, particularly for properties acquired before July 23, 2024. This article explores the details of the new tax rules, their implications, and how property owners can benefit.

Table of Contents

- Understanding LTCG Tax on Property

- Key Amendments in LTCG Tax for 2024

- Impact on Property Owners and Investors

- Government’s Perspective & Public Reactions

- How to Choose the Best LTCG Taxation Method

- FAQs: Common Questions Answered

- Conclusion & Final Thoughts

Understanding LTCG Tax on Property

What is Long-Term Capital Gains (LTCG) Tax?

LTCG tax is levied on the profits earned from selling a property held for more than two years. Until now, the tax was charged at 20% with an indexation benefit, which allowed taxpayers to adjust their purchase price for inflation, thereby reducing taxable gains.

How LTCG Tax Was Calculated Earlier

Previously, if a property was purchased for INR 50 lakhs in 2010 and sold for INR 1 crore in 2024, the indexed purchase price would increase to approximately INR 80 lakhs, reducing the taxable gain to INR 20 lakhs. With a 20% tax rate, the payable tax would be INR 4 lakhs.

Key Amendments in LTCG Tax for 2024

Two Taxation Options Explained

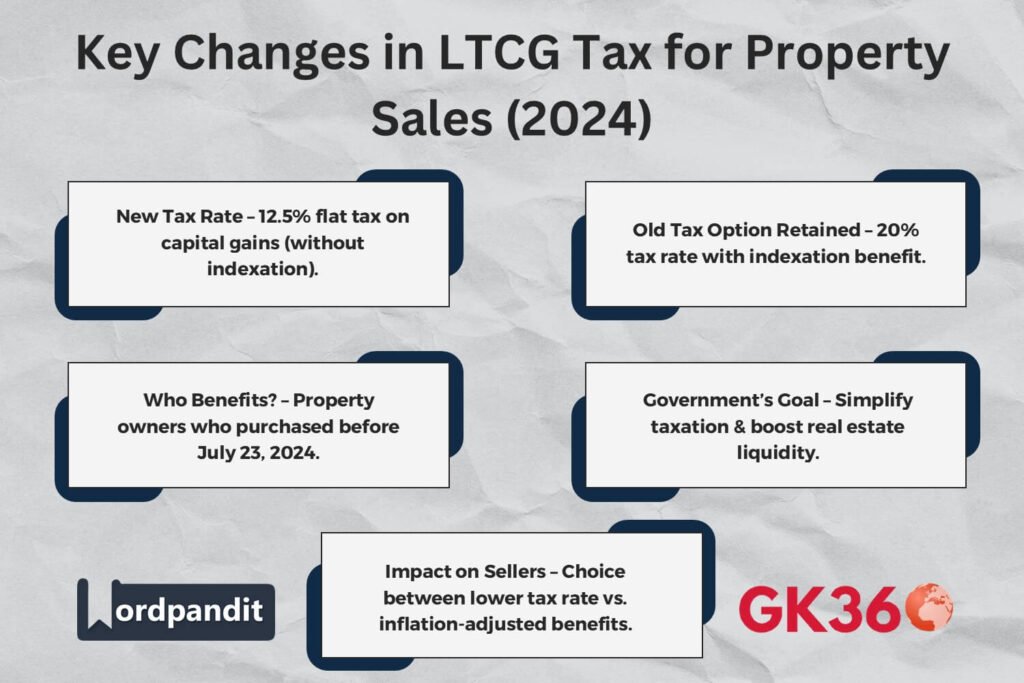

The Finance (No. 2) Bill, 2024, introduces two taxation methods for property owners:

- New Option: A flat 12.5% tax rate on capital gains without indexation.

- Old Option: Retains the 20% tax rate with indexation benefit.

Who Can Avail These Benefits?

- Property owners who acquired assets before July 23, 2024.

- Sellers evaluating whether a lower tax rate or indexation benefits provide more savings.

Impact on Property Owners and Investors

Tax Savings Calculation Examples

Using the previous example:

- New Scheme (12.5% without indexation): Tax on INR 50 lakhs gain = INR 6.25 lakhs.

- Old Scheme (20% with indexation): Tax on INR 20 lakhs gain = INR 4 lakhs.

Depending on inflation-adjusted gains, some sellers might benefit from the old scheme, while others may prefer the new lower rate.

Real Estate Market Implications

- Increased property transactions as sellers take advantage of the lower tax rate.

- Greater investor confidence, particularly in long-term real estate investments.

Government’s Perspective & Public Reactions

The government has justified the removal of indexation by emphasizing simplification of the tax system and increasing liquidity in the real estate sector. However, real estate experts and some taxpayers argue that inflation-adjusted benefits were essential to ensuring fair taxation.

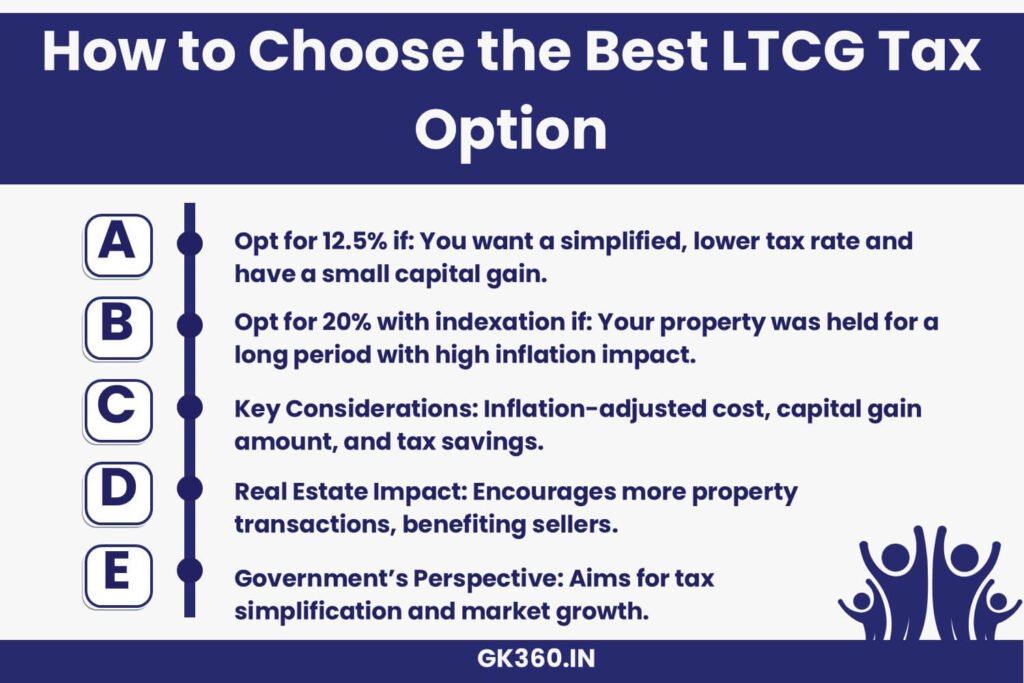

How to Choose the Best LTCG Taxation Method

Factors to Consider Before Selecting an Option

- Holding Period: Older properties may benefit more from indexation.

- Inflation Trends: If inflation has been significantly high, the old scheme may be beneficial.

- Capital Gains Amount: Smaller gains might be better under 12.5% taxation, whereas large gains could favor 20% with indexation.

FAQs: Common Questions Answered

- What is the new LTCG tax rate on property? The new tax rate is 12.5% without indexation, as opposed to the previous 20% with indexation.

- Should I opt for the new 12.5% tax or the 20% with indexation? It depends on the inflation-adjusted purchase price and the final capital gain. If your indexed cost is close to the sale price, the new scheme is beneficial. If not, the old scheme might save you money.

- Who is eligible for the new LTCG tax regime? Taxpayers who own properties purchased before July 23, 2024 and are selling them after the amendment takes effect.

- Will this amendment affect property prices? The amendment may encourage more property sales, potentially stabilizing or increasing supply in the real estate market.

- Where can I get official government updates on LTCG tax changes? Official announcements and updates are available on the Income Tax Department and Ministry of Finance websites.

Conclusion & Final Thoughts

The Finance (No. 2) Bill, 2024 introduces a lower LTCG tax rate but removes indexation benefits, making it crucial for property sellers to evaluate their tax liability carefully. By providing two taxation options, the government aims to balance simplicity with flexibility. Property owners should analyze their investment timeline, inflation impact, and expected gains before deciding which method best suits their financial goals.

Key Takeaways Table

| Aspect | Details |

|---|---|

| New LTCG Tax Rate | 12.5% flat tax on capital gains (no indexation). |

| Old Option Available | 20% tax rate with indexation benefit retained. |

| Who Benefits? | Property owners who purchased before July 23, 2024. |

| Why the Change? | Government aims for tax simplification & real estate liquidity. |

| Best Option for Sellers? | Depends on inflation impact & individual capital gain scenario. |

| Market Impact | Could increase property sales & investor confidence. |

Related Terms:

- India LTCG Tax Rules 2024

- New Property Tax Rules in India

- Real Estate Capital Gains Tax 2024

- 12.5% LTCG Tax vs 20% with Indexation

- How to Save Tax on Property Sales

- Finance Bill 2024 LTCG Amendments

- Impact of New LTCG Rules on Real Estate

- Property Investment Tax Planning 2024

- Long-Term Capital Gains Tax India Explained

- Best Tax Option for Selling Property in India